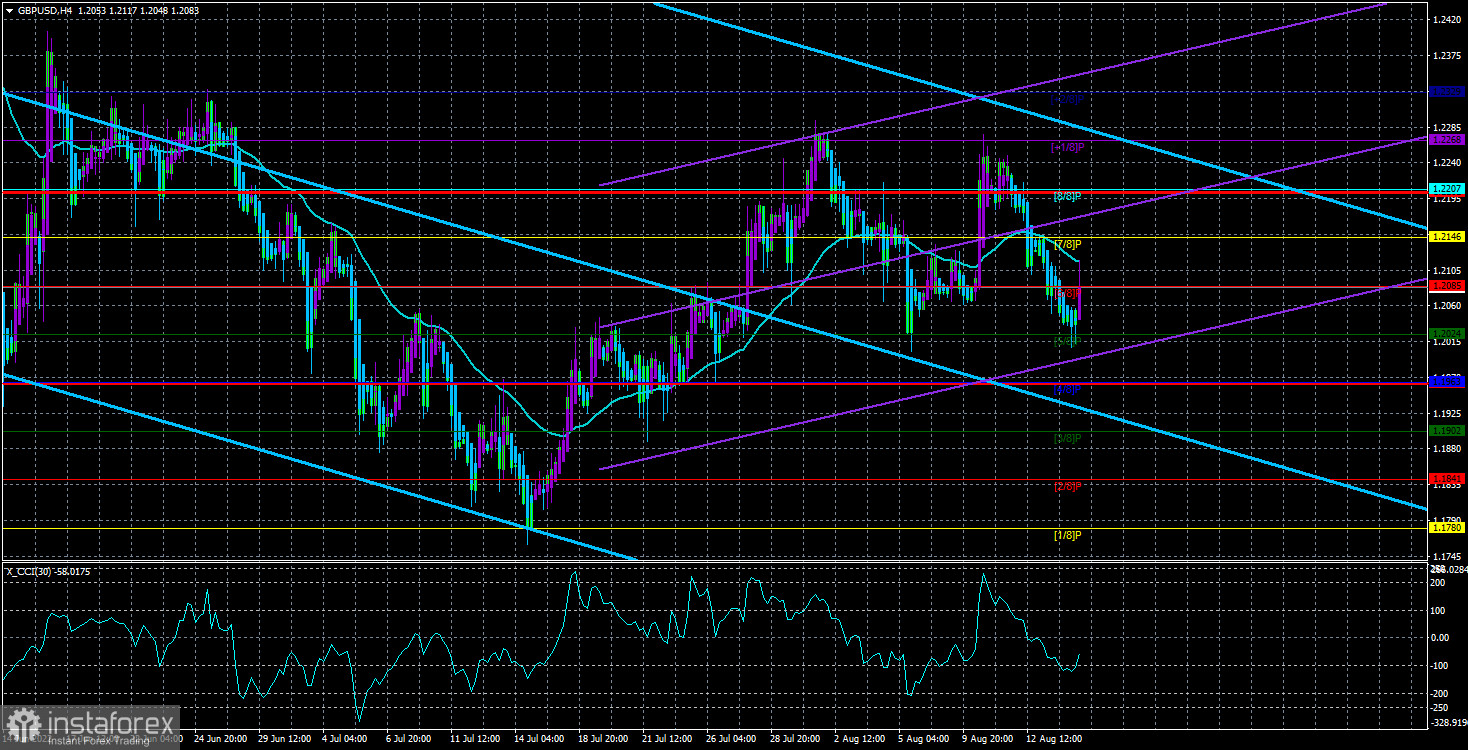

The GBP/USD currency pair also continued to move down on Tuesday. The pound sterling has continued to fall for several days, while the fall is almost recoilless. We immediately want to highlight two facts. The first is that the euro and the pound are moving almost identically again. The second – the pound sterling has drawn two identical zigzags on the chart since August 1. In the first case, the price rose from 1.2024 to the level of 1.2268, bounced off it, and returned to 1.2024, and in the second case, the same thing. Of course, we could say that we have formed a side channel, but so far, this movement does not look flat. It looks like the pound could not overcome the level of 1.2268, tried again, and then fell. And the second is working out the level of 1.2024. If the pair aimed at resuming the downward trend (as we believe), then, in any case, it should have returned and passed it. Thus, the technical picture is interesting, but no more.

For the pound sterling, the "foundation" and geopolitics remain the same as before, the same as for the euro currency. The pound still shows higher resistance than the euro currency, but this does not negate the fact that there is a downward trend that lasted more than a year and a half. Yes, the pound is getting cheaper less against the dollar (although that's still to be seen). Yes, the pound has updated only 2-year, not 20-year, lows. But at the same time, some negative is constantly coming from the UK. Boris Johnson had no time to resign as Andrew Bailey announced the coming severe recession! Now everyone is waiting for the British economy to start shrinking. Everyone is wondering what the Bank of England will do next if British inflation continues to accelerate, despite six increases in the key rate. In general, there is a lot of uncertainty, and few factors support the British pound.

The pound is in a position where "technique" matters more.

There are quite a lot of interesting publications planned in the UK this week, and it all started on Tuesday, and it started quite bland. Yesterday, it became known that the unemployment rate at the end of June did not change and amounted to 3.8%, and wages, including bonuses, increased by 5.1% with a forecast of 4.5-4.8%. It turns out that the unemployment report turned out to be completely neutral. There was simply nothing for traders to react to. And the report on wages turned out to be slightly better than forecasts. But, as we already know, the pound sterling was getting cheaper most of the day, and it was falling when these data were published. In fairness, it should be admitted that these reports were not the most significant. This morning, an inflation report will be published, which may signal an increase of 9.9% y/y. To be honest, the reaction to this report can be almost any because the CPI has been growing for a long time, and the Bank of England cannot yet take it under its control.

Moreover, it is unclear whether the British regulator will go to the bitter end and continue to raise the rate, despite the recession already announced by Andrew Bailey, until inflation begins to show a significant slowdown. On the one hand, it turns out that the BA needs to tighten its monetary approach, which can help the British pound to start resisting the hegemony of the dollar again. On the other hand, if in the US, inflation at least began to slow down in response to the rate increase to 2.5%, then in Britain, it did not. It is difficult to say how the market will assess the fact of a new acceleration in the rate of price growth. We would therefore pay attention to the Murray level of "5/8" - 1.2024. If it is overcome without problems, the probability of the pair continuing to fall will increase. By the way, the 1.2024 level is not only the "5/8" Murray level. It is also the level at which the critical line on the 24-hour TF runs. Accordingly, overcoming it will further increase the chances of strengthening the US currency.

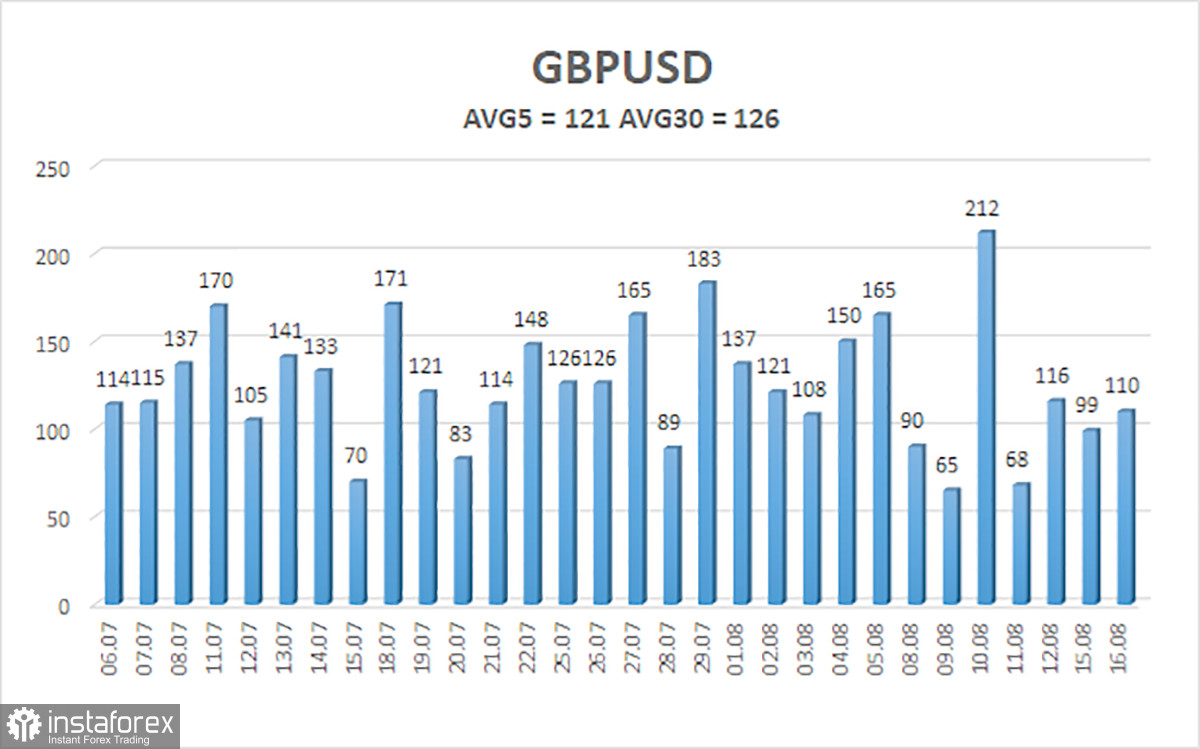

The average volatility of the GBP/USD pair over the last 5 trading days is 121 points. For the pound/dollar pair, this value is "high." On Wednesday, August 17, thus, we expect movement inside the channel, limited by the levels of 1.1962 and 1.2202. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest resistance levels:

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair consolidated below the moving average and began a new downward movement. Therefore, at the moment, you should stay in sell orders with targets of 1.2024 and 1.1963 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixing above the moving average line with targets of 1.2207 and 1.2268.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.