Markets, like people, hear what they want to hear. Federal Reserve Chairman Jerome Powell's announcement that the federal funds rate has reached a neutral level and its future path will depend on the data led investors to consider slowing down the process of monetary restriction, with a further reduction in borrowing costs in 2023. One of the main beneficiaries of such an idea was gold. However, its rally looks premature, and the inability of the XAUUSD bulls to gain a foothold above $1,800 per ounce indicates their weakness.

Well-known economist Nouriel Roubini called the idea of a "dove" Fed rollover crazy and argue that for inflation to return to the target of 2%, rates should be at the level of 4.5–5%. Gradually, the markets themselves realize that they were wishful thinking. At Forex, interest in the US dollar is returning, commodity assets continue to fall, and only the stock market is going uphill without brakes. As soon as the S&P 500 begins to dive into the abyss, the demand for safe-haven assets will grow, and the strengthening of the US currency will be a heavy blow for the precious metal.

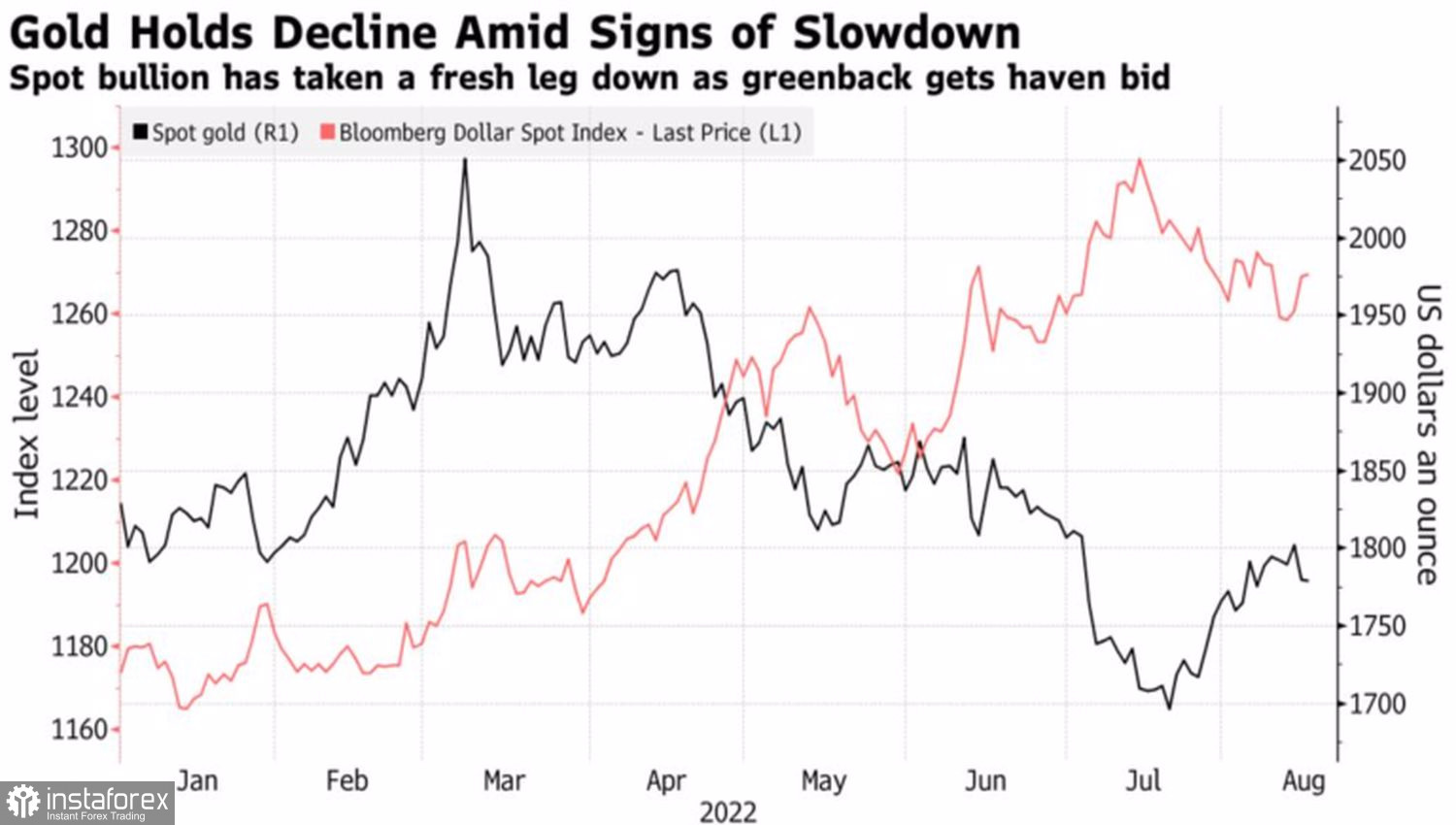

Dynamics of gold and US dollar

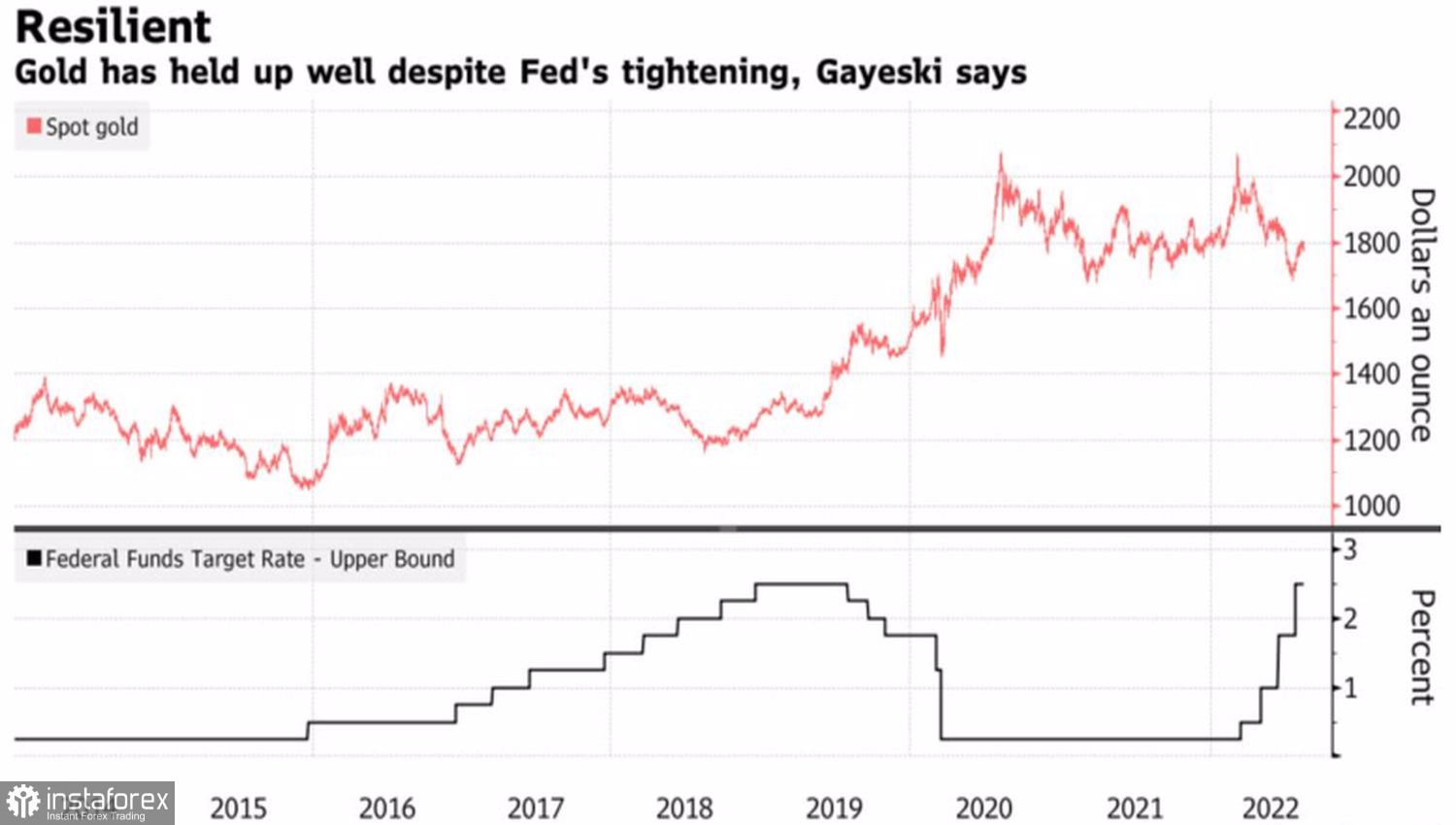

In fact, the resumption of the upward trend in XAUUSD can be said only when the Fed moves to ease monetary policy. Initially, it will stop reducing the balance sheet, and then after 12–18 months, it will begin to reduce rates. It is unlikely that the latter will occur in 2023, so gold is likely to remain under pressure in the medium term. This is well understood by fans of the physical metal, who have been reducing ETF stocks for nine weeks in a row. And this is in conditions when prices for the precious metal are growing for 4 five days in a row.

Gold dynamics and federal funds rates

On the other hand, the resilience of non-interest-bearing gold in the face of the USD rally to near two-decade highs and rising US Treasury yields is respectable. As soon as there are signs of a slowdown in the process of monetary restriction by the Fed, buyers of the precious metal go into battle. You don't need to look far for an example: the decrease in the likelihood of a 75 bps increase in the federal funds rate in September from 70% to 40% allowed gold to soar to $1,808 per ounce. Then the strength of the "bulls" dried up.

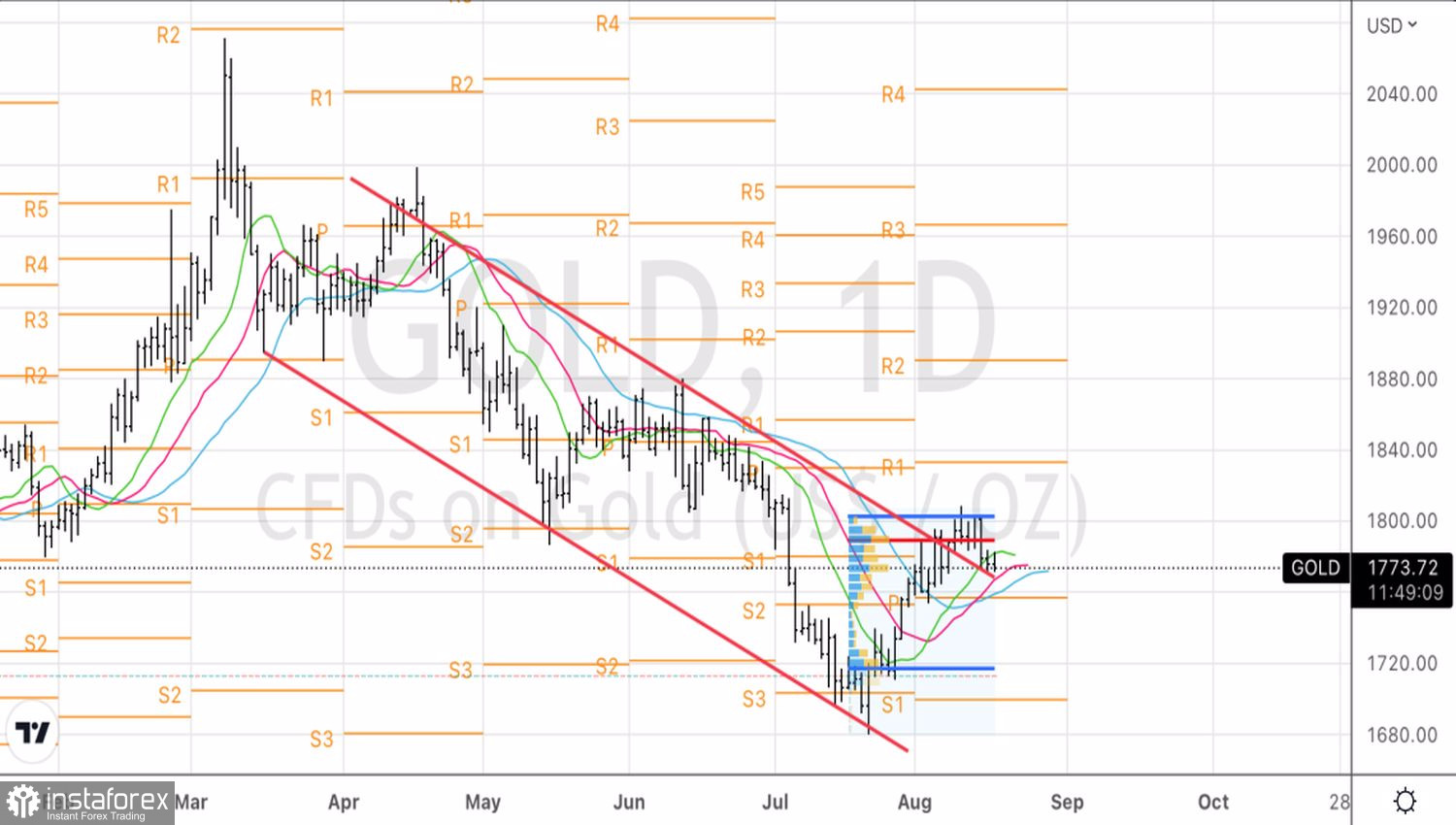

In my opinion, what we observed in the third decade of July - in the first of August, is a classic false start. The precious metal literally took Jerome Powell's words about reaching a neutral level by the rate and information about the slowdown in inflation as a reason to sell the US dollar and buy Treasury bonds, which raised their yield. The Fed hadn't done its job yet, so it was too early to buy XAUUSD.

Technically, on the daily chart, gold's inability to hold above its fair value of $1,789 an ounce is a sign of bullish weakness. The return of the precious metal to the boundaries of the descending trading channel and falling below the pivot point by $1,765 is the basis for its sales.