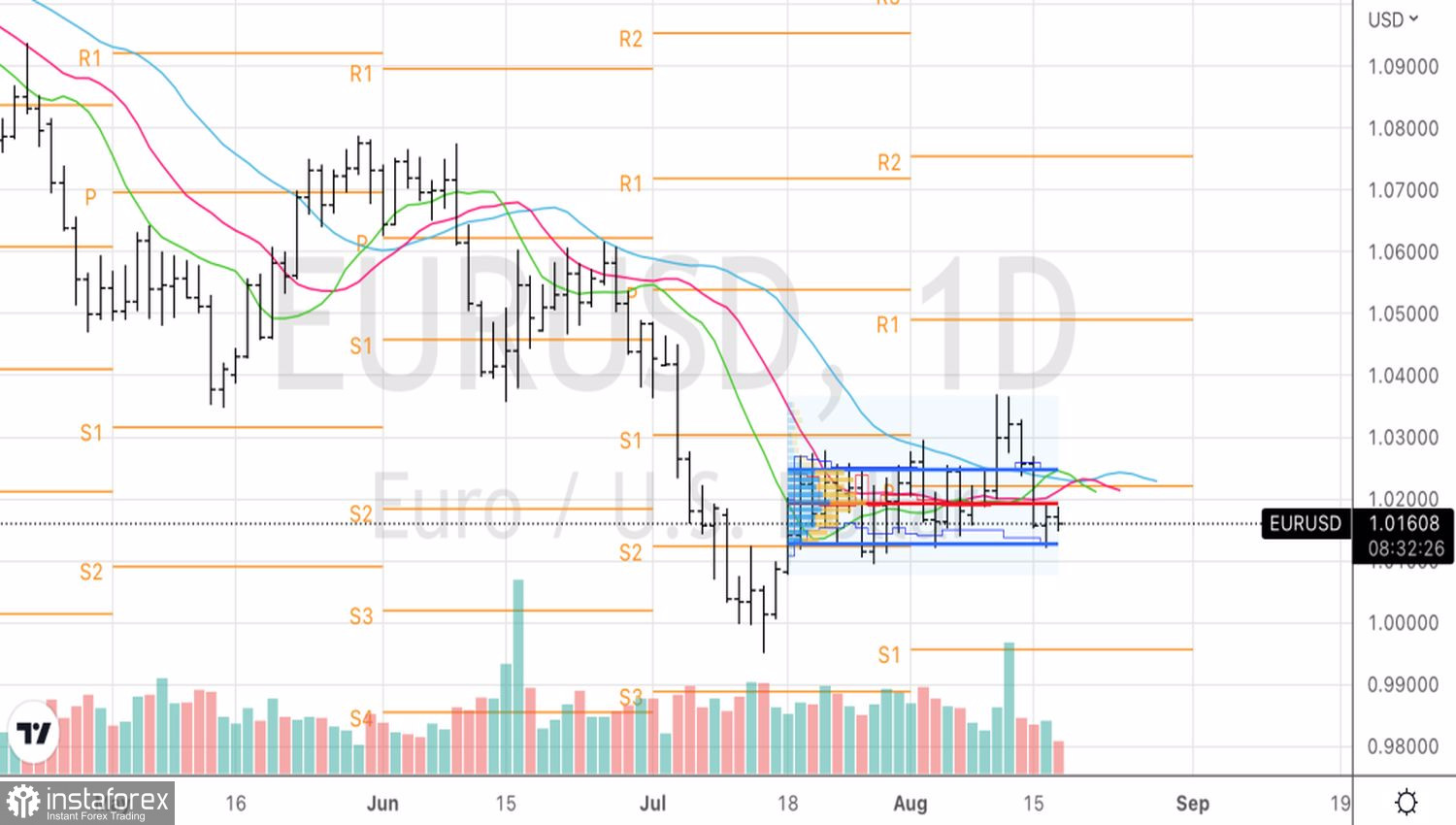

Financial markets continue to play on the nerves of the Fed, which allowed even such a weak currency as the euro to feel the ground under its feet near the lower limit of the trading range of $ 1.01-1.03. Moreover, the minutes of the July FOMC meeting are on the nose, following which Jerome Powell recklessly stated that the federal funds rate had reached a neutral level, and the Fed refuses direct guidance and will make decisions depending on incoming data. Investors considered this the first sign of an imminent "dovish" shift in the thinking of the Central Bank and began to buy shares actively. And while this strategy is profitable, the S&P 500 has managed to grow by 17% from the levels of the July bottom.

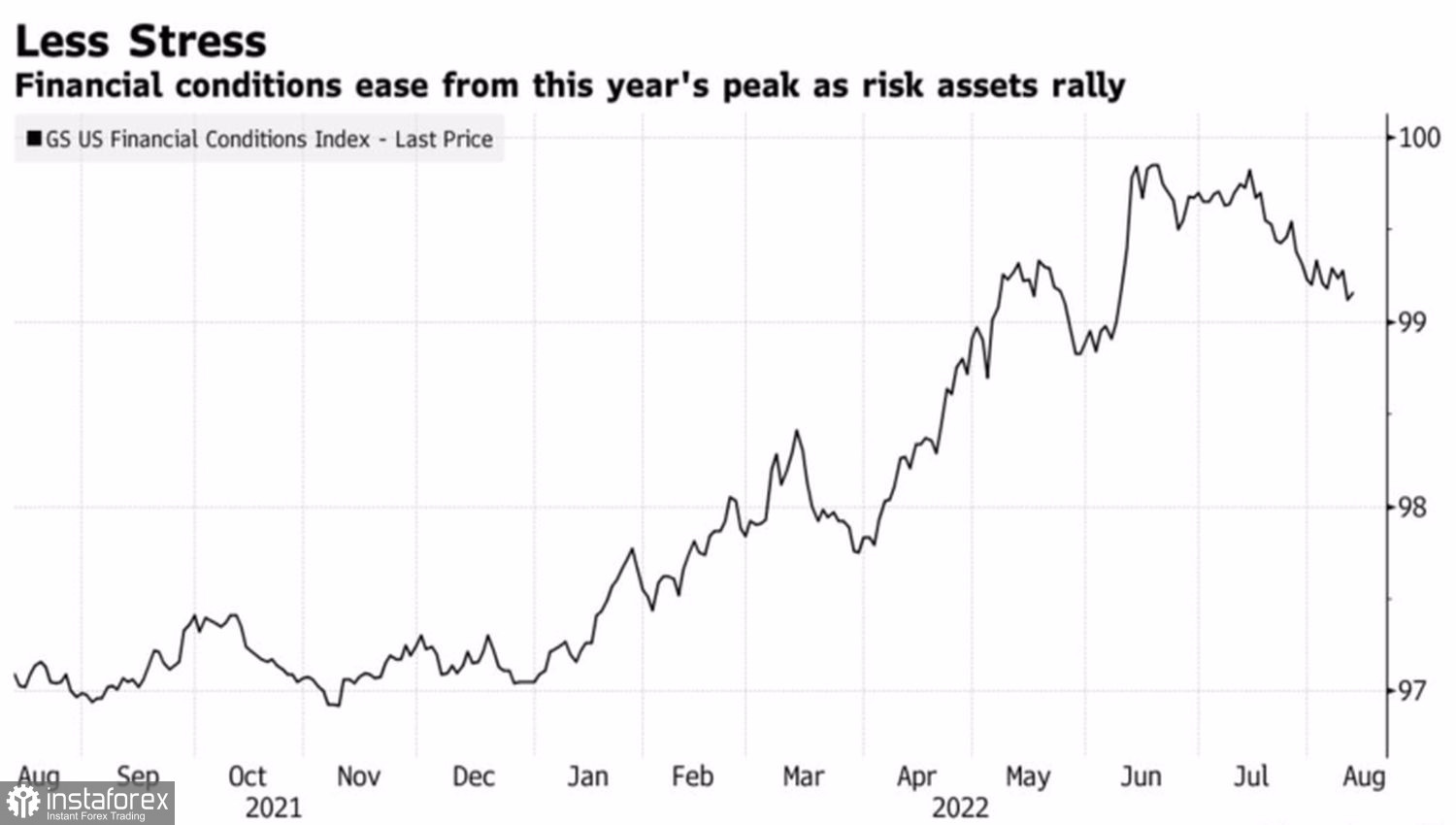

The rapid rally of the stock index, falling yields of Treasury bonds, and the US dollar improve financial conditions. And without their tightening, it is impossible to achieve a slowdown in employment growth, the economy, and average wages. That is, you can't beat inflation. From time to time, Jerome Powell probably has a terrible dream: it's 2025, consumer prices are at 6%, he is presenting a report on monetary policy to Congress, and lawmakers are asking how he could let inflation ruin the economy.

Dynamics of financial conditions in the US

Determination is needed so that the nightmare does not come true. Most likely, even more than before. Financial markets need to be put in their place, cornered, and shown who is the boss in the house. But how to do it? The "hawkish" rhetoric of FOMC members failed to scare the S&P 500. Any pullbacks of the stock index are immediately used for purchases. It is not a fact that Jerome Powell will be able to stop the rally in the stock market. If it fails, it will be a serious blow to the authority of the Fed.

At the same time, the Central Bank has much more powerful tools than words. According to the famous economist Henry Kaufman, you should not beat hands if you want to change someone's opinion and actions. You have to punch in the face. The acceleration of folding the balance sheet and such a "hawkish" surprise for the stock market as a rate increase by as much as 100 bps can turn the situation upside down.

Although according to the Fed's plans, the volume of assets on the balance sheet should decrease by $ 47.5 billion per month from June, actual sales in July amounted to only $ 22 billion. The indicator has not changed much and still hovers around $ 8.9 trillion. The acceleration of its winding down, especially since the monthly figure should rise to $ 95 billion from September, will push up the treasury bonds' yield and end the S&P 500 rally.

Thus, the market should be sitting on pins and needles, waiting for an adequate reaction from the Fed to its pampering and the associated strengthening of the US dollar.

Technically, on the daily EURUSD chart, the quotes came close to the lower limit of the trading range of 1.01-1.03. A successful support test at 1.012 will allow you to increase previously formed short positions as part of the implementation of the strategy of working on the Deception-outlier pattern.