The recession in the eurozone is becoming more and more palpable, almost all analysts and economists are talking about it. This fact is not disputed in any way, since there are no arguments to think and speak otherwise. The eurozone economy grew by 0.6% in the second quarter, according to Wednesday's second assessment, below expectations of 0.7% and below the first estimate of 0.7%.

The onset of a recession in the eurozone was provoked by high energy prices, which, in turn, is a consequence of a reduction in Russian gas supplies, according to Commerzbank. The euro will suffer as the economic downturn intensifies. It is already clear how hard it is for the single currency to bear the entire burden of internal problems along with a strong dollar.

Analysts are systematically lowering their expectations for the EUR/USD pair. Economists at Commerzbank have also significantly adjusted their forecast. As an argument, bank officials added the ECB's indecisiveness to the gas problems.

You can count on a symbolic recovery of the euro only next year, and then, if there are grounds. Germany, the locomotive of the euro bloc economy, is in a very unenviable position. Because of the abnormal heat, rivers dry up, and natural gas can run out in winter.

Analysts continue to assert that the EUR/USD pair will return to parity in autumn. It is worth noting that the low of the current year is settled at around 0.9954.

The euro will test 1.0000 in September, then in December, as expected, the mark of 0.9800 will be broken. The single currency will try to consolidate around this mark until March next year. Recovery to the area of 1.0200 is possible by June, and in September - to 1.0600.

However, a partial recovery of the euro, as noted in Commerzbank, is possible under certain conditions. Europe must meet its energy needs without Russian gas, and the ECB will resume the cycle of rate hikes.

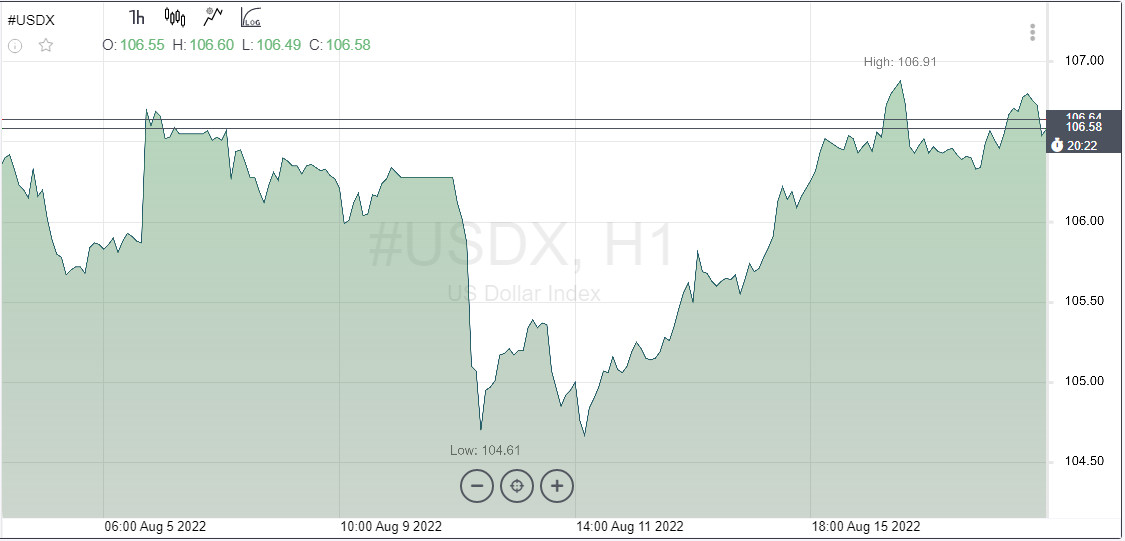

Meanwhile, the dollar rally is beyond doubt. A strong greenback will continue to put pressure on the already weak single currency. Swedbank is also waiting for the EUR/USD 1.0000 to be tested in autumn.

The Federal Reserve is still aggressive on the dollar's side and the idea that the peak of inflation will be enough to weaken the vigilance and monetary policy is fundamentally wrong. There is speculation, but it's more like market players trying to wishful thinking.

"The long dollar position was further reduced last week after lower-than-expected US inflation data. But given that core inflation has reached 5% over the past three months and the labor market is tight, the Fed cannot relax," Swedbank economists comment.

For markets as a whole, the Fed's move to slower rate hikes is important because it will give investors more confidence that the end of the rate hike cycle is nearing, but not yet.

Swedbank notes that market players are now waiting for another potential Fed rate hike of 75 basis points in September. It will be followed by another until the funds rate is brought to a peak of 3.6% in early 2023. There may then be a pause before contraction.

The minutes of the July FOMC meeting showed that all participants supported the expediency of raising the rate by 75 basis points in the future. At the same time, they agreed that the future rate hike will depend on the incoming information, and expressed the opinion that at some point, if necessary, the central bank may slow down the rate hike.

After the release, US markets began to bet on a 50 basis point rate hike in September. This probability was estimated at 60%. As a result, the dollar began to lose ground on hawkish minutes from the Fed. But it's not evening yet. Before the Fed's next meeting, a lot of water will leak in the form of US statistics. New data may change the mood of both the central bank and the markets.