The GBP/USD currency pair adjusted to the moving average line on Wednesday, bounced off it, and resumed its downward movement. The pair's rebound from the moving average occurred exactly when the "report of the week" - inflation for July - was published in Britain. We will discuss this report in more detail later, but for now, we will only say that it has grown again, this time to 10.1% y/y. Well, we see absolutely nothing surprising in this. Has anyone doubted that inflation in the UK will continue to grow if the head of the Bank of England, Mr. Bailey, openly stated that he expects the consumer price index to be at 13%? The regulator has raised the key rate six times in a row, but all the pound has managed to show is a correction of 500 points over the past month. And inflation did not notice all the efforts of the central bank at all and continues to do so. Thus, from our point of view, the overall situation for the British pound is beginning to deteriorate sharply.

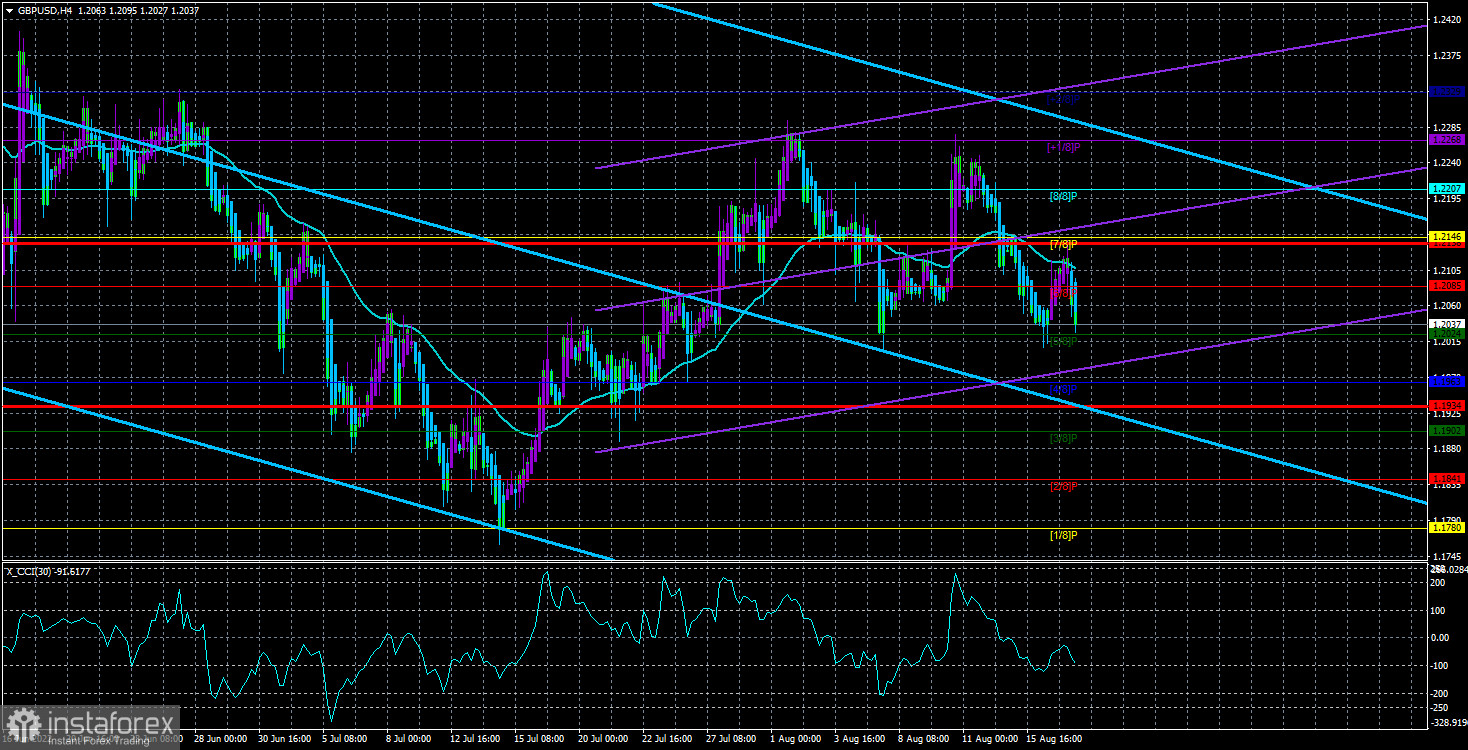

From a technical point of view, the pair twice failed to overcome the Murray level of "+1/8" - 1.2268, after which it rolled back to the Murray level of "5/8" - 1.2024, which it also failed to overcome twice. Thus, to continue the fall of quotes, it is necessary to overcome the level of 1.2024. Fixing below that will also confirm our hypothesis that the long-term downward trend will be resumed. Last week we assumed that the pound could continue to adjust, but recent macroeconomic events and the market reaction to them show that few people are still willing to buy the British currency. And the factors that support the pound are fewer than those that support the US dollar. However, do not forget that BA has raised the rate 6 times in a row, so the pound is likely to fall but weaker than the euro.

With rising inflation, traders rushed to sell the pound and did not believe BA's ability to curb inflation.

So, as already mentioned, inflation at the end of July increased in the UK to 10.1%. Finally, we saw a two-digit number. And it should be noted that this is far from the limit. From our point of view, inflation in the Kingdom can grow by up to 15%. First, the American economy usually recovers faster than the British or European. If the Fed could stop inflation from rising by 9% by raising the rate to 2.5%, then the Bank of England, as a less efficient central bank, could achieve the same result by raising the rate to at least 3%. And until it raises it to this level, the consumer price index may continue to accelerate. Second, Britain would not be Britain if it did not constantly create problems for itself out of the blue. It is not yet known who will win the election of Prime Minister, but there is no doubt that this is not the last crisis.

It is unclear what to do with the "Northern Ireland protocol". The European Union has already appealed to the Court about this. Four legal procedures have been initiated against London due to Brexit agreement violations. Scotland continues to push for a referendum at the end of 2023. Relations with Russia are spoiled, and with China - they are deteriorating daily. And the military conflict between Ukraine and the Russian Federation affects the UK or the European Union much more than the United States or any other country overseas. Therefore, geopolitics remains an important factor for both currency pairs. And Britain, if it continues to create problems for itself, risks further lowering the pound sterling paired with the dollar. It is difficult to say how profitable this is for the Bank of England. It's no secret that many countries, on the contrary, are interested in a low exchange rate for their currency in order, for example, to increase demand for exporting their goods abroad. And in an impending recession, this method can save the economy from additional losses. If everything stays the same now, it will be difficult for the British currency to show growth against the dollar for a very long time. So far, traders are already selling the pound on rising inflation. So they do not believe that the Bank of England will continue to raise the rate.

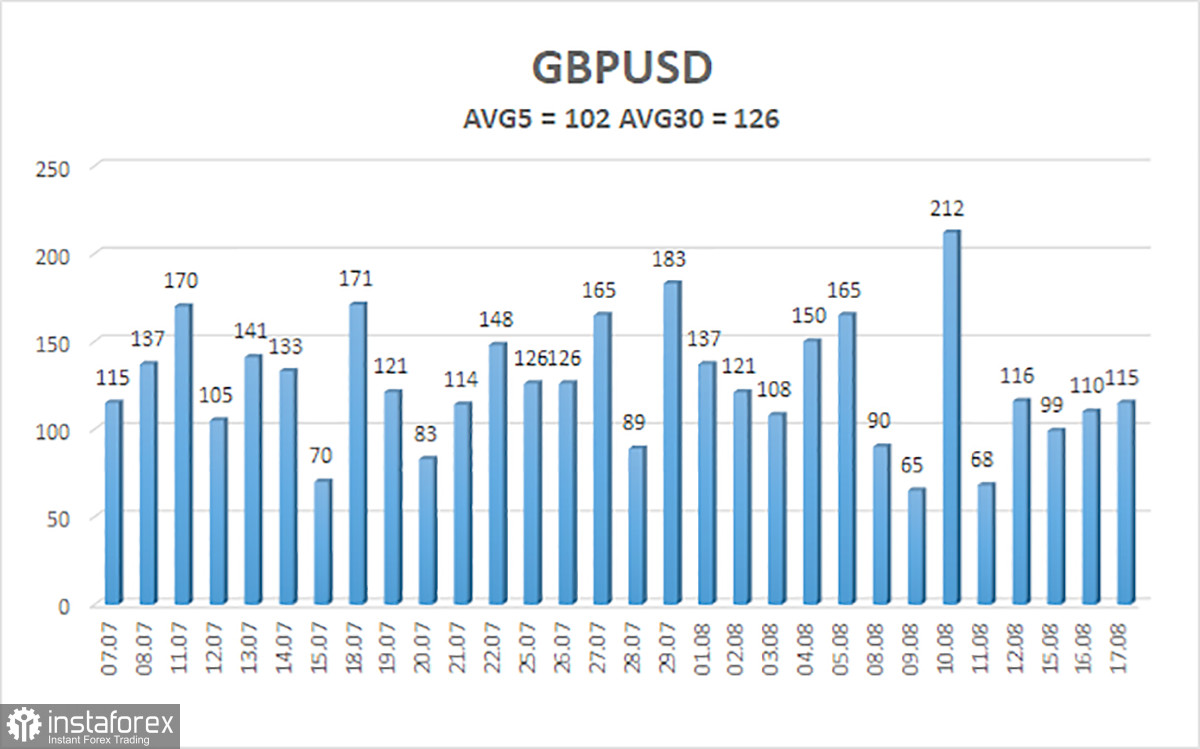

The average volatility of the GBP/USD pair over the last 5 trading days is 102 points. This value is "high" for the pound/dollar pair. Therefore, on Thursday, August 18, we expect movement inside the channel, limited by the levels of 1.1934 and 1.2138. The upward reversal of the Heiken Ashi indicator signals a new round of upward correction.

Nearest support levels:

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest resistance levels:

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Recommendations:

The GBP/USD pair continues to be located below the moving average on the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1.1963 and 1.1934 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixing above the moving average line with targets of 1.2146 and 1.2207.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.