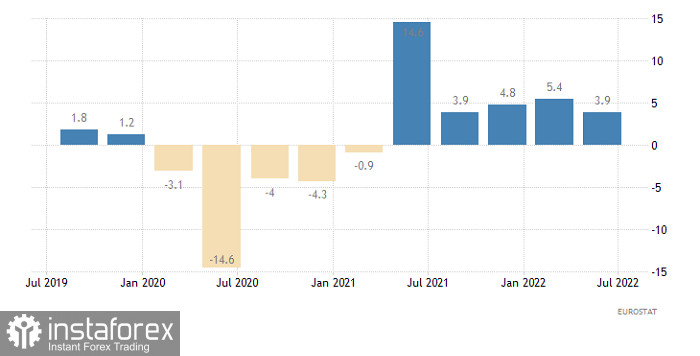

Despite the fact that the data for Europe and the United States clearly favored the dollar's growth, the market actually remained standing still. Although the second estimate of the euro area GDP was somewhat worse than the first. Instead of slowing down to 4.0%, economic growth slowed down to 3.9%.

Change in GDP (Europe):

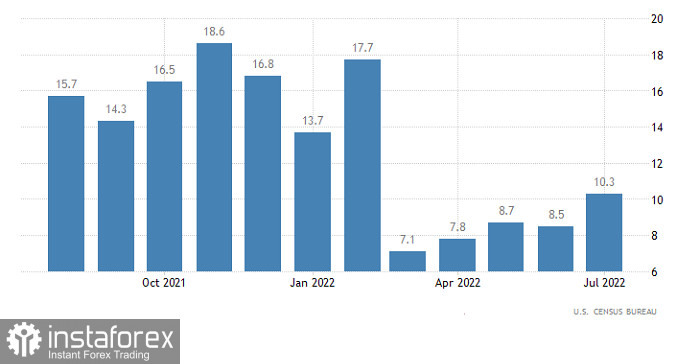

What's more, US retail sales data came in significantly better than expected and instead of slowing down from 8.4% to 8.1%, they accelerated from 8.5% to 10.1%. That is, in addition to the acceleration of growth, the previous data were revised upwards.

Retail Sales (United States):

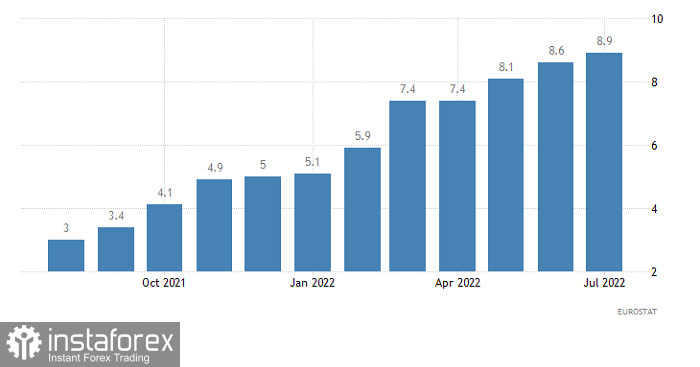

Most likely, the stagnation in the single currency is associated with today's release of data on inflation in Europe, which should rise from 8.6% to 8.9%. That's just the final data, which should only confirm the preliminary assessment, which the market has already taken into account. That is, logically, these data cannot affect anything. Nevertheless, given the apparent stagnation, it is quite possible that they will be the reason for some changes. And it is in the direction of strengthening the single currency. Since the growth of inflation means a more active increase in interest rates of the European Central Bank.

Inflation (Europe):

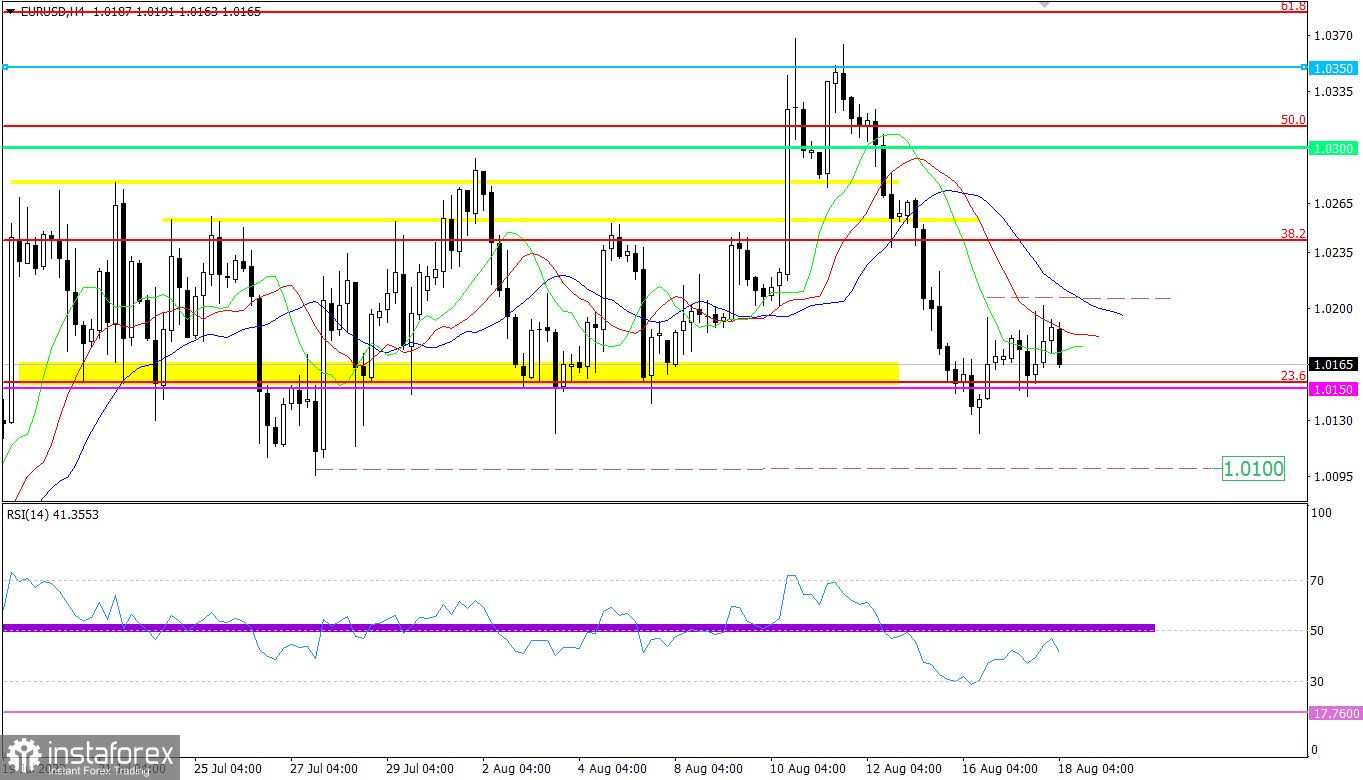

The EURUSD currency pair has slowed down its downward movement within the support level of 1.0150. As a result, there was a rollback of about 50 points, and then stagnation.

The technical instrument RSI H4 in the rollback stage approached the middle line 50, but failed to cross it from the bottom up. The indicator continues to be in the lower 30/50 area, which indicates a high interest of traders in the down cycle.

The moving MA lines on Alligator H4 are directed downwards, which corresponds to a movement cycle from the resistance level of 1.0350 to the support level of 1.0150.

Expectations and prospects

The area of the support level is still putting pressure on short positions, which may lead to the subsequent building of the scope within 50-60 points.

Coordinates serve as signal values: 1.0100 in case of a downward scenario and 1.0210 if we consider the prolongation of the current rollback.

It should be taken into account that the signal will be confirmed only after the price stays outside one or another value in a four-hour period.

Complex indicator analysis has a variable signal in the short-term and intraday periods due to stagnation. Technical instruments in the medium term are oriented to sell, which is in line with the direction of the main trend.