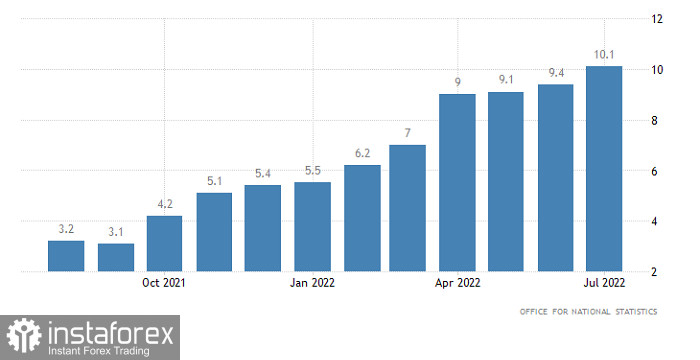

The market has been behaving strangely since yesterday. Pound kept on decreasing even though inflation in the UK accelerated from 9.4% to 10.1%. The figure indicates a possible increase in the rates of the Bank of England, which should be bullish for pound.

Inflation (UK):

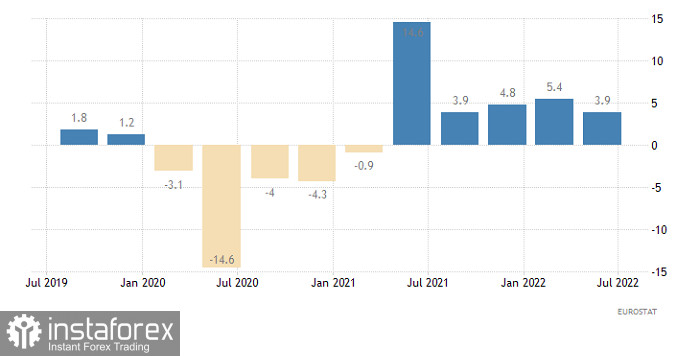

Euro, meanwhile, seems to be marking time in spite of the second estimate of the Eurozone's GDP being somewhat worse than the first. Economic growth reportedly slowed down to 3.9% instead of to 4.0%

GDP (Europe):

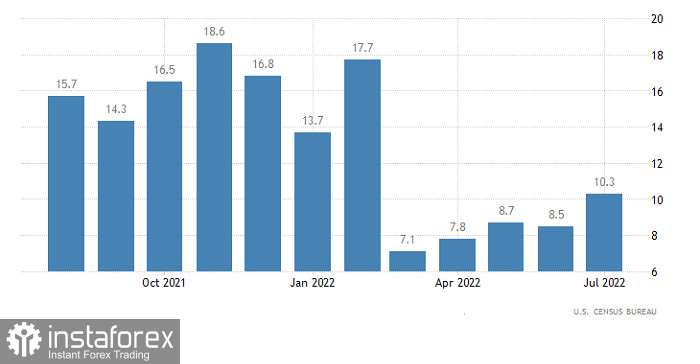

As for the US, retail sales data came in much better than expected. Instead of slowing down from 8.4% to 8.1, it accelerated from 8.5% to 10.1%.

Retail sales (United States):

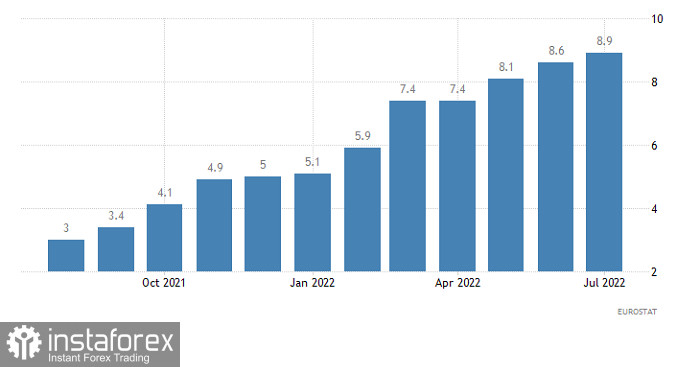

The stagnation in EUR/USD is most likely in anticipation of today's data on EU inflation, which should rise from 8.6% to 8.9%.

Inflation (Europe):

Although the data will only confirm the preliminary assessment and not affect anything, there is a chance that slight changes will occur. This is because a further growth in inflation will prompt more active increase in interest rates of the European Central Bank.

EUR/USD halting near the support level of 1.0150 paused the downward trend and cued a rebound from 1.0150 to 1.0200. This situation can be considered as the accumulation of trading forces, which will eventually lead to a speculative price jump.

The slowdown and approach of GBP/USD to 1.2150 reduced the volume of long positions, leading to a price rebound. This move almost completely restored dollar positions, bringing the quote to the psychological level of 1.2000. If the pair stays there, another rebound is possible. If not, a breakdown will occur, followed by a drop below 1.1950.