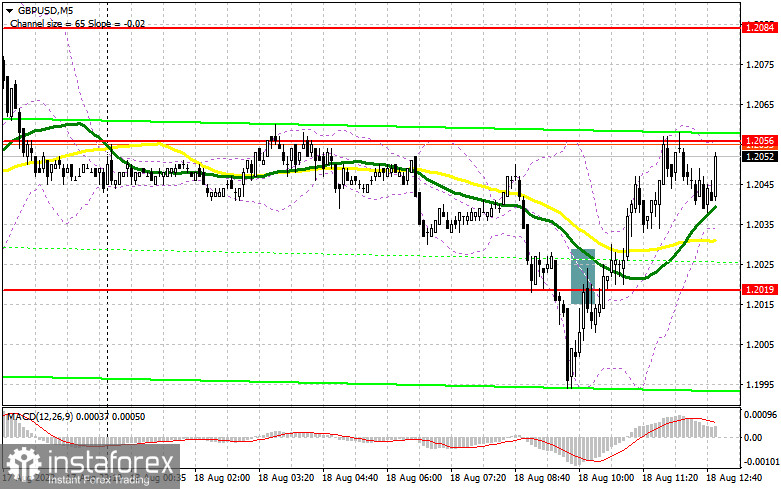

In my morning forecast, I paid attention to the level of 1.2019 and recommended deciding on entering the market. Let's look at the 5-minute chart and figure out what happened there. An instant breakout on 1.2019 occurred together with a reverse test from the bottom up, which seemed to give an excellent signal to sell the pair in a continuation of the bearish trend. But, as usually happens, the market went against speculators, so we had to fix losses and revise the technical picture for the afternoon.

To open long positions on GBP/USD, you need:

The bulls have already achieved a breakdown of 1.2056. They need a consolidation at this level, which should happen only after the reverse test from top to bottom. I recommend waiting for many fundamental statistics in the USA in the afternoon, ensuring that there is a real buyer at the current levels. Reports on the number of initial applications for unemployment benefits, the Fed-Philadelphia manufacturing index, and a report on the volume of housing sales in the secondary market are expected. Weak indicators will certainly weaken the dollar's position in the short term, leading to another upward spurt of the pound. The speeches of FOMC members Esther George and Neel Kashkari are unlikely to surprise traders with anything. Only the formation of a false breakdown in 1.2056 after the pair's decline forms a buy signal in the continuation of the bull market, which can return the pound to 1.2092. Its breakdown and a reverse test from top to bottom will take us to 1.2119, and a further goal will be a maximum of 1.2147, where I recommend fixing the profits. If GBP/USD falls and there are no buyers at 1.2056, the pair will again hang in the side channel while maintaining the advantage of the pound sellers. Only a false breakout at 1.2022 will give a new buy signal. It is possible to open long positions on GBP/USD immediately for a rebound from 1.1996 or even lower – around 1.1962 with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Bears will count on strong statistics for the United States and on the pair's return to the level of 1.2056 – the main goal of sellers for the second half of the day, as only this will save the downtrend and lead to a further update of weekly lows. Protecting the 1.2092 level is also an equally important task. A false breakdown at this level will provide the pound sellers with everything necessary, allowing them to count on a downward movement to the 1.2056 area and a breakthrough of this range. A bottom-up reverse test of 1.2056 will give an entry point for sale with a return to 1.2022, from where buyers have already been active today. The farthest goal will be the minimum of the week 1.1996, where I recommend fixing the profits. With the option of GBP/USD growth and the absence of bears at 1.2092, bulls will have a real chance of continuing growth and updating weekly highs. In this case, I advise you not to rush with sales: only a false breakdown in the area of 1.2119 will give an entry point to short positions in the expectation of a rebound of the pair. In case of lack of activity, there may also be a jerk up to the maximum of 1.2147, where you can open short positions immediately for a rebound, counting on the pair moving down by 30-35 points within the day.

The COT report (Commitment of Traders) for August 9 recorded a reduction in short positions and an increase in long ones, which led to a decrease in the negative delta. And although a less active reduction in UK GDP in the 2nd quarter of this year allows us to count on the fact that the economy will survive this crisis more steadily, households do not have to pay less on their bills, which only exacerbates the cost-of-living crisis in the country. The talk that by the end of this year, the UK economy will slip into recession also does not give confidence to traders and investors. Do not forget how the GBP/USD pair is affected by the decisions of the Federal Reserve System. Last week, it became known that inflation in the US slowed down a little – this is a good reason to look towards risky assets, but it is unlikely that this will lead to an increase in the bullish trend for the same pound. We will most likely remain within a wide side channel until the end of the month since we hardly have to count on updates of monthly highs yet. The COT report indicates that long non-commercial positions increased by 12,914 to 42,219. In contrast, short non-commercial positions decreased by 9,027 to the level of 76,687, which led to a reduction in the negative value of the non-commercial net position to the level of -34,468 from the level of -56,409. The weekly closing price decreased to 1.2038 against 1.2180.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.