The Australian dollar paired with the US currency is showing corrective growth, reacting to the release of key data on the growth of the labor market in Australia. And although the release turned out to be, to put it mildly, controversial, AUD/USD bulls focused their attention on the headline indicator, which reflected the decline in unemployment in Australia. The fact itself, of course, is positive, but if we consider the situation as a whole, it does not look so rosy. And if we recall the rhetoric of the recently published minutes of the last Reserve Bank of Australia meeting, then the picture does not emerge at all in favor of the Australian dollar. Therefore, the current increase in the price of AUD/USD should be considered as a correction after a three-day 200-point decline.

Of course, among all the components of today's release, the unemployment rate indicator stands out. In fact, this is the only component that came out in the green zone. Thus, unemployment was at the level of 3.4% in July. This result is stronger than the preliminary expectations of most experts (they predicted stagnation at the level of 3.5%). It should be noted here that this indicator refers to lagging economic indicators, therefore, in this context, it is necessary to focus on more up-to-date data.

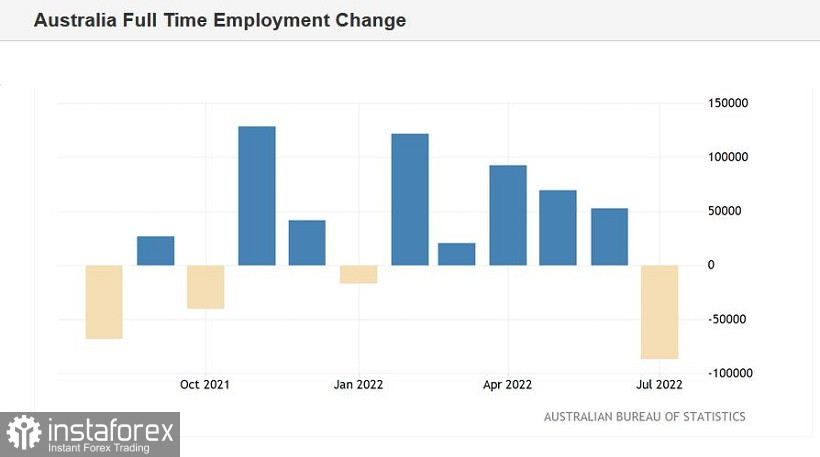

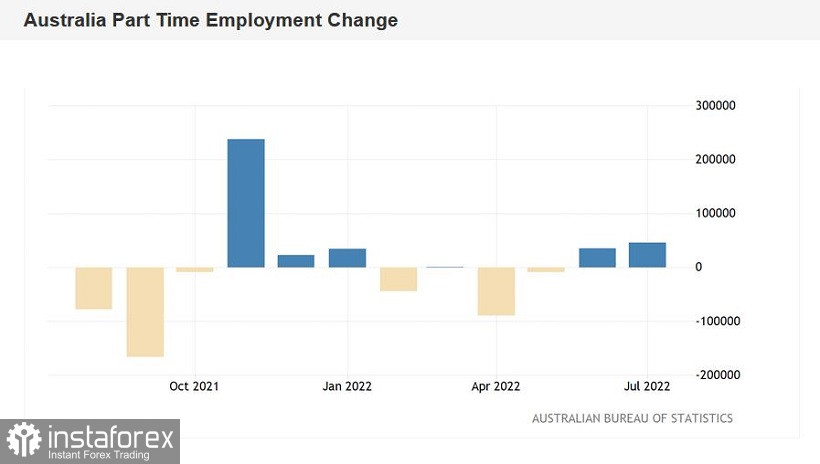

But operational data signal a contradictory situation in the labor market. For example, the rate of growth in the number of employed fell by 40,000 in July. This indicator was in the negative area for the first time this year. Until this moment, negative dynamics was observed only in October 2021, when another wave of the coronavirus pandemic covered Australia. And here it is necessary to pay attention to the fact that the decrease in the indicator occurred solely due to a decrease in the full employment component. Whereas the part-time component increased (by almost 47,000). As you know, full-time positions offer a higher level of wages and a higher level of social security compared to temporary part-time jobs. This factor affects the dynamics of wage growth, and indirectly - the dynamics of inflationary growth. Therefore, in this case, the "Australian Nonfarm" signals unhealthy trends in the labor market. In addition, another component of the release came out in the red zone: the share of the economically active population decreased to 66.4%, contrary to forecasts of growth to 67.1%.

In my opinion, the "headline" indicator of the report will not be able to provide long-term support to the aussie amid other components. The unemployment rate is one of the fairly "rolling" indicators, while more recent data were blatantly disappointing. That is, AUD/USD bulls formally got a reason for a corrective rollback (after all, de facto unemployment fell to a record low), but at the same time they were unable to overcome the key resistance level of 0.7000. Moreover, as part of the correction, they were not even able to approach this target: the upward surge bogged down at around 0.6975.

Let me remind you that the minutes of the RBA's August meeting, published on Tuesday, were perceived by the market as dovish, as it reflected the weakening of the hawkish mood of the central bank. The RBA confirmed that it will continue to raise the interest rate, however, the pace of monetary tightening will depend on the incoming data. Already after the August meeting, it became known that the consumer price index in the second quarter unexpectedly slowed down to 1.8% q/q. At the same time, over the previous three quarters, this indicator showed a consistent upward trend. And the text of the accompanying statement of the last meeting did not please the AUD/USD bulls: its essence boiled down to the fact that the RBA will systematically tighten its monetary policy in the future. As a result, many experts came to the conclusion that on August 2, the RBA raised the rate by 50 points for the last time. Further, the central bank, apparently, will resort to a 25-point step, and possibly pause in December.

The data on the labor market in Australia is not capable of turning the tide for the pair. Moreover, they turned out to be, to put it mildly, contradictory, and in my subjective opinion - negative for the aussie. Therefore, short positions on the pair are still a priority.

However, from a technical point of view, it is advisable to enter short positions after overcoming the price barrier of 0.6930. At this price point, the middle line of the Bollinger Bands indicator, as well as the Tenkan-sen and Kijun-sen lines "intertwined" on the hourly chart. After the pair is under this target, the price will be between the middle and lower lines of the Bollinger Bands indicator, and the Ichimoku indicator will form a bearish Parade of Lines signal. In this case, you can consider short positions with the target of 0.6860 - this is the lower line of the Bollinger Bands, which coincides with the lower boundary of the Kumo cloud on the D1 timeframe.