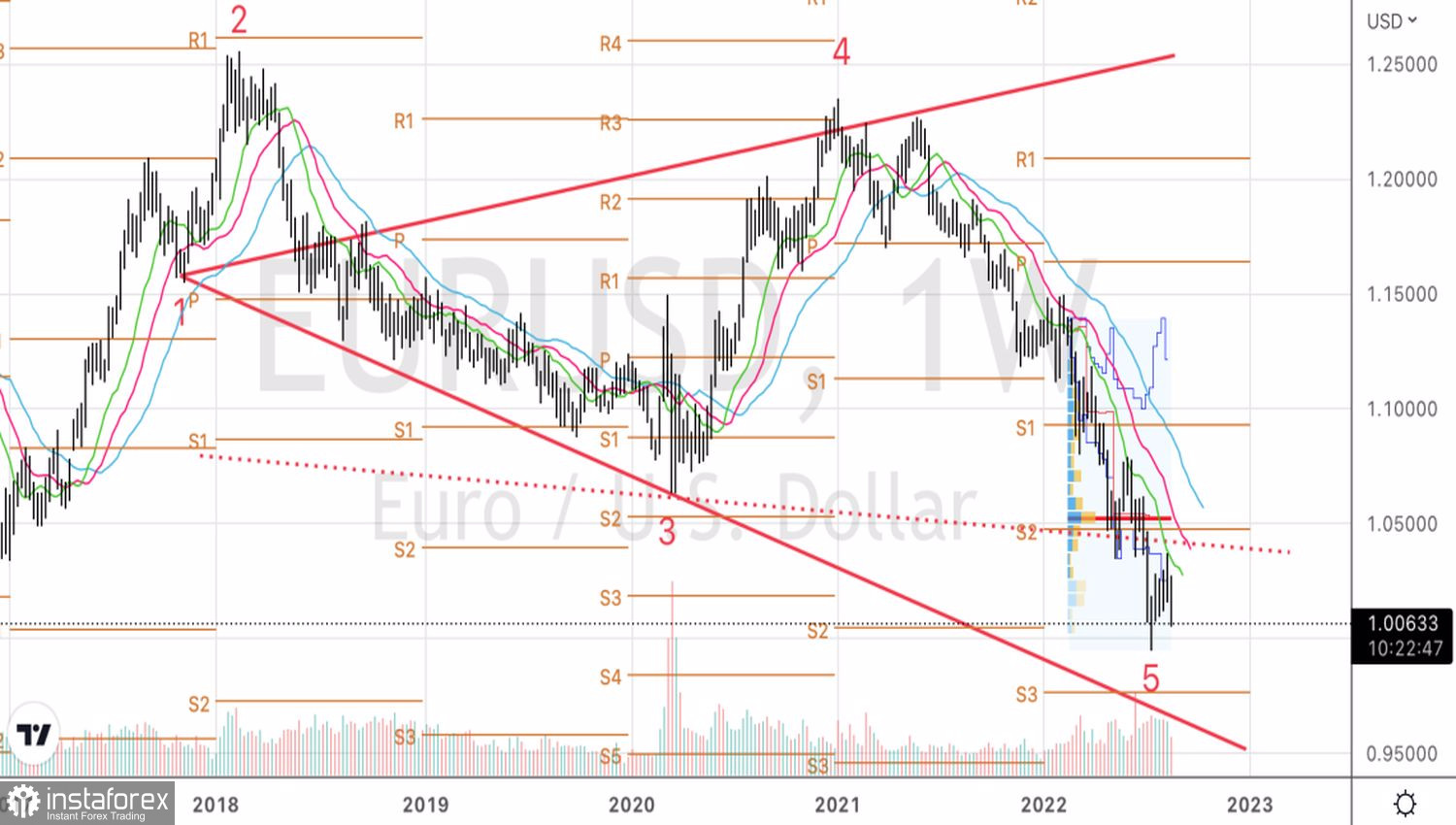

Resistance is futile! Amid the energy crisis raging in Europe, EURUSD bulls are forced to flee the battlefield. The main currency pair is steadily moving towards parity, knowing full well that it is unlikely that it will be possible to find the bottom at its level for the second time in 1.5 months. The euro was helped by slowing US inflation, but as soon as investors realized that the Federal Reserve would continue to raise rates, their attention switched to the US and eurozone economies. And the second is still hopelessly losing.

The August business data releases should highlight the divergence in GDP growth. Bloomberg expects European purchasing managers' indexes to continue their plunge, while the US services PMI rally will prove that American exceptionalism is not an empty phrase. These statistics and the release of data on the index of personal consumption expenditures, the key indicator of inflation monitored by the Fed, will be the main events of the third week of August in the economic calendar. However, all of them will surely be eclipsed by Fed Chairman Jerome Powell's speech at Jackson Hole.

The market behaved like a child in relation to the minutes of the July FOMC meeting: it did not understand anything. The Fed continues to throw all its efforts into the fight against inflation, but fears that it will go too far. It declares the transition to a policy of dependence on data, which was already known after Powell's speech at a press conference. As a result, Powell had a great opportunity to chew everything up and explain, as Janet Yellen did in her time.

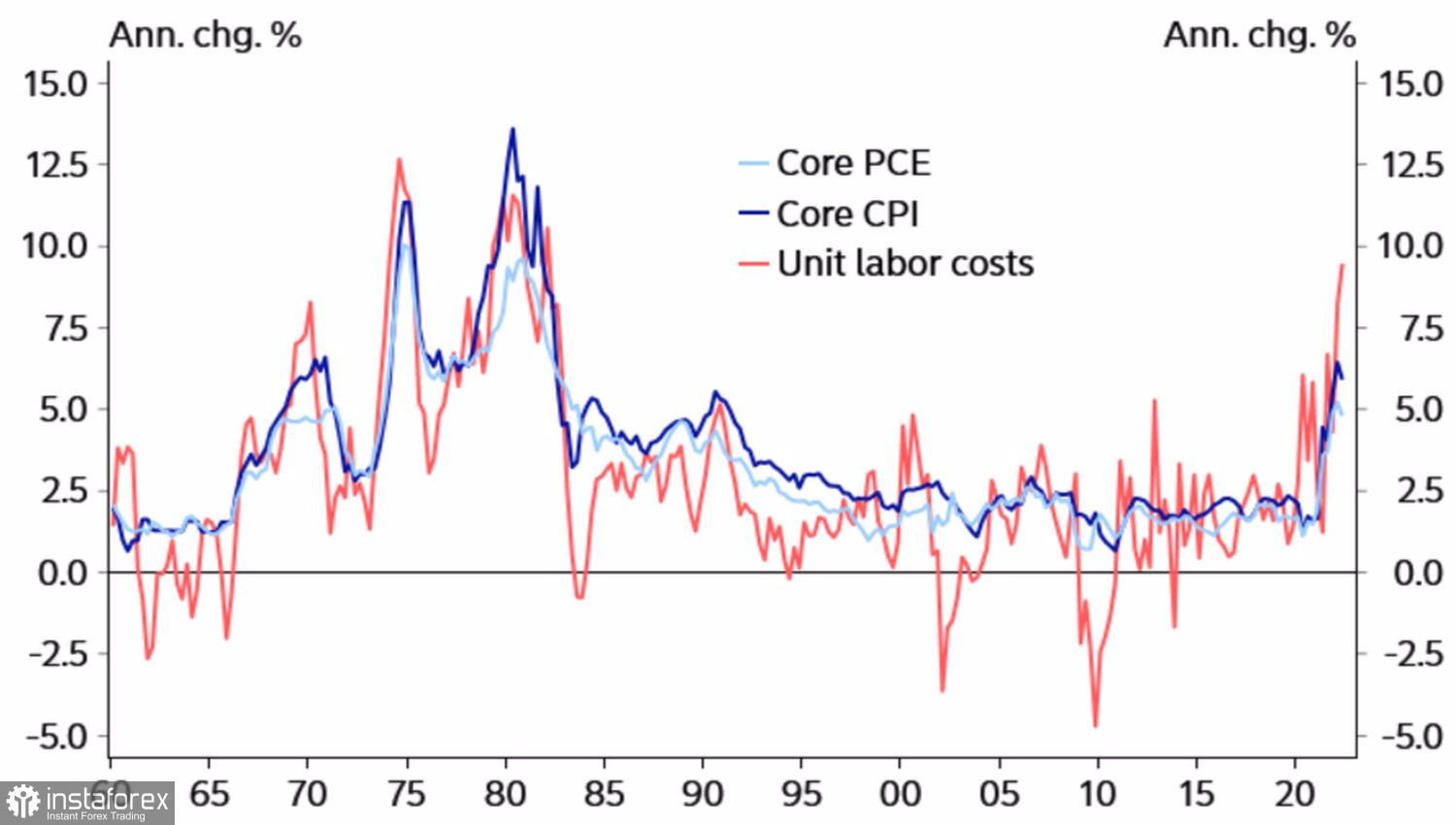

Basically, there is not much to explain. A slowdown in US inflation reduces the Fed's need for more repression of its own economy and labor market, but there are good reasons for the central bank to keep raising the federal funds rate and keep it high for an extended period. No matter how much consumer price growth slows down, core inflation is unlikely to drop at the speed of a courier train. As, however, and salaries.

Dynamics of inflation and labor costs in the United States

It is not certain that the core CPI in the US has reached its peak, and if it does pass, no one can guarantee that the current rate of monetary restriction by the Fed is enough to bring inflation back to the 2% target. Most likely, borrowing costs will have to increase to 4-4.5%, and not to 3.7%, as currently expected by the derivatives market. To celebrate the victory over high prices, a significant slowdown in the economy is required, and it most likely will not happen. So high rates in the United States are serious and for a long time. Together with the energy crisis in Europe and the proximity of the eurozone economy to recession, this does not paint a rosy scenario for EURUSD.

Technically, the pair is trying to find a bottom on the weekly chart - to form point 5 of the Wolfe Wave pattern. Most likely, the euro will have to fall to $0.977-0.984, and possibly even to $0.95-0.96, before bouncing back up. Recommendation for EURUSD - sell.