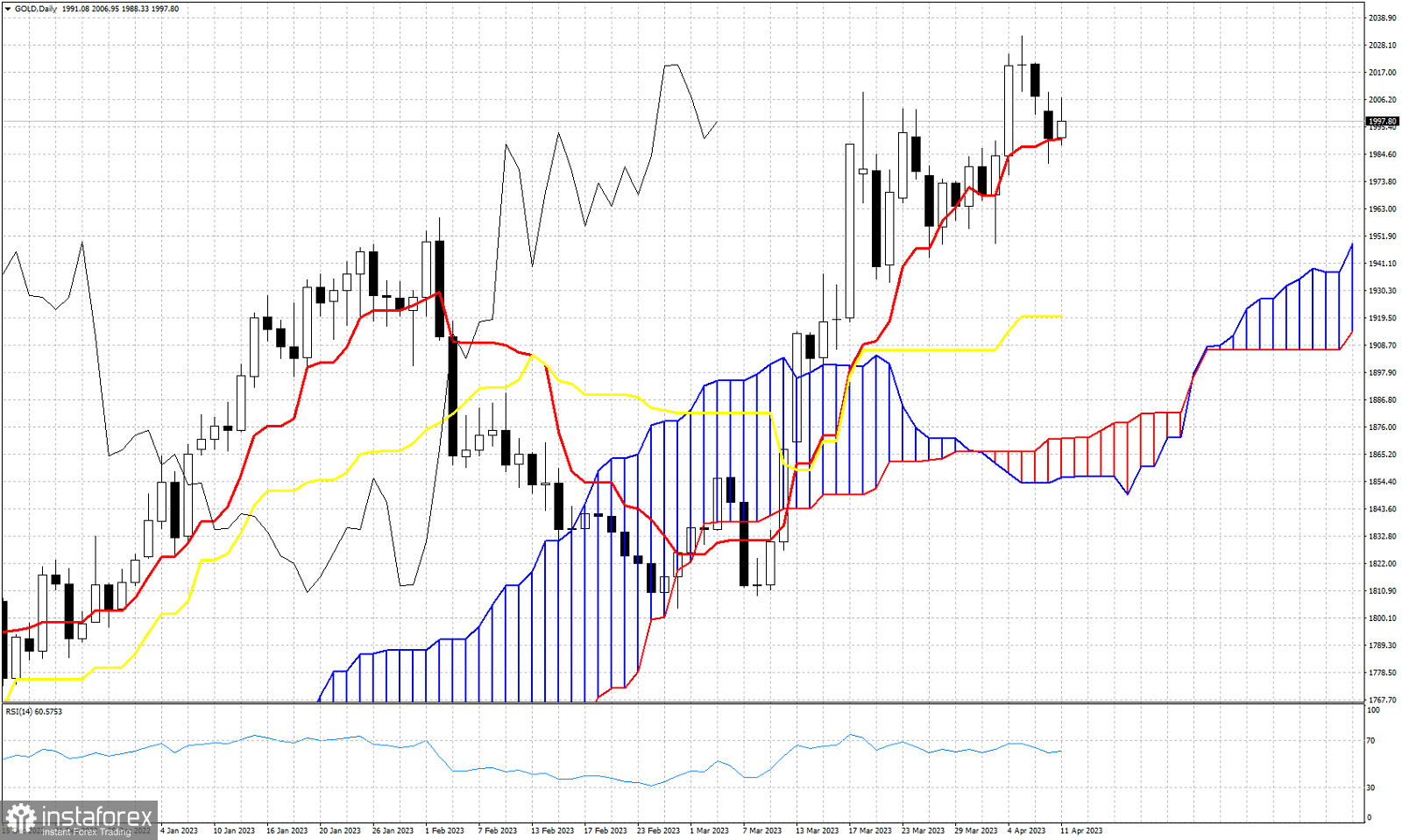

According to the Ichimoku cloud indicator on a daly basis, Gold remains in a bullish trend. Price made a pull back yesterday and tested the first important support level where we find the tenkan-sen (red line indicator). Today the tenkan-sen is at $1,990 and a daily close below this level would be a sign of weakness. A close below the tenkan-sen would suggest that a pull back towards at least the kijun-sen (yellow line indicator) should be expected. The kijun-sen is currently at $1,920 and the Kumo (cloud) is at $1,877. As long as price remains above the Daily Kumo, trend remains bullish. The Chikou span (black line indicator) is also above the candlestick pattern (bullish). Technically a pull back towards $1,920 or even $1,880-70 area is justified. However this can not change the trend alone. Bears needed a bigger reversal in order to regain control of the daily trend.