The EUR/USD currency pair continued its downward movement on Friday, and the illustration above clearly shows that it is already approaching the lows of a month ago, which at the same time act as 20-year lows. Also, in the illustration above, an upward correction is visible, which lasted for several weeks and amounted to 400 points. We have repeatedly drawn traders' attention to the fact that the euro currency cannot adjust by more than 400 points within the framework of a global downward trend. Therefore, we can assume that all the formalities have been completed, and now the pair can continue their fall. As for the reasons for the euro currency to fall now, the market does not seem to need them. The foundation and geopolitics remain very difficult for the euro currency, and macroeconomics has only an indirect influence on the pair's movement. Often, the market ignores statistics. Accordingly, we must now continue to keep the foundation and geopolitics under control.

And these are the factors that cannot change quickly. For example, the difference between the Fed's and the ECB's monetary approaches is not only obvious but also getting worse every month and a half. The Fed does not just raise the rate but also increases the difference with the ECB. Consequently, the growth factor of the dollar is only getting stronger every month. We believe that the foundation will begin to "unfold" only when the real prospect of completing the Fed rate hike cycle looms on the horizon. And it will be a long time since we have seen only one month with a slowdown in inflation so far.

Consequently, no one understands how the indicator will behave in the future. If it continues to decline actively, this may force the Fed to raise the rate at a slower pace and for a shorter period. But if not, the rate may rise to 4% and up to 4.5%, as some members of the Fed's monetary committee are already talking about. And the ECB may raise the rate in September for the second time in the last 11 years, and that's it.

A boring week awaits us in macroeconomic terms.

There will be very few macroeconomic and fundamental events in the new week. Moreover, Monday will be, as usual, a semi-holiday since the calendar of events is empty. The first reports will be published on Tuesday. The European Union will release data on business activity in production and services, which are now of great importance for the common foundation. Last month, business activity in the manufacturing sector fell below the critical level of 50.0, which indicates a recession in this area. This indicator may fall even lower in August, and the indicator of the service sector may come close to the level of 50.0, which is now indicated by forecasts.

On Thursday, the report on GDP in the second quarter of Germany will be released. We would also like to highlight it, although it is unlikely to significantly affect the movement of the euro/dollar pair. According to experts, GDP growth will be 0%, which may be the starting point. The starting point for the European economy in recession. The German economy continues to be the "locomotive" for the entire European economy, and it may be the first to start going into recession. And there are no other important events planned in the European Union. Christine Lagarde has not spoken publicly for a very long time, but it should be remembered that it is summer, and politicians also have the right to vacation. In general, the week will be quite boring, but even those reports coming out are unlikely to support the European currency. Maybe it will not fall by another 200-300 points, but it will keep the downward trend.

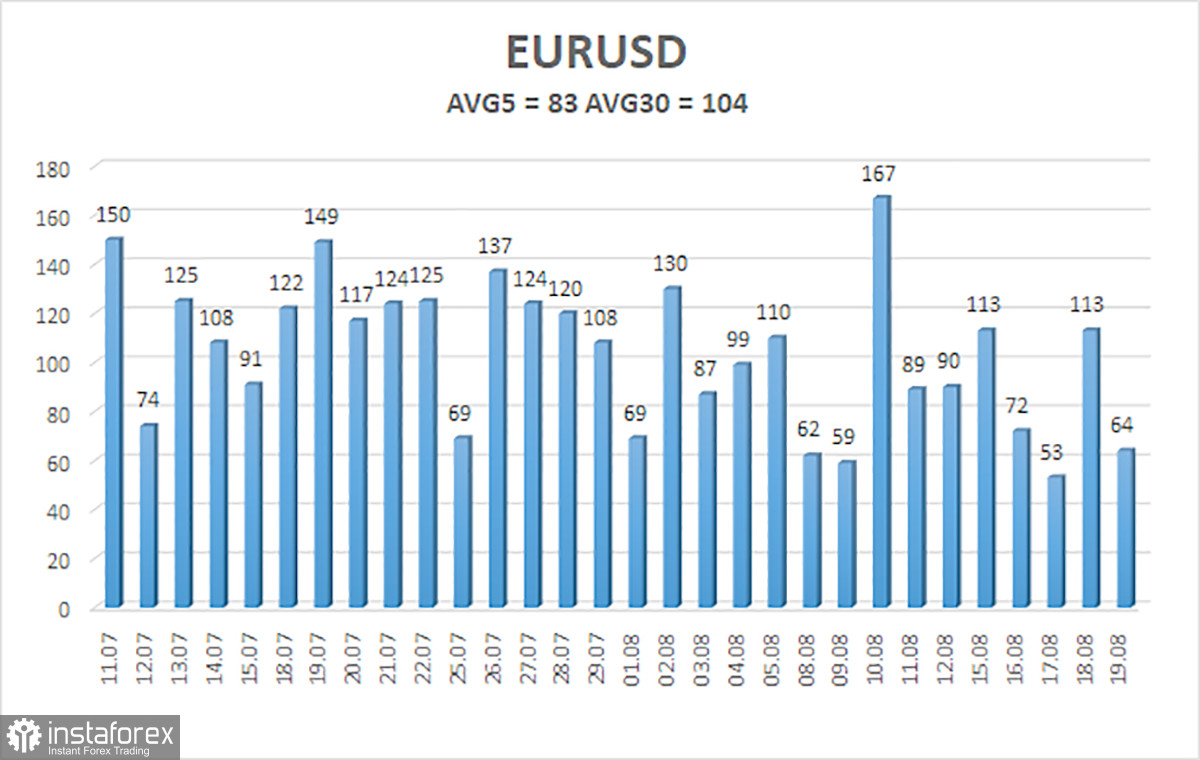

The average volatility of the euro/dollar currency pair over the last five trading days as of August 22 is 83 points and is characterized as "average." Thus, we expect the pair to move today between 0.9956 and 1.0122. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward correction.

Nearest support levels:

S1 – 1.0010

S2 – 0.9949

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0071

R2 – 1.0132

R3 – 1.0193

Trading Recommendations:

The EUR/USD pair continues its downward movement. Thus, it is now possible to stay in short positions with targets of 1.0010 and 0.9956 until the Heiken Ashi indicator turns up. It will be possible to consider long positions after fixing the price above the moving average with targets of 1.0254 and 1.0315.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.