Fed Chairman Jerome Powell will have a chance to reset expectations in the financial markets when central bank governors meet this week for their annual meeting at Jackson Hole.

Powell is speaking on the economic outlook Friday at 10 a.m. (EDT) and is expected to reiterate the Fed's determination to keep raising interest rates to bring inflation under control, though he will probably refrain from signaling how major officials will act when they meet next month.

"That's everyone's top-of-mind question: How much will Powell micro-manage financial conditions? We have reached a point where the economy is showing signs of slowing," said Laura Rosner-Warburton, a senior US economist at MacroPolicy Perspectives in New York. "If we don't see more slowing in the data and instead things bounce, then the Fed will have to more actively manage financial conditions."

Powell's speech will be the highlight of a two-day conference in the Grand Teton Mountains of Wyoming. The prestigious event, which in the past has been used by Fed chairmen as a venue for key policy decisions, brings together leading policymakers from around the world.

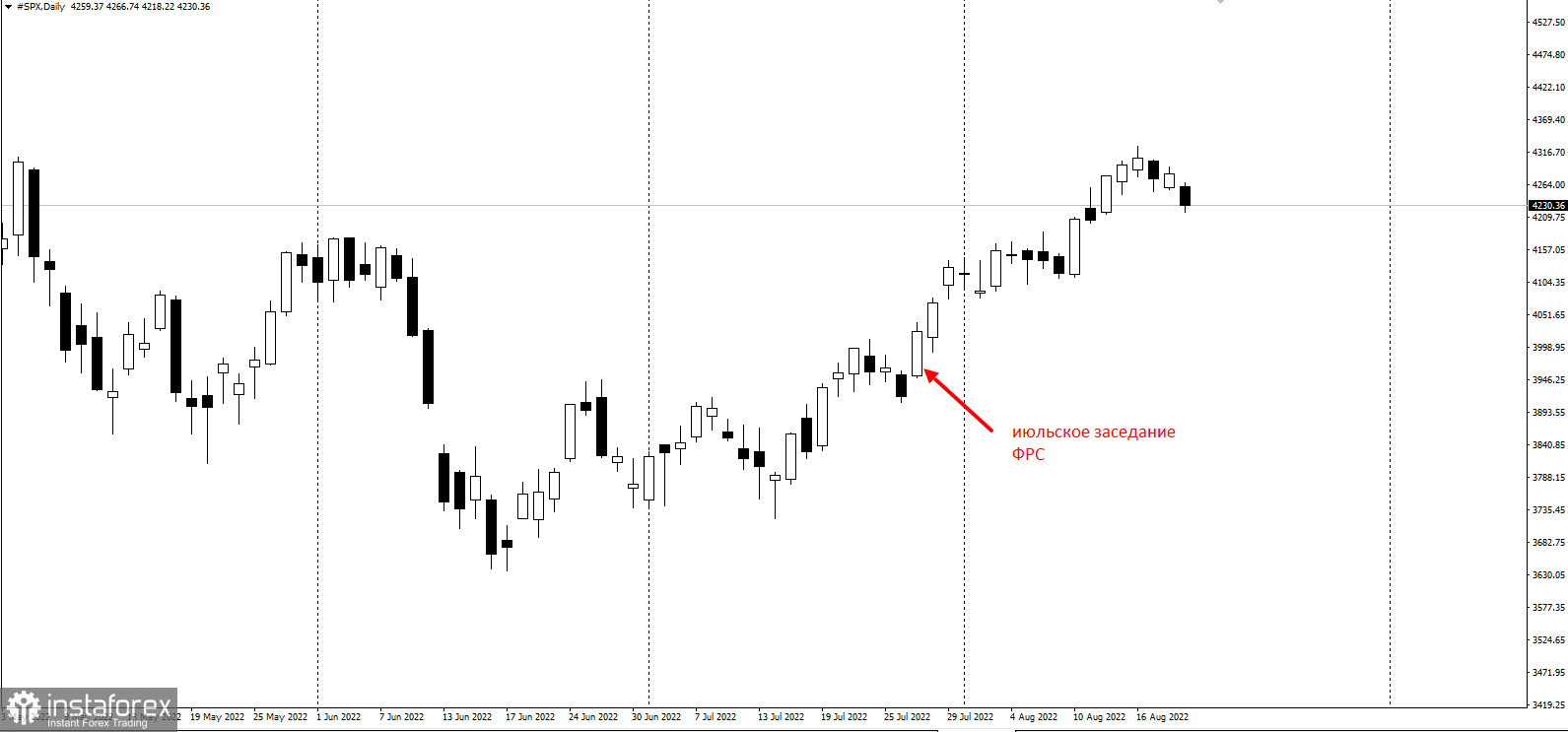

US stocks soared since the Fed's last meeting in late July amid growing expectations that the central bank will begin to slow the pace of tightening, as well as signs that inflationary pressures may be easing.

Investors were unconcerned by the politicians' harsh statements that their fight against inflation was far from over, although the chairman himself had not yet given his July 27 press conference.

This year's conference is being held in person for the first time since 2019. Last year, it was converted to a virtual format just days before the delta strain spread across the country. By then, inflation was well above the Fed's 2% target, but in his address to the forum, Powell stressed that this pressure was likely to be temporary.

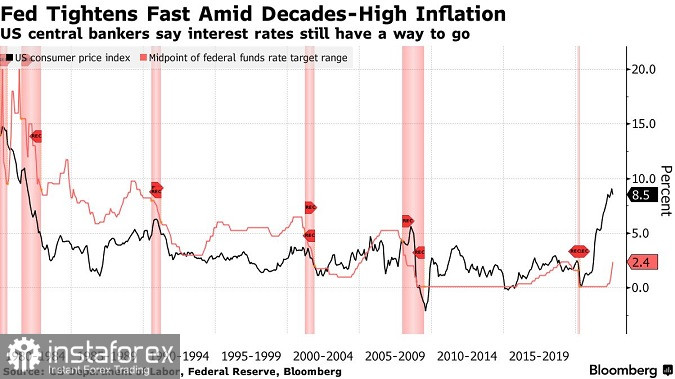

In 2021, US inflation was near its highest level in four decades, and Powell admitted that the Fed's analysis was wrong and policymakers should have started raising interest rates earlier.

The Fed raised the benchmark interest rate by 75 percentage points at its July meeting after raising it by the same amount a month earlier. The successive moves marked the fastest pace of tightening since the early 1980s.

At the moment, investors see similar odds of either a 0.5% hike or another 0.75% hike at the Fed's September 20-21 meeting. Prior to that, the Labor Department will release August employment and consumer price data, and they will likely be the determining factor for the decision.

In Europe, policymakers are having a similar debate about how significant the next rate hike should be. The ECB has lagged behind its counterparts in responding to record inflation and only began raising rates in July. After last month's half-point hike, many policymakers have not yet signaled whether they are leaning toward another such move in September or a quarter-point increase, as recession risks mount.