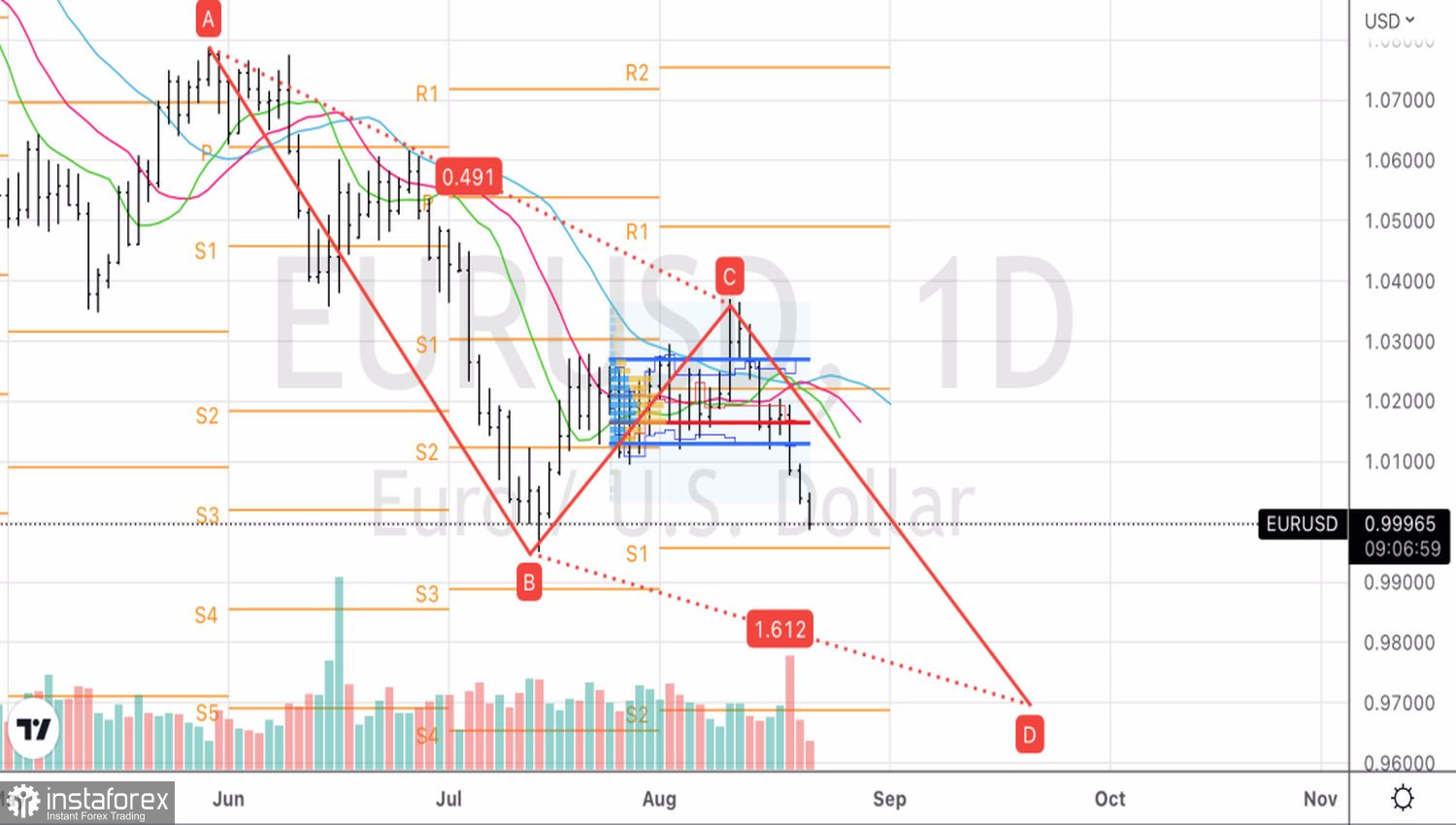

The euro is again worth less than the US dollar, and, unlike in mid-July, the bulls are unlikely to be able to cling to parity. The eurozone economy looks too sad. And the US stock market rally has gone too far. While there is no gap in the clouds for EURUSD, the main currency pair risks falling like a stone.

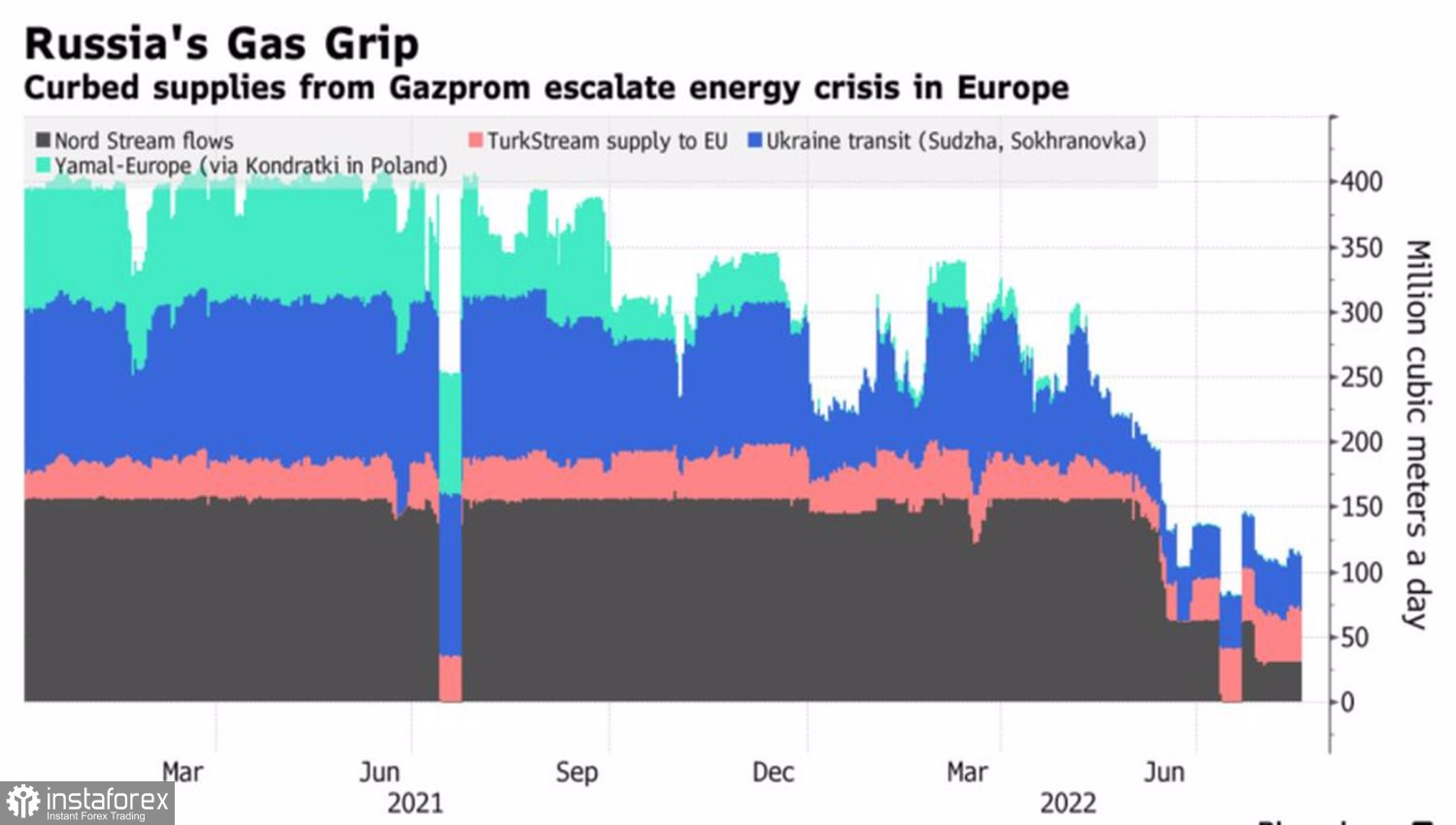

The shutdown of the Nord Stream pipeline for maintenance for three days from August 31 was another blow to the regional currency. Until quite recently, traders wondered if Russia would resume gas supplies to the EU. They are doing the same now. Germany decides to cut consumption by 20%, gas prices skyrocket by the same 20%, and logistics problems in the currency bloc's largest economy put it on the brink of recession. If it hasn't already happened. Indeed, the low water level of the Rhine makes transportation difficult, rail transport options are limited, and seaports are overwhelmed with cargo.

Dynamics of Russian gas supplies to Europe

And although the Bundesbank notes that an economic downturn is possible, rates still need to be raised so that inflation does not soar to 70-year peaks, and the ECB's monetary restriction does not impress the EURUSD bulls.

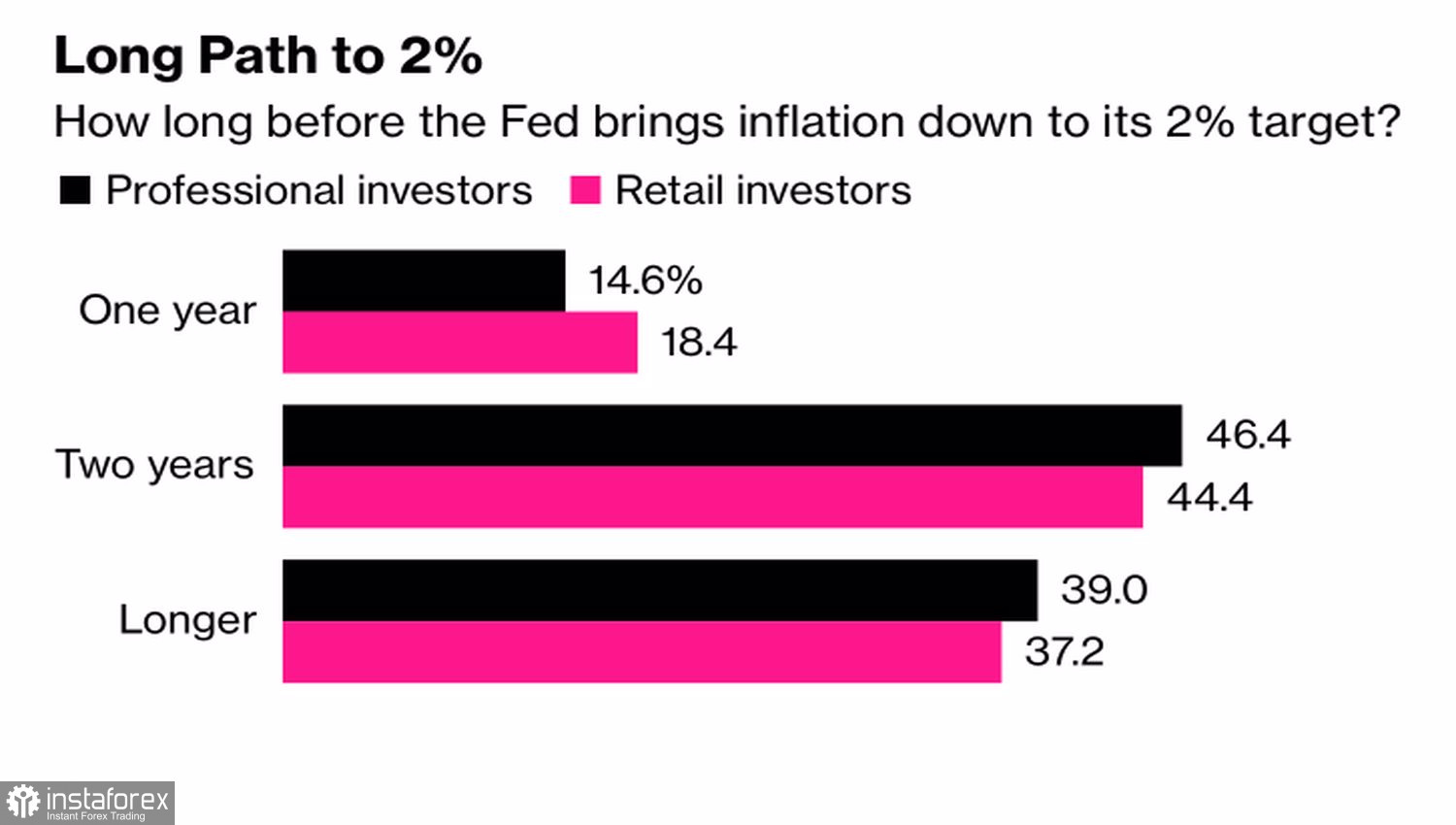

On the contrary, the issue of raising the federal funds rate is back on the agenda. The derivatives market increased the chances of its growth by 75 bps in September from 40% to 55%. And while most of the 900 MLIV Pulse survey participants, including strategists and intraday traders, believe that US inflation has peaked, 84% of respondents are confident that the Fed will not be able to return it to the 2% target for at least two years. If so, then the monetary restriction cycle will continue into 2023, and possibly into 2024, which indicates the wrongness of market expectations and reinforces fears about the fall of the S&P 500.

Forecasts to reduce inflation in the US to 2%

Investors are wary of Jackson Hole, where Jerome Powell is likely to say the same thing as his FOMC colleagues. It is necessary to fight inflation, raise rates; it makes no sense to stop halfway. The Fed's work to get the personal spending index back to the 2% target is far from complete, leaving the long-wishful stock markets in serious turmoil. Their fall will be perceived as a deterioration in global risk appetite. This will increase demand for the US dollar as a safe-haven asset.

"Bulls" on EURUSD are really not to be envied. The armed conflict in Ukraine is far from over, the degree of the energy crisis will increase as winter approaches, and the difference in rates is driving the pair down.

Technically, the update of the July low on the EURUSD daily chart will activate the AB=CD pattern and increase the risks of a continuation of the downward trend in the direction of its target by 161.8%. It corresponds to the mark of 0.97. The recommendation is to keep the shorts formed from the level of 1.0275 and periodically increase them on pullbacks.