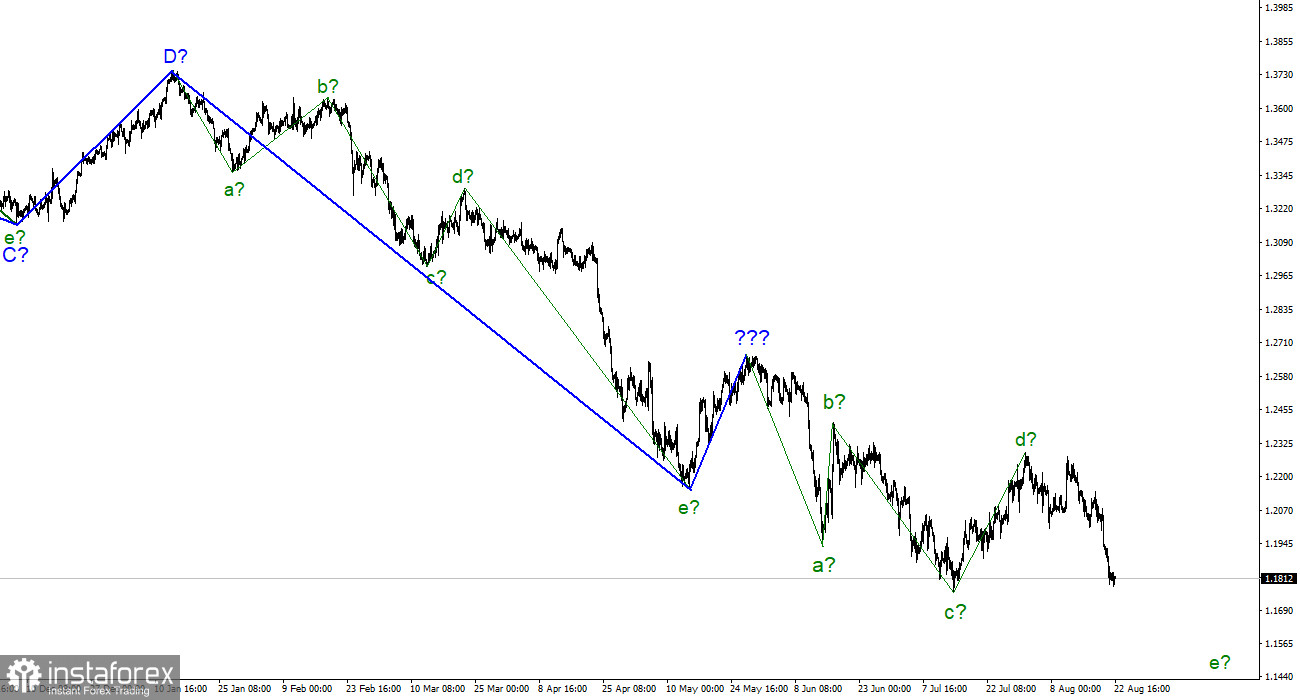

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but does not require any clarifications yet. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. And the current trend has already taken a very extended form. I believe that in this case, it is much better to identify rare corrective waves, after which new clear structures will be built. At this time, we have completed waves a, b, and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, then the decline in quotes should continue in the near future. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. Ascending and descending waves alternate almost equally. However, it is the corrective status of the trend for the British that allows it to complete the wave e near the 161.8% Fibonacci level.

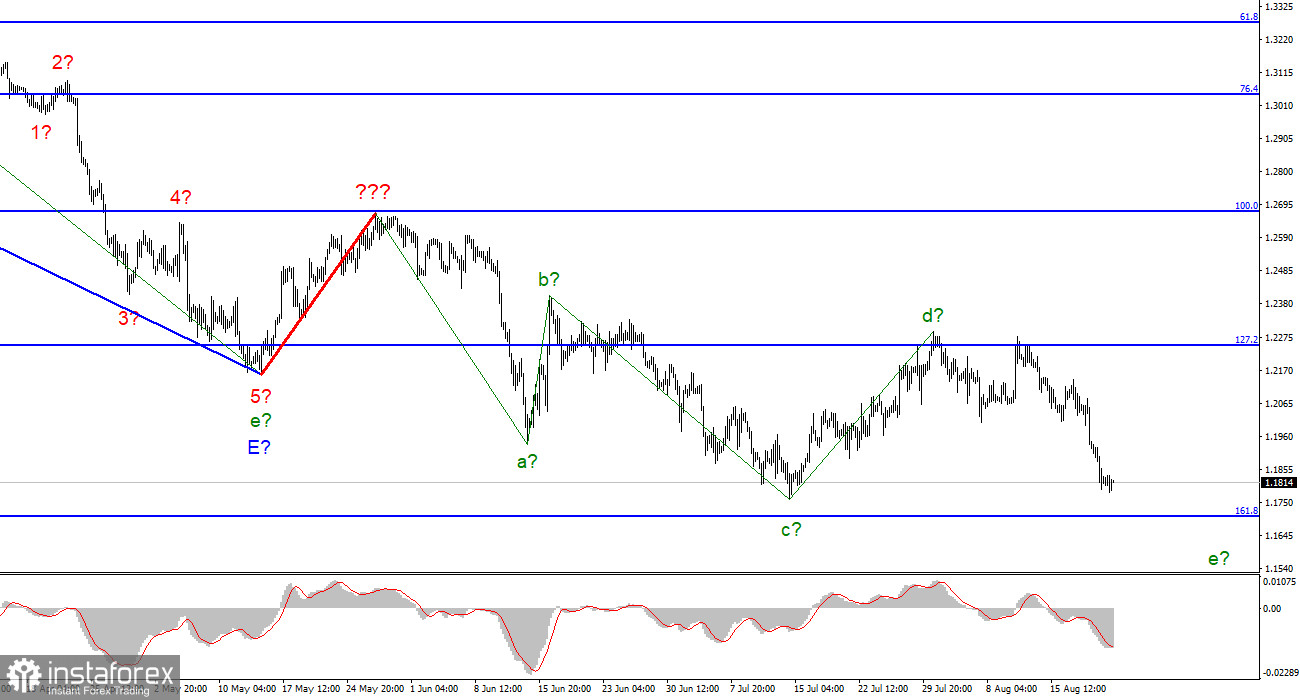

The exchange rate of the pound/dollar instrument decreased by 100 basis points on August 19, and by another 10 on the 22nd. The pound's losses were insignificant today, but today is still Monday. And on Mondays, the market sometimes "rests." There is no news background, and the market has nothing to work out. Although last week it was not embarrassed by the lack of a news background on individual days. According to the British, the situation is a little different now. If a European can fall for as long as it wants, since the ECB does not support it at all, and the recession in the EU scares the market very much, then the situation in the UK is a little better. It will not be able to avoid a contraction of the economy, but the Bank of England is still doing much more than the ECB to fight inflation and support the pound. Do not forget that inflation in the UK is higher, and it is already known about the recession that can last at least 5 quarters. In the European Union, inflation is lower, and it is still very difficult to judge the recession since the European economy grew by 0.6% in the second quarter of 2022. But at the same time, inflation in the EU can still accelerate for as long as it wants, because the ECB has raised the rate only once. Many analysts now fear that the conflict with Moscow will lead to the fact that gas will stop coming to Europe from Russia. This will lead to the fact that some enterprises will stop, and in winter they will have to turn on the hard economy mode. However, I would not like to get ahead of myself. That's when the shortage of energy and fuel begins, then it will be possible to talk about it. There are no such problems in the UK. The positions of the British look weak, but still better than the positions of the Europeans. And the wave marking allows the completion of the decline already around the level of 1.1708.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now to postpone the sale of the instrument with targets located near the estimated mark of 1.1708, which equates to 161.8% Fibonacci for each MACD signal "down." A successful attempt to break through the 1.1708 mark will indicate the readiness of the market for new sales in the British.

At the higher wave scale, the picture is very similar to the euro/dollar instrument. The same ascending wave is unsuitable for the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.