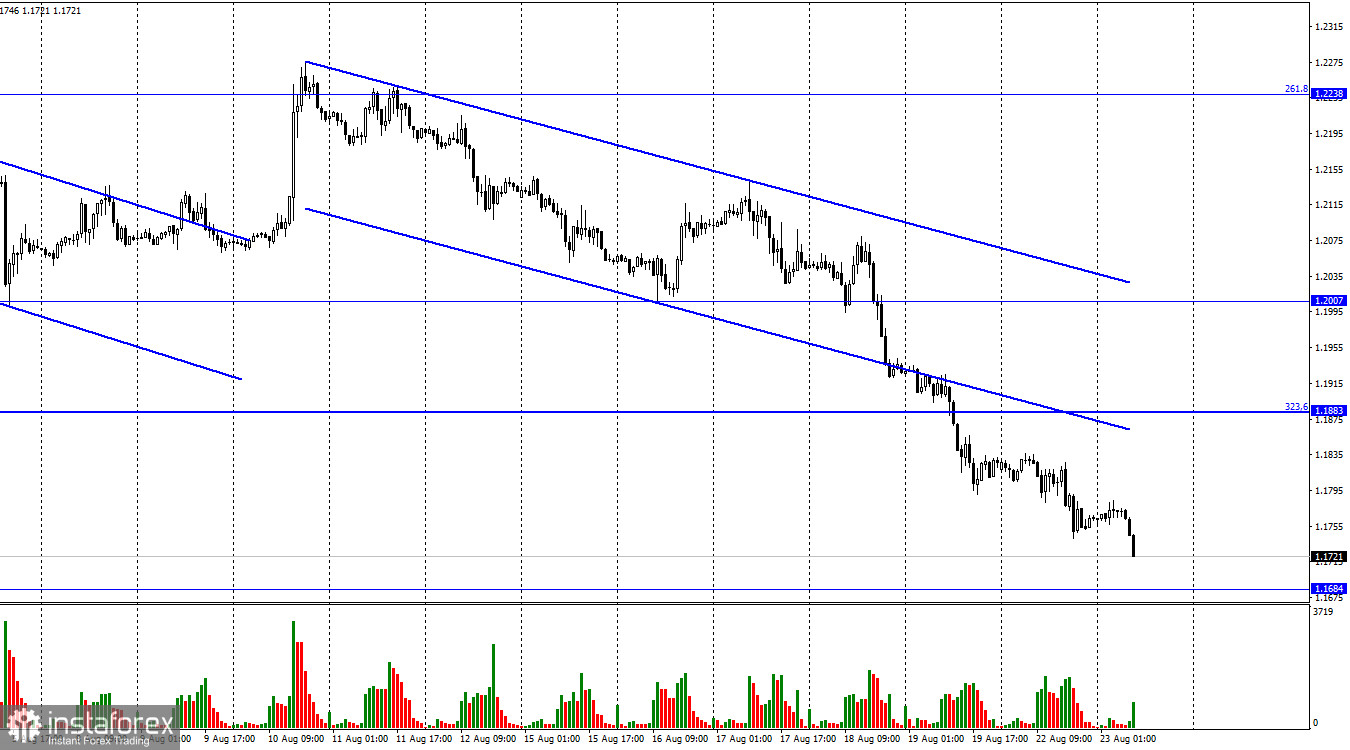

Hi, dear traders! According to the H1 chart, GBP/USD continued to drop towards 1.1684. The pair's downward movement continued on Tuesday, and the pair can reach that level today. If the pair bounces off 1.1684 upwards, it could then rise slightly towards the Fibo level of 323.6% (1.1883). However, if the pair settles below 1.1684, it could possibly decline towards 1.1496. GBP/USD is falling without any notable events that could have triggered the slump, similar to EUR/USD. The last week's data releases might have pushed the pair down. However, the beginning of this week has shown that traders are bearish on GBP/USD even if there are no important events on the economic calendar. The influence of statistics on traders last week was questionable.

Both EUR and GDP are on the decline, despite the release of economic data in the UK. Traders might also ignore today's data releases, such as the PMI reports in the UK and the US. The UK PMI is predicted to stay above 50, even though the index could decline once again. The US PMI has already fallen below the 50-point mark, but traders are unlikely to stop going long on USD because of PMI alone. Market players are currently influenced by more global factors than just a single index. A growing expectation of a Fed rate hike in September is one of such factors. Even a smaller 0.50% increase will still surpass the Bank of England's rate move.

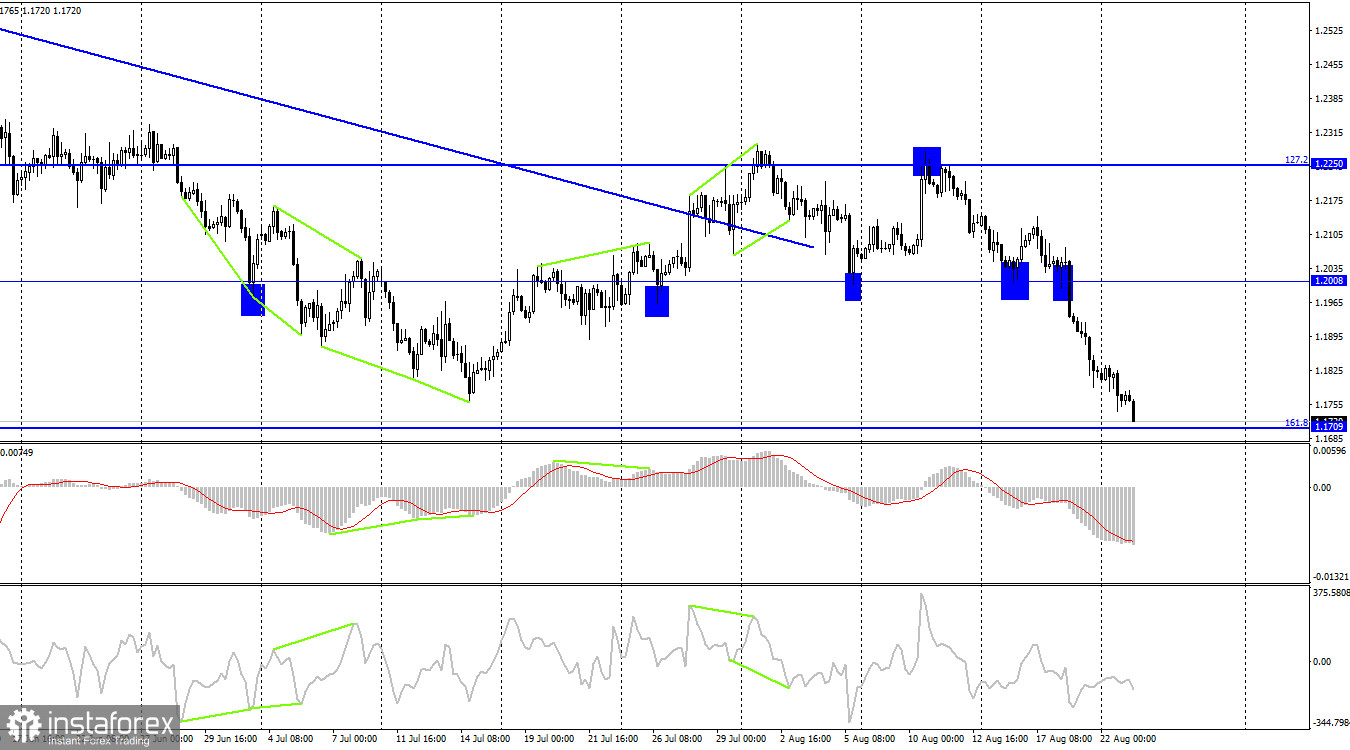

According to the H4 chart, the pair fell to the retracement level of 161.8% (1.1709). If GBP/USD bounces off 1.1709 upwards, it could then rise slightly towards 1.2008. However, if the pair settles below 1.1709, it could possibly fall towards 1.1496. There are no emerging divergences today, but they are not particularly important at this point, as GBP/USD is moving downwards without any retracements.

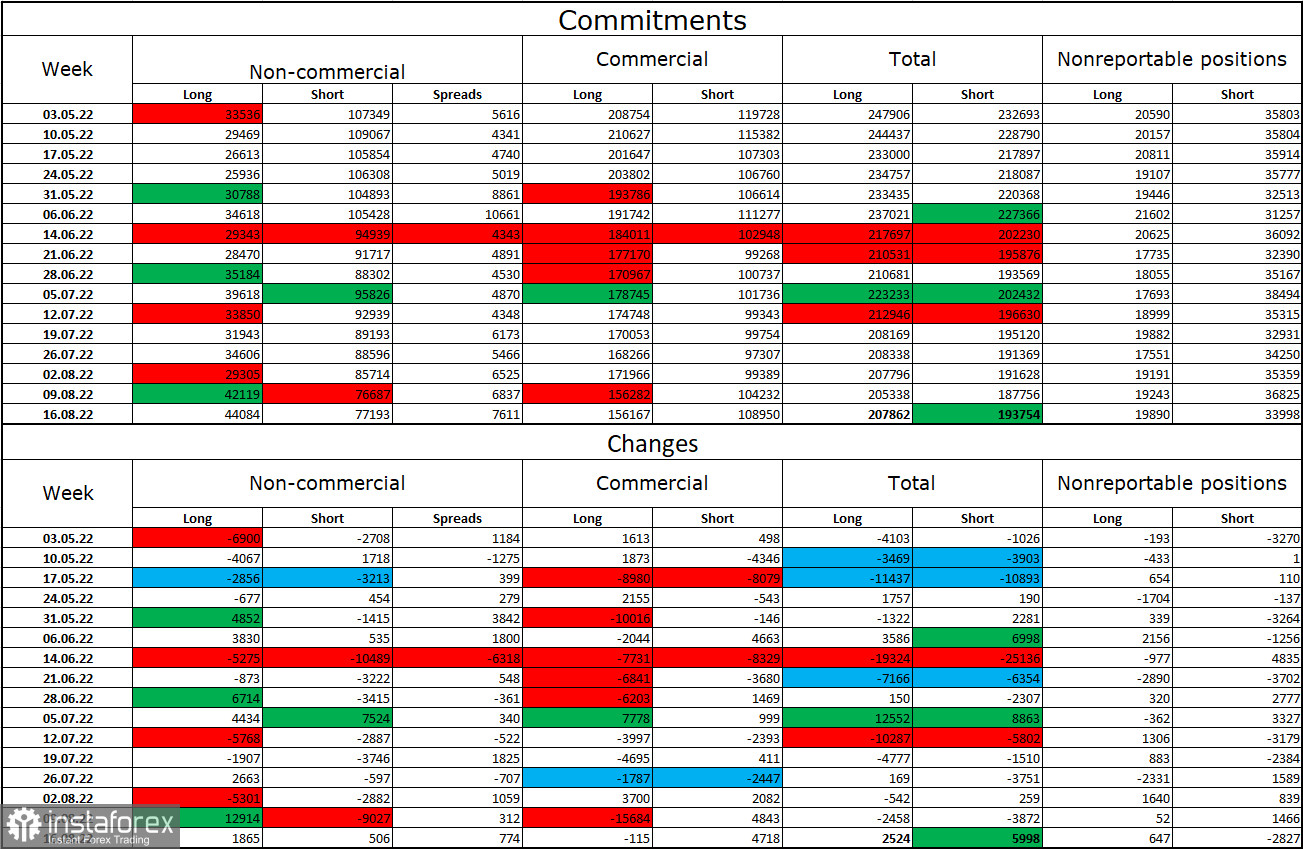

Commitments of Traders (COT) report:

Non-commercial traders became slightly less bearish in the last week covered by the report. Traders opened 1,865 Long and 506 Short positions. Market players remain bearish on GBP/USD, and Short positions continue to outnumber Long ones greatly. However, more traders are now net long on GBP/USD than before. Major players remain bearish on the pound, and it will take a lot of time for them to become predominantly bullish. Over the past several weeks, the pound sterling's upward movement has been limited, and the COT reports suggests that GBP is more likely to continue its decline than begin a new long-term uptrend.

US and UK economic calendar:

UK - Manufacturing PMI (08-30 UTC).

UK - Services PMI (08-30 UTC).

US - Manufacturing PMI (13-45 UTC).

US - Services PMI (13-45 UTC).

Tuesday's data releases in the US and the UK could possibly fail to influence traders.

Outlook for GBP/USD:

Earlier, traders were recommended to open short positions if the pair settled below 1.2208 on the H1 chart, with 1.1709 being the target. GBP/USD has almost reached this level. New short positions can be opened if the pair settles below 1,1709, targeting 1.1496. Long positions can be opened if the pair settles above the descending trend channel on the H1 chart, with 1.2238 being the target.