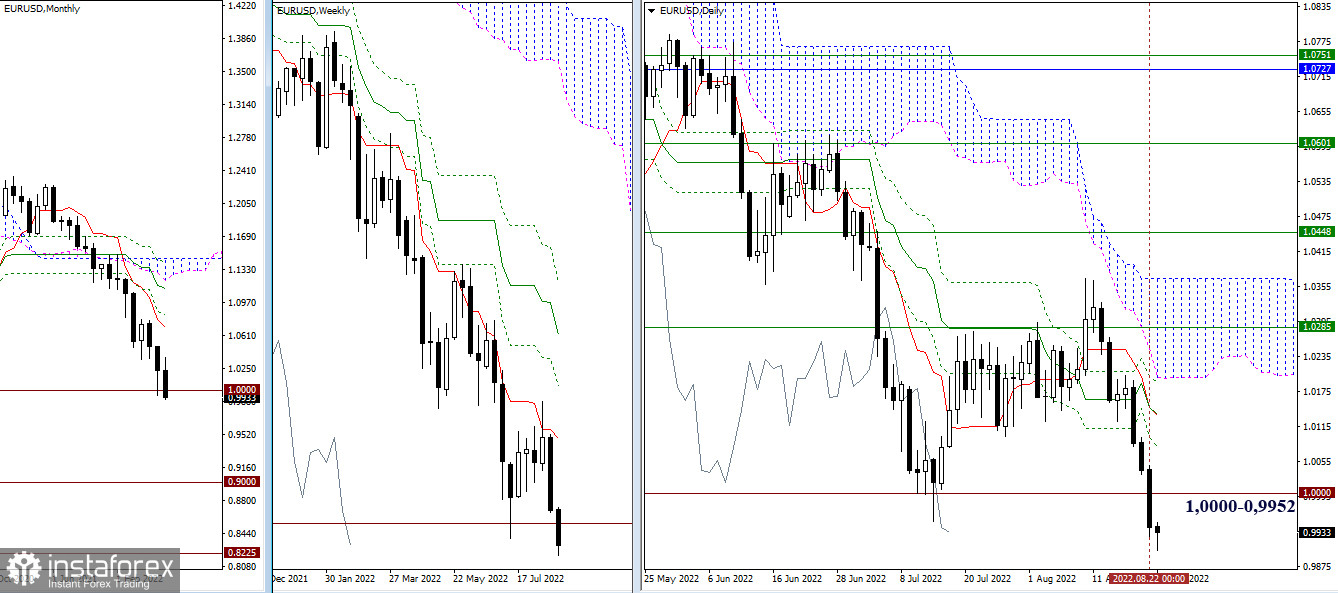

EUR/USD

Higher timeframes

Last week's sentiment retained its strength and predominance, which contributed to the continuation of the decline. Bears managed to close the last day below the indicated reference points of psychological support (1.0000) and the minimum extremum (0.9952). If bulls recover their positions, the passed levels of 1.0000 and 0.9952 can exert attraction and resistance. Reliable consolidation below 1.0000 and 0.9952 will restore the downward trend of the higher timeframes. The reference points for a further decline in the current situation can be the psychological level (0.9000) and the minimum extremum of 2000 (0.8225).

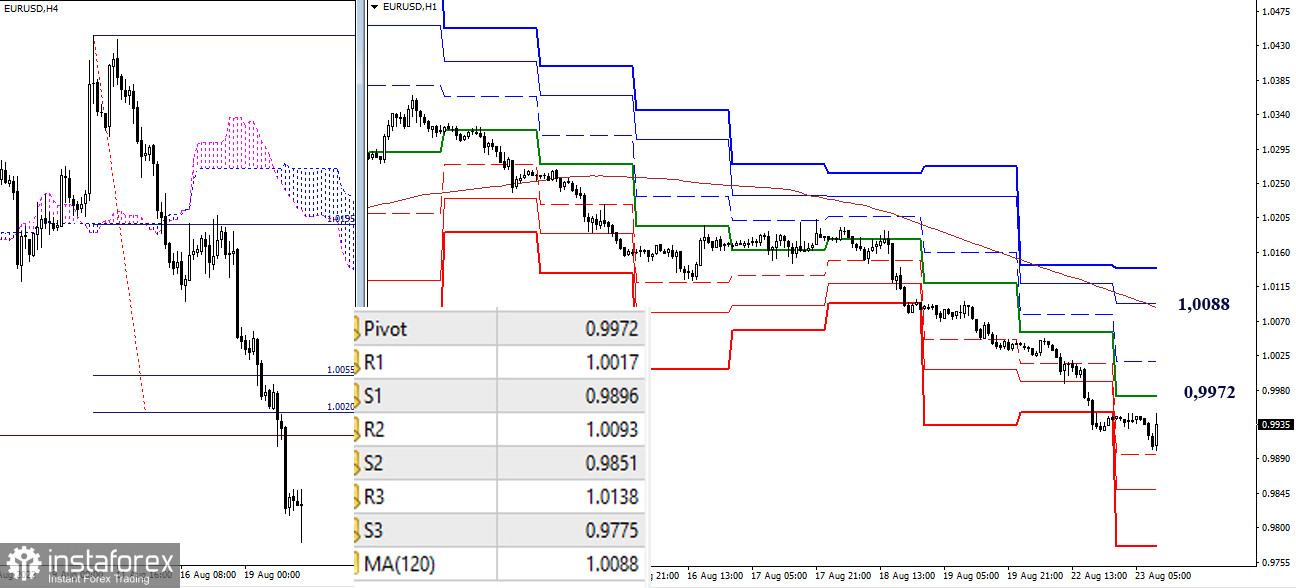

H4 – H1

Bears currently have the advantage on the lower timeframes. They are now testing the first support for the classic pivot points (0.9896). Further reference points for the decline within the day are two other supports of the classic pivot points—0.9851 (S2) and 0.9775 (S3). With the correction developing, bulls will need to focus on passing the key levels, which are now the resistance levels 0.9972 (central pivot point of the day) and 1.0088 (weekly long-term trend). Intermediate resistance can be noted at 1.0017 (R1).

***

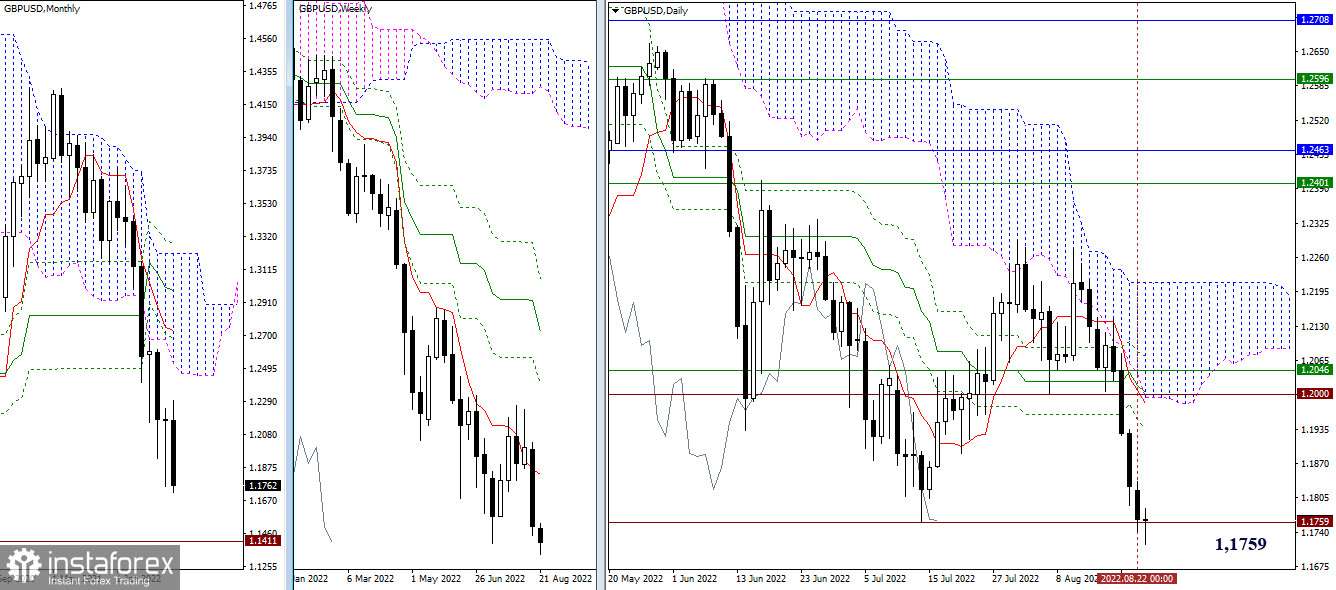

GBP/USD

Higher timeframes

Yesterday, bears updated the minimum extremum and tested its support (1.1759). Soon, the result of interaction with the level will form. As the downward trend movement continues, the next reference point will be the minimum extremum of 2020, fixed at 1.1411.

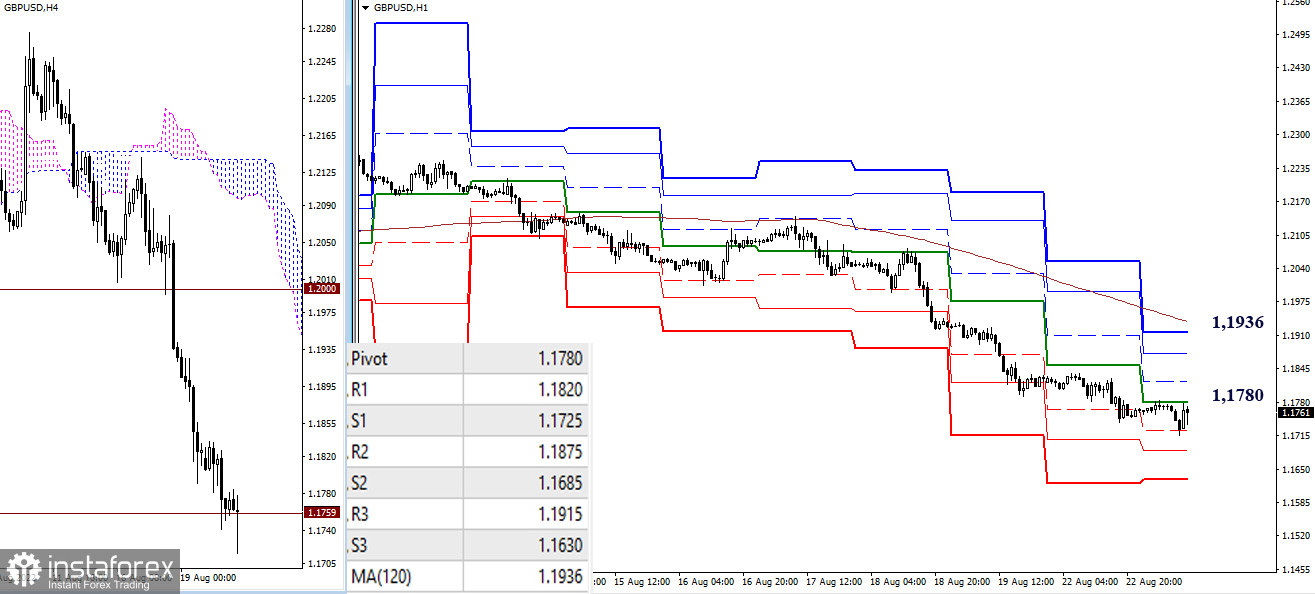

H4 – H1

The pair continues to decline, there is a downward trend, and the main advantage in the lower timeframes belongs to the bears. The reference points for the decline within the day are the support of the classic pivot points (1.1725 – 1.1685 – 1.1630). A corrective rise, consolidation above the key levels of 1.1780 (central pivot point of the day) – 1.1936 (weekly long-term trend) and a reversal of the moving average will help change the current balance of power. Intermediate resistance on this path can be provided by the resistance of the classical pivot points (1.1820 – 1.1875 – 1.1915).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)