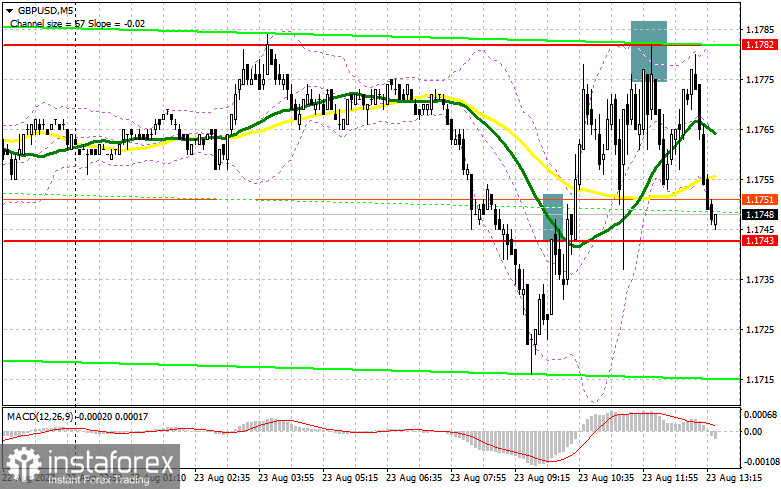

In the morning, the focus was on 1.1743, with entry points considered from this level. Let's look at the 5-minute chart to get a picture of what happened in the market. Although the pair broke through this mark and retested it from bottom to top, no sell signal was generated. Instead, losing trades had to be fixed. A false breakout through 1.1782 brought some 30 pips of profit, which was enough to offset losses. The situation changed in the second half of the day.

When to go long on GBP/USD:

GBP is still bearish. Although the currency updated the yearly low, major players are trying to resist the continuation of the bear trend. During the North American session, volatility could increase after the release of US business activity data. A row of technical indicators is moving near zero, which means pressure on the pair could build up on strong PMI results in the US. A buy signal could be made after a false breakout through 1.1733, with a target at 1.1778, almost in line with the bearish MAs. Bullish power could increase after a breakout and a top-bottom retest of the range, with a target at 1.1820. A more distant target stands at the 1.1865 high. Profits could be locked in at this level. Should GBP/USD fall with no bullish activity at 1.1733, the bear trend will continue. In such a case, long positions could be considered after a false breakout through the 1.1693 low. Likewise, long positions could be opened on a bounce from 1.1643 or 1.1573, allowing a 30-35 pips intraday correction.

When to go short on GBP/USD:

During the North American session, a brief correction is likely, with the dollar receiving support from US macro reports. Attempts to sell the pair at lows, like during the European session, would be pointless. In the case of a bullish correction, bears should defend the 1.1778 mark. Bearish power could increase after a false breakout, with a target at 1.1733. A sell entry point will be created after a breakout through 1.1733 and its bottom-top retest, with targets at 1.1693 and the yearly low of 1.1643. The most distant target is seen at around 1.1573. Profits could be locked in at this level. If GBP/USD shows growth and there is no bearish activity at 1.1778, a bullish correction could occur. In such a case, a nice sell entry point could be created after a false breakout through 1.1820, with the possibility of a pullback afterwards. Short positions could also be opened on a bounce from 1.1865 resistance, allowing a 30-35 pips downward correction intraday.

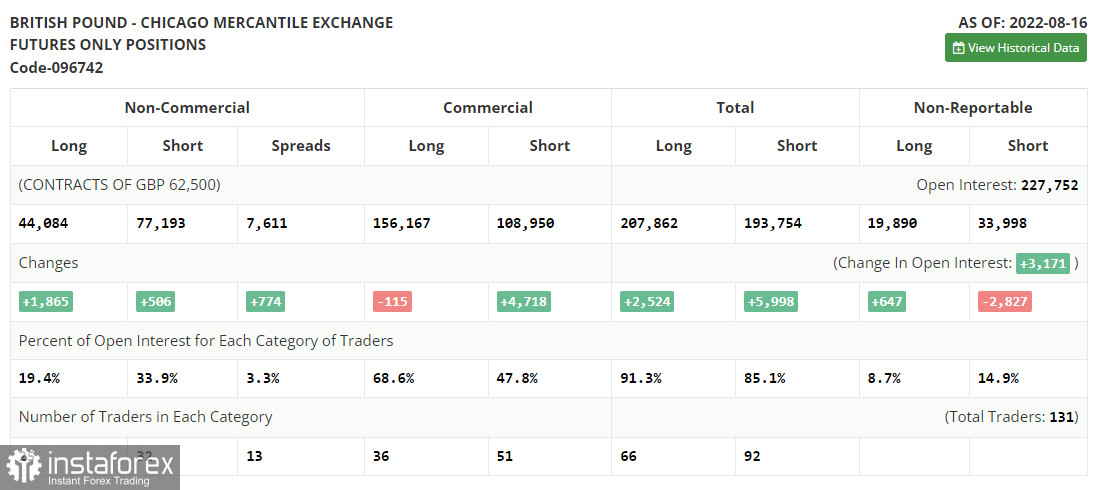

Commitments of Traders:

The COT report for August 16 logged an increase in both short and long positions. Yet, this fact does not reflect the real picture. The pair has been under pressure since the middle of last week. So, demand for GBP is likely to decrease. The greenback may rise sharply against the pound after the Jackson Hole symposium if Fed Chairman Jerome Powell says the central bank is still hawkish about interest rates and inflation. According to the COT report, long non-commercial positions rose by 1,865 to 44,084, while short non-commercial positions fell by 506 to 77,193. Consequently, the non-commercial net position came in at -33,109, up from -34,468. The weekly closing price rose to 1.2096 versus 1.2078.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating the continuation of the bear trend.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at around 1.1778, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.