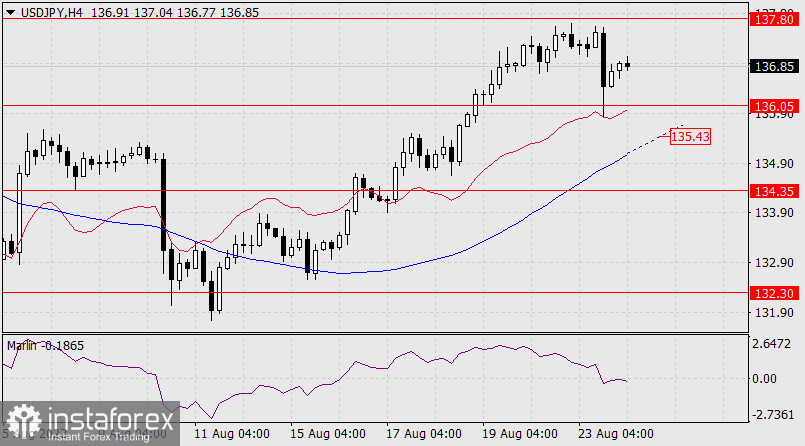

Yesterday, USD/JPY slightly missed the price channel line at 137.77 and is now moving down to support at 136.05 on the daily chart. But the price made a false exit to the MACD indicator line, which showed the completion of growth and, it seems, turned into a medium-term decline. Goals of the movement are 134.35, 132.30.

As we expected, stock markets continued to decline and increased pressure on the currency pair. Yesterday, the S&P 500 fell 0.22%, and such a sharp decline in the index, which began on August 19, is very similar to the collapse of the index on June 9-16 (-10.6%). If history repeats itself, the dollar may go below 132.30 against the yen.

On the four-hour chart, the breakthrough downwards was contained by the balance indicator line. But the Marlin Oscillator is still in the negative territory and now the price can repeat the attack on the support at 136.05 with great success. Then the price will have to overcome the MACD line (135.43) and there it is not far from the linear support at 134.35.