On Tuesday, GBP/USD started the day with a new decline even before the planned macroeconomic data was out. It should be noted, though, that business activity indices have purely statistical meaning. So, we didn't expect to see any strong reaction to their release. Meanwhile, the pound continues to fall for no reason as some traders may think. Indeed, this may seem strange as the quote is tumbling without pullbacks even though there are no reports or fundamental background. However, in every article, I pay attention to the global fundamental background which consists of two parts. First of all, the reason lies in the geopolitical factor although nothing new is happening on this front. Europe is about to face a serious energy crisis that may have only a slight effect on the UK. Therefore, the pound is pressured by the geopolitical factor in the sense that all anti-Russian sanctions imposed by London will work against the country itself. Besides, prices are soaring due to the conflict in Ukraine. If we consider the cost of fuel, energy, and food, this makes the cost of living in the UK extremely expensive.

The second part is the fundamental economic factor. At first glance, the situation doesn't look so bad as the Bank of England regularly raises the rate. Yet, this measure seems useless as inflation hasn't declined even a bit, while the threat of a recession is becoming more real. It turns out that the BoE has triggered the start of a recession and failed to cap soaring prices. So, the regulator may keep raising the rate further, thus pushing the economy into a recession, or it may give up and hope that inflation will disappear by itself, which is almost impossible. The official report of the UK central bank gives a grim forecast of inflation hitting 13%. If the regulator stops its monetary tightening, the inflation rate could soar to 15%. So, the situation looks bad all around.

GBP unlikely to strengthen if Liz Truss wins

As we mentioned yesterday, the economic crisis in the UK goes hand in hand with the political crisis. Boris Johnson is finally resigning. However, recent polls show that most conservative voters regret that Johnson is leaving the office and see no other candidate that could replace him. At the moment, Liz Truss is leading the race to become the next Prime Minister. But it seems that in this case, people will have to choose the lesser of two evils. Boris Johnson is believed to be a charismatic leader. Meanwhile, neither Liz Tuss nor Rishi Sunak can boast of this quality. Yet, Liz Truss has the highest chance to become the next Conservative leader. She pledges to support Ukraine and maintain the anti-Russian rhetoric. She also promises to lower taxes. From an economic viewpoint, such decisions will only increase the burden on the local budget. If Liz Truss wins, things are unlikely to change drastically as she is a big supporter of Boris Johnson. So, the pound won't find support in the political factor. Therefore, the sterling may have dark times ahead before things start to improve. In the medium term, there are no conditions for the pound to advance.

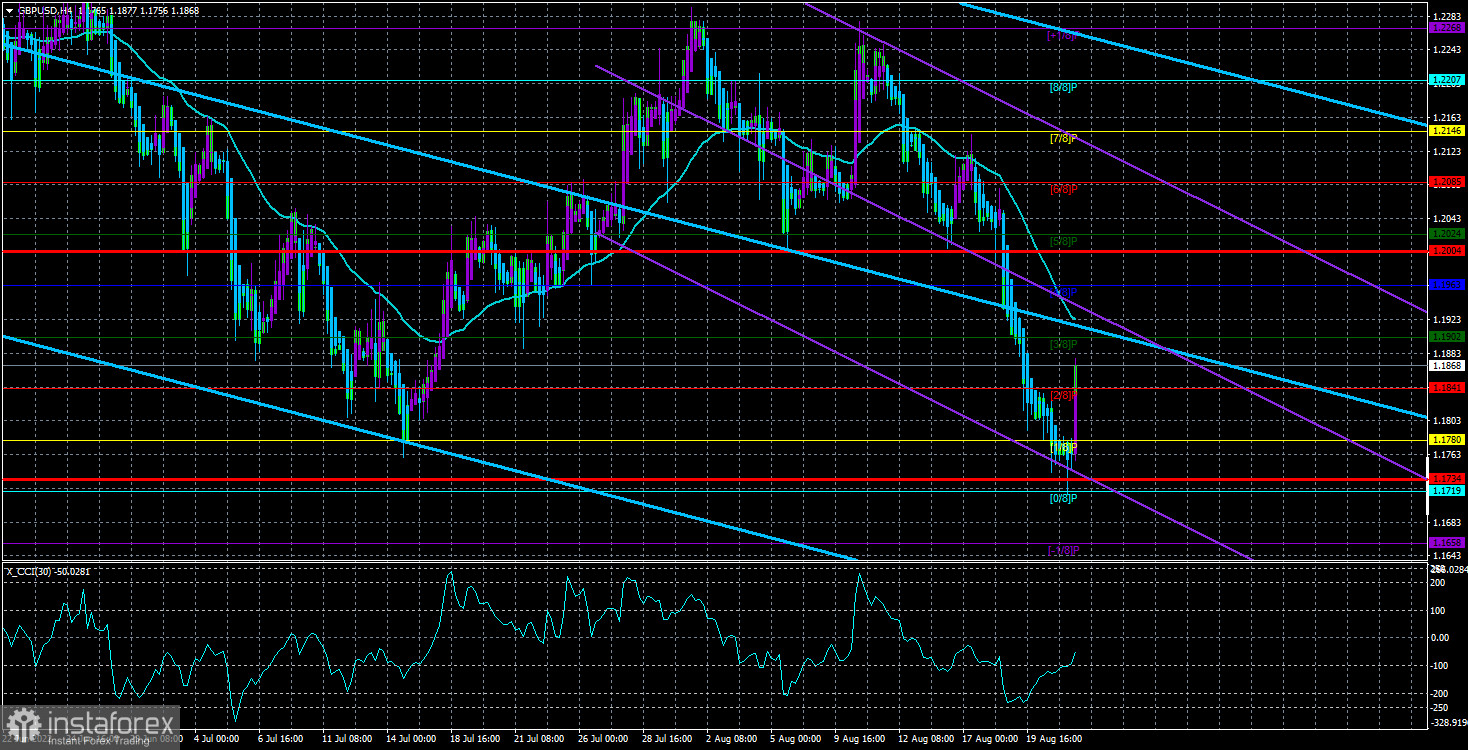

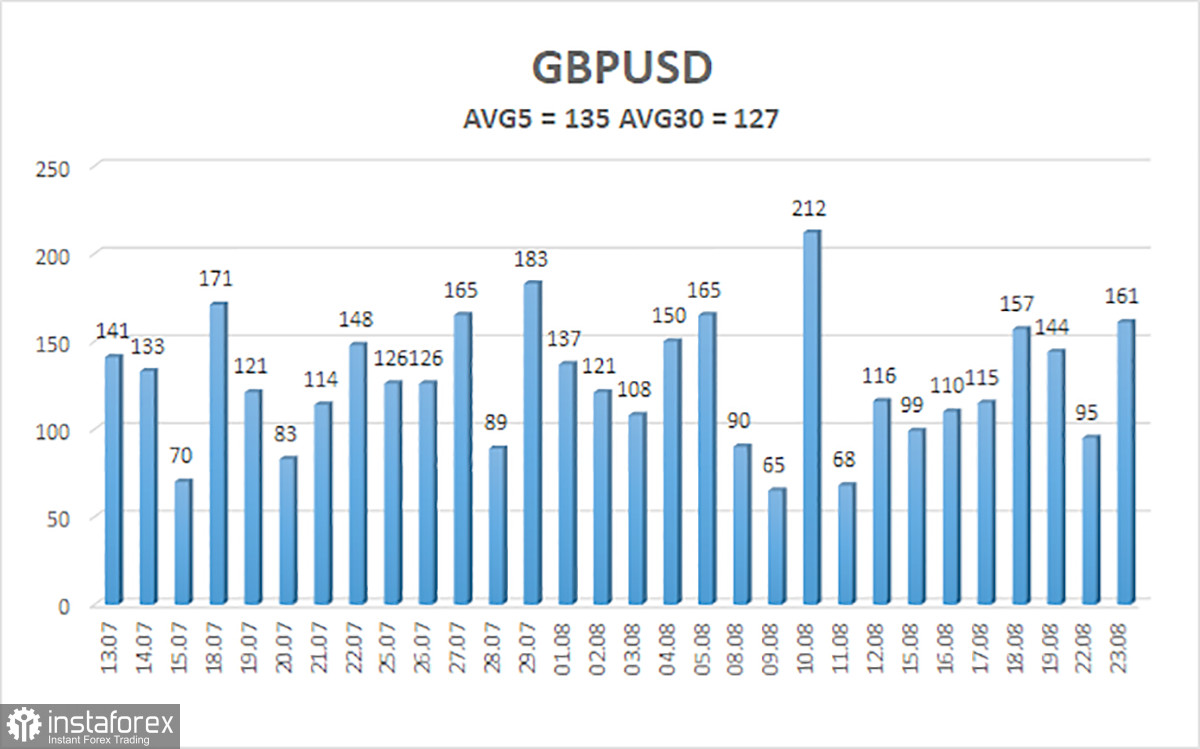

The average volatility on GBP/USD has been 135 pips over the past 5 days. This is a high level for the pound/dollar pair. On August 24, we expect the quote to move within the channel formed between 1.1734 and 1.2004. The downside reversal of the Heiken-Ashi indicator signals the resumption of the downtrend.

Nearest support levels:

S1 – 1.1780

S2 – 1.1719

S3 – 1.1658

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1902

R3 – 1.1963

Trading tips:

On the 4-hour time frame, the GBP/USD pair is staying below the moving average. At this time, it is better to consider sell orders with the targets at 1.1780 and 1.1734 if the Heiken-Ashi indicator turns to the downside. Buy orders will be relevant when the price settles above the moving average with the targets at 1.1963 and 1.2004.

What's on the chart:

Linear regression channels help define the current trend. If both of them are moving in the same direction, the trend is strong.

Moving average (20.0, smoothed) shows a short-term trend and the direction to follow.

Murray levels are the key levels used for defining price movements and corrections.

Volatility levels (red lines) show the possible price channel where the asset is likely to spend the day, considering the current volatility indicators.

CCI: when the indicator enters the oversold zone (below -250) or the overbought area (above +250), a trend reversal is approaching.