Good afternoon, dear traders! On Tuesday, the EUR/USD pair kept falling before the release of US PMI Indices data. After the publication, the US dollar sank sharply. Yet, it moved up by 100 pips shortly after. However, the pair is still moving in the downward corridor. It indicates that trading sentiment is bearish. Hence, the quotes may resume a downward movement at any moment. The Services PMI Index sank to 44.1, while the Composite PMI Index dropped to 45. Traders did not expect such a strong fall and began to get rid of the US currency. It triggered a correction. However, this correction was not visible on the chart as immediately after its completion, the pair declined to 0.9782.

A decrease in US PMI Indices means that the US economy is gradually slowing down. It could signal a recession. Many analysts are now widely discussing the likelihood of a recession. US GDP figures for the first and second quarters were negative. Nevertheless, the Fed believes that the economy will avoid a downturn although traders have a different point of view. However, they are still opening long positions on the US dollar. As a result, the US dollar is likely to resume growth despite the dismal economic reports. Durable Goods Orders data is due today. If the reading is weak, the greenback may extend losses. However, in the long term, it is likely to continue its rally.

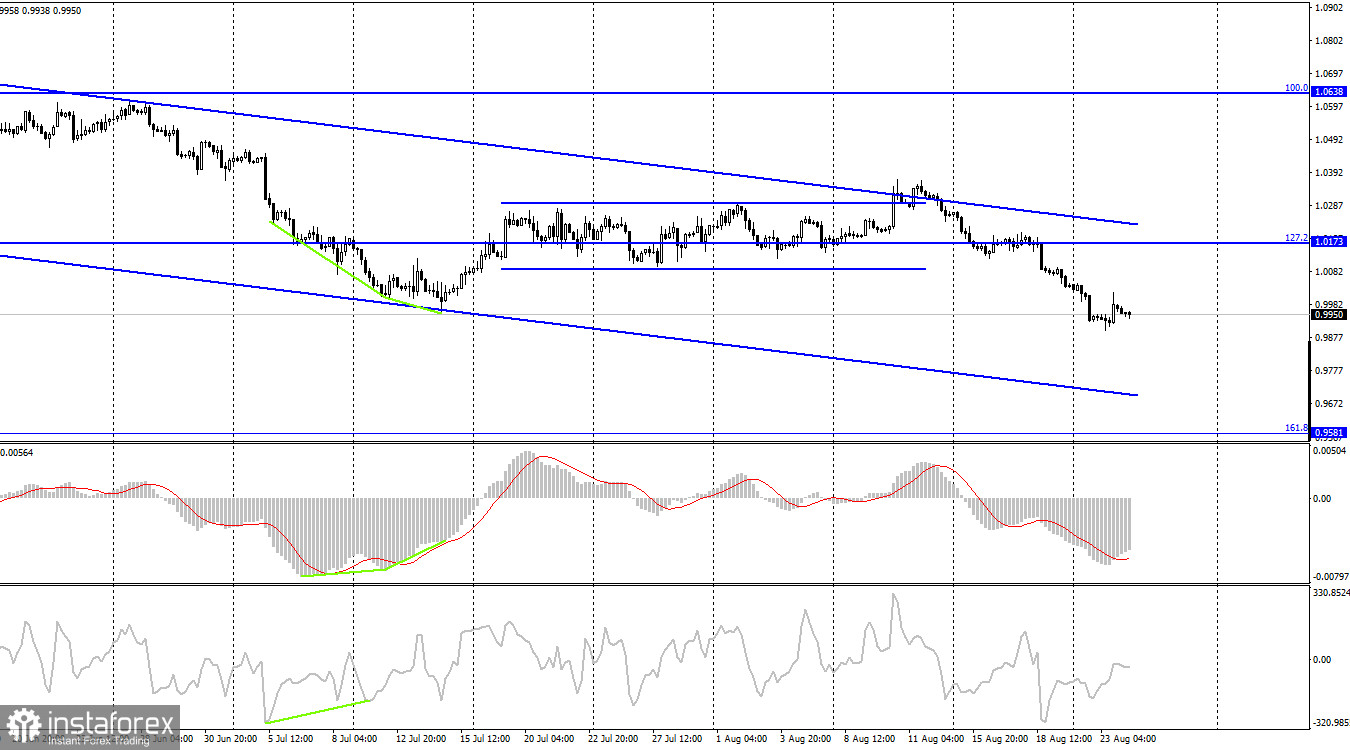

On the 4H chart, the pair slid below 1.0173 - the Fibonacci correction level of 127.2%. The pair failed to rise above the downward corridor. It means that the sentiment remains bearish. It may drop to 0.9581 - the Fibonacci correction level of 161.8%. There are no divergences in the indicators today. However, it does not matter at all as the pair keeps declining.

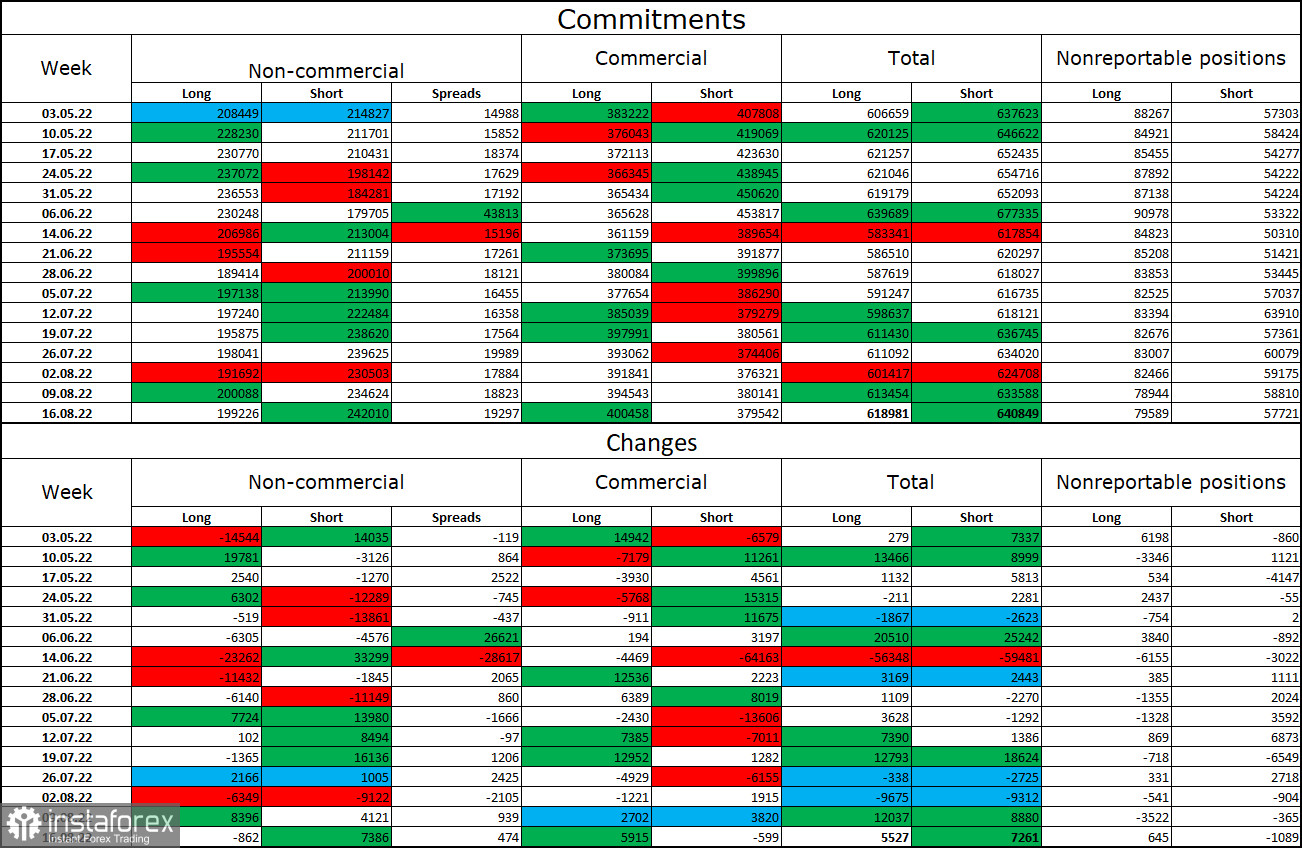

Commitments of Traders (COT):

Last week, speculators closed 862 Long contracts and opened 7,386 Short ones. It means that the bearish mood of the major traders has strengthened again. The total number of Long contracts now totals 199,000 and the number of Short ones amounts to 242,000. The difference between these figures is still not too big. Yet, it demonstrates that the bears are holding the upper hand. In the last few weeks, the likelihood of a rise in the euro has been gradually growing. However, recent COT reports have revealed that short positions still exceed long ones. The euro has not been able to show steady growth in the last five or six weeks. Thus, the bullish scenario looks extremely unlikely. I believe that the euro/dollar pair will continue its downward movement.

Economic calendar for US and EU:

US – Durable Goods Orders (12:30 UTC).

On August 24, the economic calendar for the European Union and the United States contain one more or less interesting report. The influence of the fundamental factors on market sentiment will not be strong today.

Outlook for EUR/USD and trading recommendations:

It is recommended to open new short positions on the pair at 0.9581 if it closes below 0.9963. Another target level may be 0.9782. It is better to open long positions if the pair rises above the downward corridor on the 4H chart with a target level of 1.0638.