For the EUR/USD pair, bearish sentiments still prevail. Despite the sharp corrective pullback observed yesterday, the buyers of the pair could not hold the initiative. The price again fell below the parity level, to the middle of the 99th figure.

This behavior of traders speaks of two circumstances.

Firstly, the support level of 1.0000 has lost its reliability and a kind of armor resistance. If in July traders cautiously, very dosedly tested the area of the 99th figure (quickly returning back, fixing profits), now EUR/USD sellers easily overcome this barrier, which until recently was considered a reliable price citadel. Moreover, yesterday the pair's bears even announced their claims to the area of the 98th figure, coming close to 0.9900. Such ambitiousness and, I would say, in some way, the courage of market participants indicate that traders in the EUR/USD pair have got used to the idea that the 1.0000 mark has lost its former sacredness. At the moment, this is just another level of support, which, under certain conditions, can be overcome.

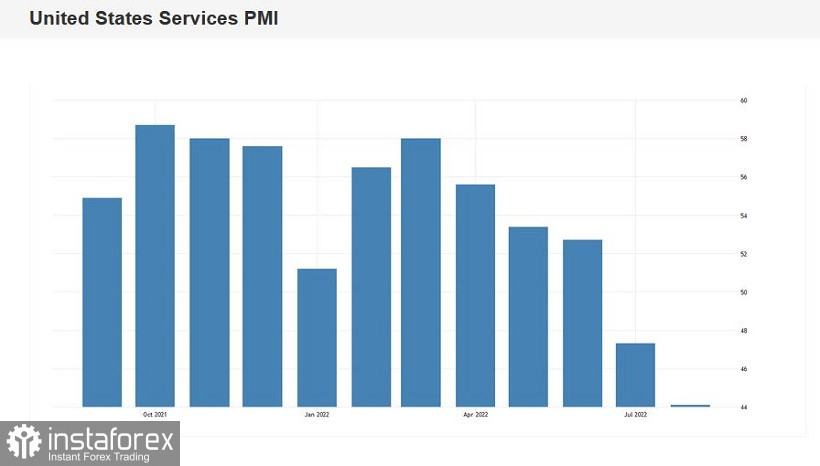

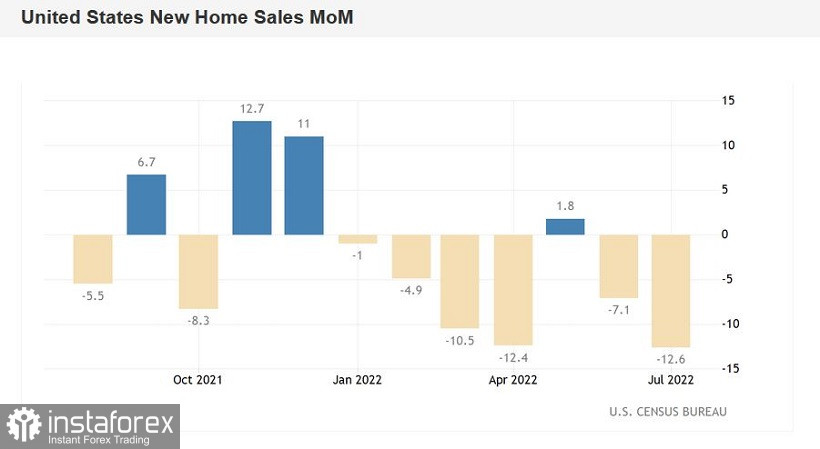

The second conclusion that can be drawn from the results of yesterday's trading on the EUR/USD pair indicates that the current situation is unstable. Yes, on the one hand, sellers keep the price below parity. But on the other hand, even a slight breath of fundamental negativity can destroy this house of cards. Yesterday the pair jumped almost 100 points in less than an hour after disappointing macroeconomic reports from the US. In particular, the services PMI fell to 44 points, the weakest result since May 2020. Composite PMI also updated the annual minimum at 45 points. The U.S. manufacturing PMI was also in the red, dropping to 51.3, its worst reading since July 2020. The American real estate market also disappointed: the volume of home sales in the primary market decreased by 12% in July at once.

The published reports turned the pair 180 degrees, allowing EUR/USD buyers to rise above the parity level again. However, not for long: the bears seized the initiative, dragging the price to the middle of the 99th figure.

But the incident with the upside jerk suggests that the situation for the pair can change at any moment. Especially considering the fact that tomorrow an economic symposium starts in the US city of Jackson Hole, within which (on Friday) the head of the Fed will speak. If Jerome Powell makes a restrained rhetoric, focusing on the first signs of a slowdown in the US consumer price index, the dollar will come under significant pressure. Moreover, even if the head of the Fed repeats the theses that he voiced at the end of the July meeting, the greenback will also be under pressure.

Recall that, commenting on the 75-point increase in the rate in July, Powell was skeptical about the prospects for continued aggressive tightening of monetary policy. According to him, the Fed may resort to another "unusually large" rate hike in September "if inflationary pressures on the economy do not ease sufficiently by the fall." Answering clarifying questions from journalists, Powell noted that a more active rate hike (meaning a 75-point increase) "may take place at one of the future meetings, if the incoming data favors it." Otherwise, the Fed is ready to implement the scenario of a moderate rate increase.

As you know, the latest reports on the growth of the consumer price index, producer price index and import price index came out in the "red zone." Therefore, a natural question arises: do the published releases have a 75-point rate increase in September? Or can the Fed afford a 50-point move, especially against the backdrop of a technical recession in the US, which was recorded in two quarters?

The answer to this question will have the strongest impact on the greenback. If Powell maintains a hawkish, combative tone (allowing a 75 pip advance next month), the EUR/USD bears will not only consolidate below parity, but are likely to start testing the next support level at 0.9900. Otherwise, if the head of the Fed announces a reserved position, EUR/USD buyers will be able to seize the initiative by organizing a correction to 1.0050 (Kijun-sen line on the daily chart). Powell can not only repeat his July theses, but also remind that before the September meeting, one more Nonfarm (August), as well as key data on inflation growth, will be published. And, they say, the final decision on the size of the rate increase will be made after the accumulation of all macroeconomic data. Such rhetoric will also put pressure on the greenback.

Thus, given the high degree of uncertainty, it is risky to open trading positions for the EUR/USD pair now—both up and down. The results of yesterday's trading showed that despite the dominant bearish sentiment, the situation can change at any moment. In such conditions, it is advisable to be out of the market.