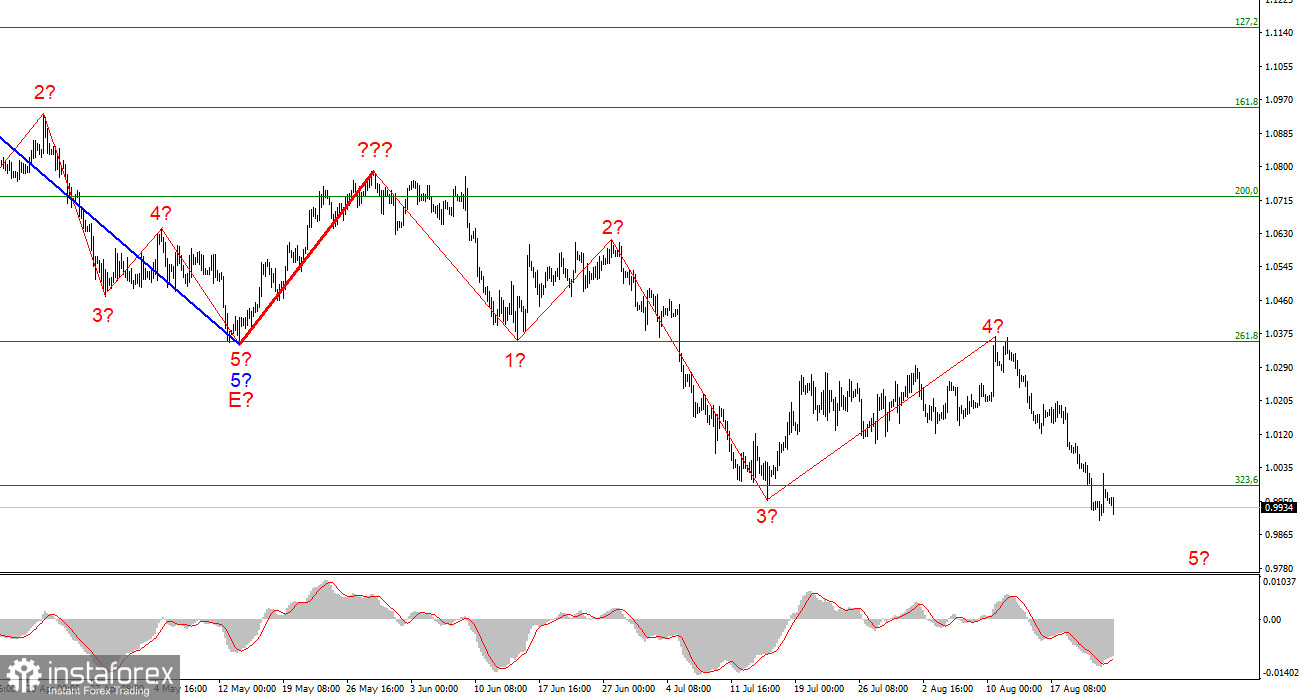

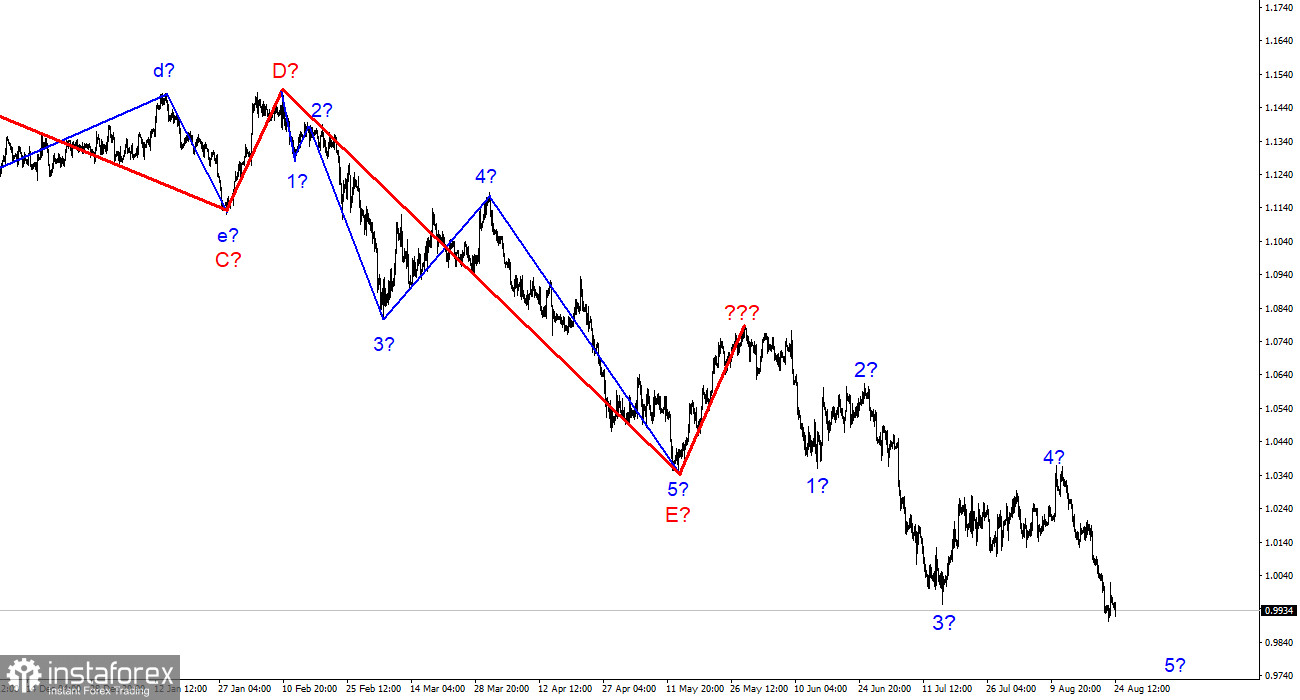

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, despite the increase in quotes within the framework of the expected wave 4 turned out to be stronger than I expected. The new wave marking does not yet consider the rising wave marked with a bold red line. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. The construction of an ascending wave has been completed, which is interpreted as wave 4 of the downward trend section. If this assumption is correct, the instrument continues to build a descending wave 5. The assumed wave 4 has taken a five-wave but corrective form. However, it can still be considered wave 4. There are no grounds to assume the completion of the downward trend section. An unsuccessful attempt to break through the 1.0356 mark, which equates to 261.8% by Fibonacci, indicates that the market is not ready to continue buying the EU currency. And a successful breakout attempt of 0.9989, which corresponds to 323.6% Fibonacci, on the contrary, indicates a willingness to continue reducing demand for the euro. I expect the decline in the quotes of the instrument will continue with targets located below the 1.0000 mark within wave 5. Wave 5 can take on almost any length since wave 4 was much longer than wave 2.

Orders for long-term use goods in the United States are at zero

The euro/dollar instrument resumed its decline on Tuesday after moving away from the lows by more than 100 basis points a day earlier. Let me remind you that yesterday's business activity in the United States greatly disappointed the market, especially in the service sector. It is noteworthy that business activity in the European Union or the UK market is not interesting. At the moment, wave 5 does not look completed yet, and an unsuccessful attempt to break through the level of 323.6% indicates a willingness to continue selling the instrument and not start buying it. Today, the news background was expressed by one report on orders for long-term use goods in the United States. The increase in July by the baseline indicator was 0%, although the market expected a higher value. However, today I do not see that the market is very worried about the weak news backdrop in the United States. I believe that until Friday (before Jerome Powell's speech at the Jackson Hole symposium), the decline in demand for the euro currency may continue.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets located near the estimated 0.9397 mark, which equates to 423.6% Fibonacci, for each MACD signal "down" in the calculation of the construction of wave 5. So far, I do not see a single signal indicating this wave's completion.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them.