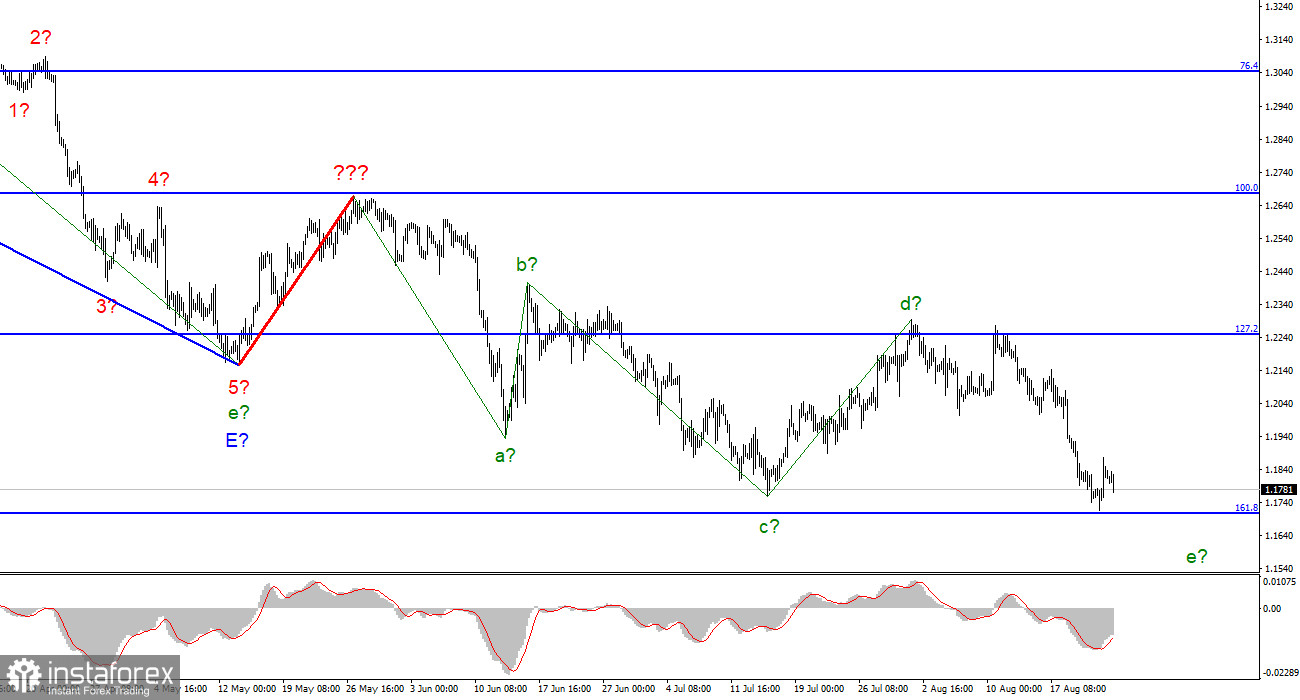

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but it does not require any clarifications yet. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. And the current trend has already taken a very extended form. I believe that in this case, it is much better to identify rare corrective waves, after which new clear structures will be built. At the moment, we have completed waves a, b, c, and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, then the decline in quotes should continue in the near future. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. Ascending and descending waves alternate almost exactly. However, the corrective status of the trend for the British pound allows it to complete the e wave near the 161.8% Fibonacci level.

Powell's speech may lead to a decline in the dollar.

The exchange rate of the pound/dollar instrument declined again on August 24. Let me remind you that on Tuesday, the report on business activity in the US services sector caused a strong market reaction. Today, only one report on orders for long-term use goods in the United States was released. It turned out to be much weaker than market expectations, but this did not affect the demand for the US currency. Thus, the market will wait for Jerome Powell's speech on Friday. The key issue of the speech will be, as we have become accustomed to in recent months, an increase in the interest rate. In the last few weeks, there has been a heated debate about how much the Fed will raise the rate in September. In favor of an increase of 75 basis points, there is an assumption that inflation in the United States will not show a new strong slowdown next month. Then the Fed will have to maintain the tightening pace of monetary policy. In favor of an increase of 50 basis points is that the US economy is approaching a recession, and inflation has nevertheless begun to decline. Therefore, the Fed no longer needs to raise the rate at the maximum pace to avoid driving the economy into an even greater reduction in GDP. Jerome Powell will have to answer this question on Friday or hint at an answer.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down." But first, you must wait for a successful attempt to break through the 1.1708 mark, indicating that the market is ready for new British sales.

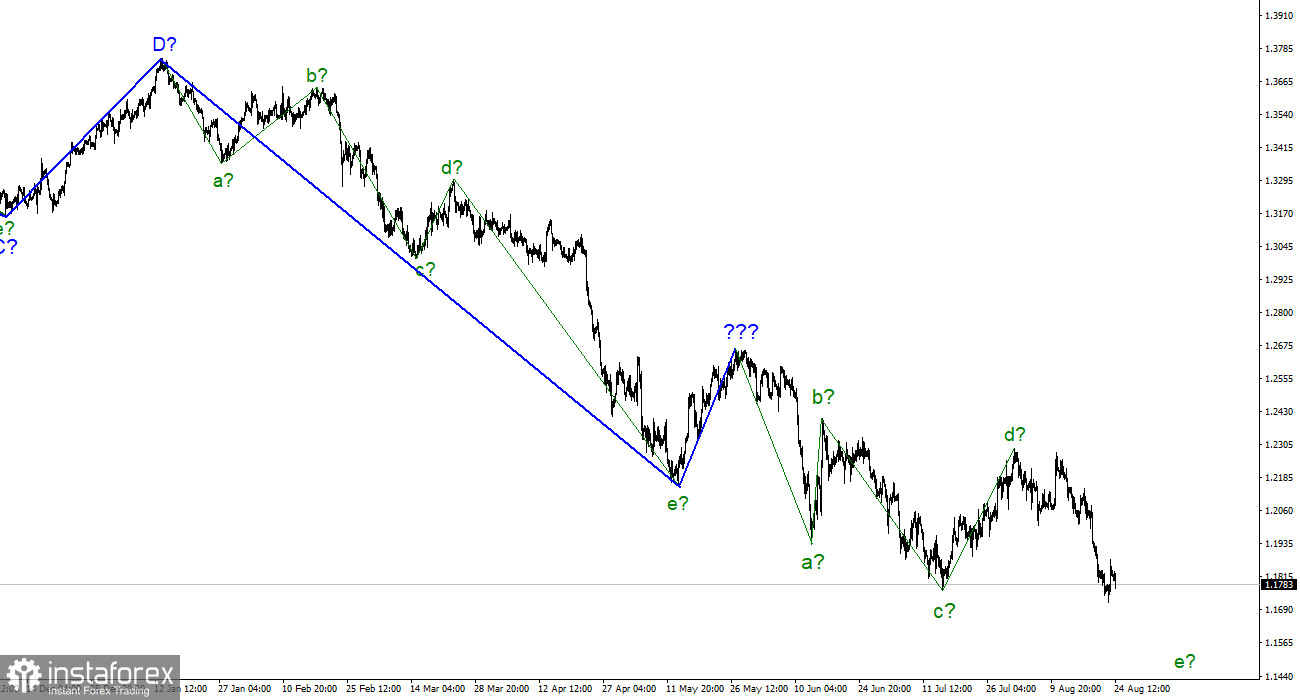

The picture is very similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.