The AUD/USD pair has entered a consolidation phase. Despite the general strengthening of the US currency, the price fell into a drift, trading in a 100-point range of 0.6850-0.6950. For the development of the upward movement, bulls need to gain a foothold in the area of the 70th figure, while for the continuation of the downward trend, bears need to go below the target of 0.6800. Since July 24, that is, for a month already, traders have repeatedly made appropriate attempts (both upwards and downwards), but "things are still there."

In general, the dynamics of the AUD/USD pair largely depends on the behavior of the US currency. For example, on Tuesday, after a general strengthening amid growing hawkish expectations, the greenback dipped across the market. The reason for the weakening was the macroeconomic reports that were published in the United States - the PMI index in the service sector, the volume of industrial production, data on home sales in the primary market. All these releases came out in the red zone, reflecting negative trends. Therefore, by the end of Tuesday, AUD/USD bulls were able to win back almost all lost positions, returning to the area of the 69th figure. However, the greenback again reminded itself. Ahead of the economic symposium in Jackson Hole (in which the head of the Federal Reserve will speak), the US dollar again began to be in high demand. As a result, the aussie continues to balance on the border of 68 and 69 figures, that is, it continues to be in its usual price range, within which the pair has been trading for the fourth consecutive week.

The Australian dollar is not able to play its game, turning the tide in favor of strong growth. Contradictory signals of a fundamental nature do not allow it to seize the initiative, as did, for example, the Canadian dollar in the USD/CAD pair.

The latest Australian labor market data can be interpreted both in favor of the aussie and against it. After all, on the one hand, the unemployment rate fell to a record low for the past 48 years (3.4%). We were also pleased with salaries - the annual increase of the indicator amounted to 2.6% - the strongest growth rate since September 2014. On the other hand, the growth rate in the number of employees last month decreased by 40,000 - this indicator turned out to be in the negative area for the first time this year (before that, a negative trend was observed only in October 2021). Moreover, the decline in the indicator occurred solely due to a decrease in the full-time employment component, while the part-time component, on the contrary, increased.

The results of the Reserve Bank of Australia's August meeting can also be viewed from different angles. On the one hand, the central bank raised interest rates by 50 basis points for the third time. On the other hand, members of the RBA made it clear that the central bank may slow down the pace of tightening monetary policy. This is evidenced by some signals of the accompanying statement (general rhetoric softened, some language was removed or rephrased), as well as comments by RBA Governor Philip Lowe.

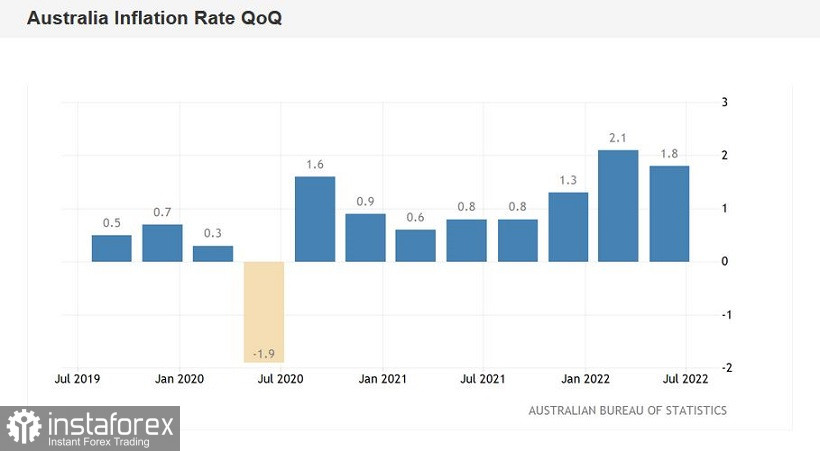

The minutes of the August meeting, made public two weeks after the meeting, only confirmed investors' concerns. In the document, the central bank indicated that the further pace of monetary tightening "will depend on incoming data." This phrase "played with new colors" after the latest inflationary data was published. It became known that the growth of the consumer price index in Australia in the second quarter unexpectedly slowed down on a quarterly basis (to 1.8% Q/Q).

Thus, the fundamental background for the aussie is not categorically negative or positive – a kind of balance is observed here, which, on the one hand, allows the aussie to strengthen its positions when the greenback weakens, but does not allow it to counterattack on its own, "breaking" the pressure of the US currency.

In other words, the Australian dollar follows its namesake from the US – the aussie does not have its own forces to turn the situation in its favor.

The greenback, in turn, is waiting for Federal Reserve Chairman Jerome Powell, who will speak at an economic symposium on Friday. Much is at stake. Despite the slowdown in the growth of the US consumer price index, hawkish expectations regarding the further actions of the Fed are intensifying in the market. Fueling the fire was Fed spokesman James Bullard (voting this year) who said he would support a 75-point rate hike in September as "inflation is still high." If Powell voices similar rhetoric on Friday, the US dollar will again remind itself: together with the Australian currency, it will try to overcome the lower limit of the range of 0.6850-0.6950, followed by an attempt to enter the area of the 67th figure.

But another scenario is also possible. Powell may well sound a low-key rhetoric, saying that the pace of the rate hike in September "will be driven by the data coming in." Moreover, before the September meeting, the August Nonfarm, as well as data on the growth of US inflation, will be published. In this case, AUD/USD bulls will certainly seize the initiative in the pair: at least they will overcome the resistance level of 0.7000 (the upper boundary of the Kumo cloud on D1, coinciding with the Kijun-sen and Tenkan-sen lines) in an attempt to consolidate above this target.

In the face of such uncertainty, it is risky to go into short or long positions - at the moment it is better to refrain from opening trading positions on the pair, as the intrigue regarding Powell's Friday speech remains.