The euro and the pound sterling have steadily advanced against the US dollar ahead of the Jackson Hole Economic Symposium as traders expect the ECB and the Bank of England to take bolder measures to fight inflation.

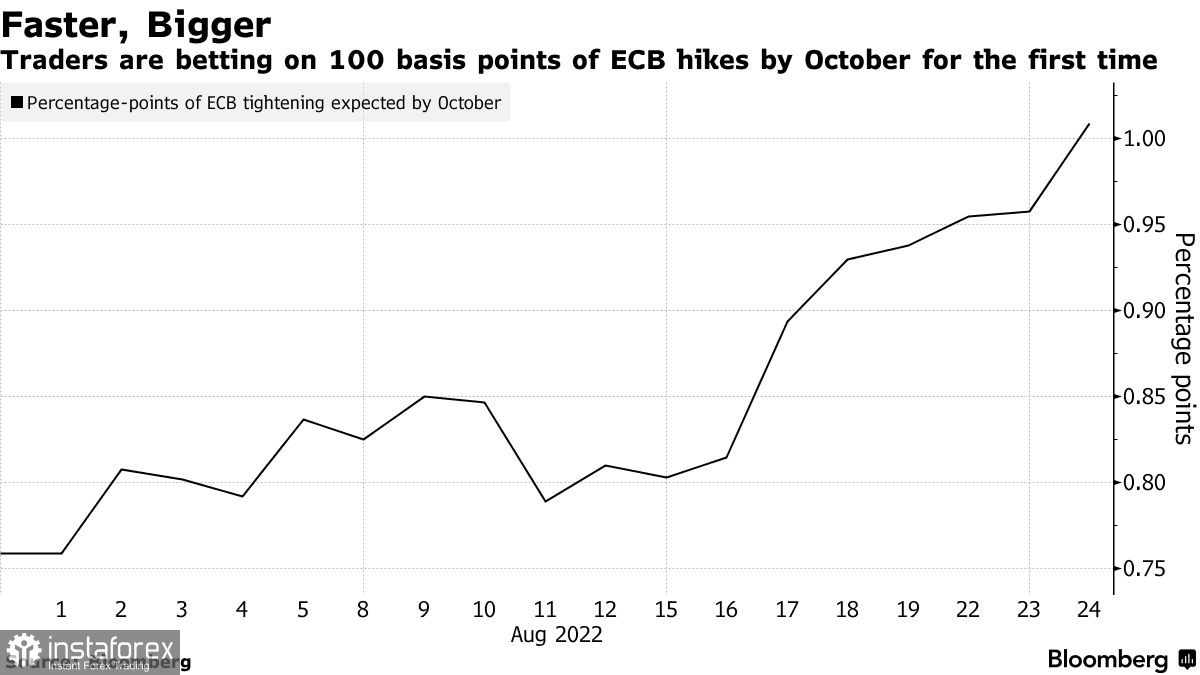

Yesterday, money markets have priced in a 1% interest rate hike by the ECB, a level last seen more than a decade ago, according to swaps tied to the decision date. Furthermore, market players are expecting the Bank of England to increase interest rates even higher – they are betting interest rates will double to 3.5% by the end of the year, compared with less than 3% just 10 days ago. According to official statistics, inflation in the UK is projected to reach 13% by October.

Many are concerned about Russia retaliating against Western sanctions by putting pressure on European gas supplies. This would send energy prices in the UK and the EU even higher. There are growing concerns that inflation, which is already rising at its fastest pace in decades, would soar even higher, unless policymakers hike the rates much faster than previously anticipated.

Energy prices are pushing up import bills, which in turn are weighing in on the euro and the pound sterling and boosting inflation, economists note. To stop the inflationary spiral, central banks would have to increase interest rates more aggressively than planned earlier. Traders are now pricing a 100 bps hike by the ECB in October for the first time.

Today, the ECB monetary policy meeting accounts for July will be published, which could shed more light on what the regulator is planning to do if inflation continues to rise. Although many investors were shocked by a 0.5% rate increase in July, it was clearly not enough to bring price growth under control.

The Bank of England is expected to hike interest rates by more than 50 bps at one of the next three decisions, with even a 100 bps move being on the table. However, these expectations failed to give support to both the euro and the pound sterling. GBP fell by 3.6% this month, while EUR dropped below parity with USD for the second time this year.

Despite trader expectations of a more aggressive tightening course in the near future, rate futures indicate that the Bank of England will likely ease its policy quickly after interest rates peak in 2023. Wagers also indicate that the ECB will slow the pace of rate increases in 2023, with interest rates set to reach 2% in September 2023.

Officials will have to take a deteriorating economic outlook into account when making decisions on interest rates. Output in the eurozone has fallen for a second month in August, while Germany, the EU's economic powerhouse, struggles to maintain economic growth. According to the latest data, GDP increased by only 0.1% in the second quarter of 2022.

Euro has managed to bounce back after nearly hitting yearly lows yesterday. To begin a new uptrend, EUR/USD would need to hold on to 1.0030 – this is the main goal for bulls right now. If EUR/USD moves above 1.0030, it would open the way towards 1.0070 and 1.0200 for the pair. A breakout below 1.0030 would push the pair down to 0.9980, where bullish traders would become more active. If EUR/USD breaks below this level, it could then fall towards 0.9910 and 0.9860, which would open the way towards 0.9820.

The pound sterling recovered yesterday and could continue its upward correction today. Bulls would need to hold on to 1.1800 - a breakout below this level would put an end to the pair's recovery and send it down towards 1.1760 and 1.1720. If GBP/USD breaks through this range, it could then drop towards 1.1680. To extend its upward momentum, the pair would need to settle above 1.1850, which would open the way towards 1.1895 and 1.1940.