Macro events on August 24

Yesterday, the macroeconomic calendar was almost empty, with US durable goods orders being the only interesting report. In July, the reading came in at 0%, well below the market forecast of 0.6%.

In light of disappointing data, the greenback bounced after a sell-off.

Interesting facts:

JPMorgan says the September rate hike by the US Federal Reserve could be the last aggressive move. The pace of further rate increases could be slower, so a rally may occur in the stock market.

As for the forex market, the greenback may fall against its counterparts.

Analysis of the August 24 price charts

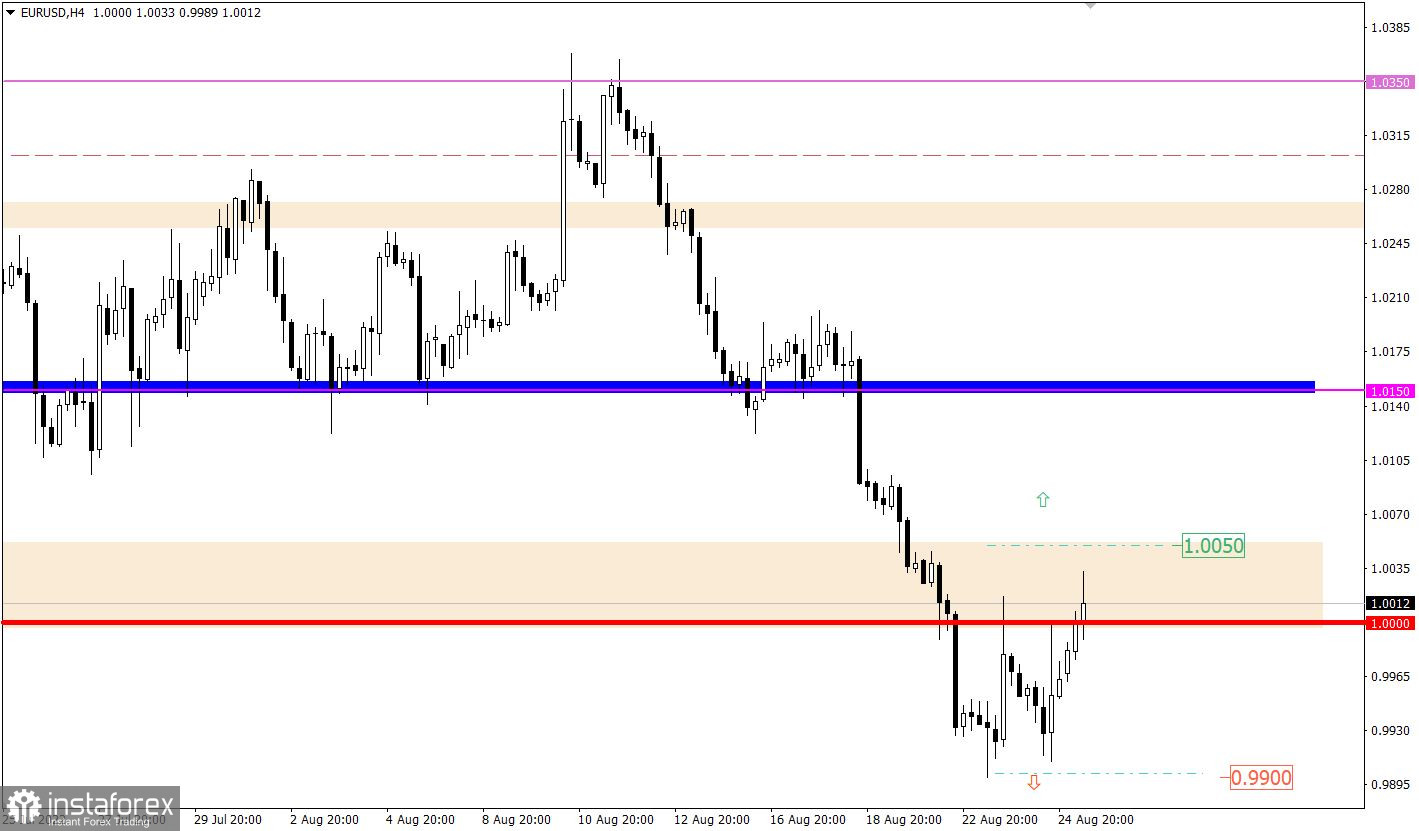

EUR/USD is hovering in the 0.9900/1.0000 range for the second day. The market is still bearish. Otherwise, the current sideways movement would have turned into a full-fledged correction.

GBP/USD has bounced from 1.1750 support for the second time since the beginning of this trading week. The size of the sideways movement on the chart is as many as 130 pips.

Macro events on August 25

Today, the United States will see the release of the second estimate for Q2 GDP. Should the data come in line with the first estimate, there will be no effect on the market whatsoever because such results have already been priced in. Otherwise, speculative activity in the market may increase.

In addition, weekly jobless claims will be published in the United States today. Their number is estimated to show growth again, which is a negative factor for the US jobs market. In this light, the greenback may feel some pressure.

Statistics in detail:

Continuing jobless claims are projected to rise to 1,443K from 1,437K.

Initial jobless claims are expected to advance to 253K versus 250K.

Trading plan for EUR/USD on August 25

Against the current backdrop, a 100 pips sideways movement is temporary. It can be assumed that it will end with an impulse once the price goes through the limit.

Should the quote consolidate above 1.0050 on the 4-hour chart, an upward correction will start.

Alternatively, if the price settles below 0.9900 at least on the 4-hour chart, the bearish trend will extend.

Trading plan for GBP/USD on August 25

The quote has slowed its downward movement near support, indicating overheating of short positions. New price impulses may occur in the current range as trading power starts to shift.

Should the price consolidate below 1.1750 on the 4-hour chart, the downtrend may extend. Alternatively, the target is seen at 1.1880 in case of a correction in the market.

Indicators on charts

A candlestick chart shows white and black bars with lines at the top and bottom. When analyzed in detail, each candlestick is different depending on a time frame: the opening and closing price as well as the maximum and minimum price.

Horizontal levels are levels of support and resistance that help traders determine when a trend is likely to change.

Circles and rectangles are highlighted examples where past reversals occurred. Such highlighting indicates horizontal lines that may exert some pressure on quotes in the future.

Up/down arrows show possible future price movements.