The EUR/USD pair continued its rather weak growth on Wednesday and Thursday, paying no attention to the corrective level of 323.6% (0.9963). Let me remind you that this week, so far, the most important event can be recognized as the report on business activity in the US in the services sector. Last month it fell to 47 points, this year to 44. It should be understood that the business activity indicator does not reflect specific economic changes. It displays the mood of purchasing managers. If they make more trades, the index goes up. If less, it falls. However, a weak index does not mean that production stops and the service sector goes into recession.

Nevertheless, a drop below 50 is always noted by traders as a negative moment. In other words, from my point of view, it was worth worrying when the GDP report in the first or second quarter was higher because it showed a real contraction of the economy. Nevertheless, the day before yesterday, traders were selling the dollar after this report. And yesterday, they also sold the dollar, at the same time, in the absence of an information background.

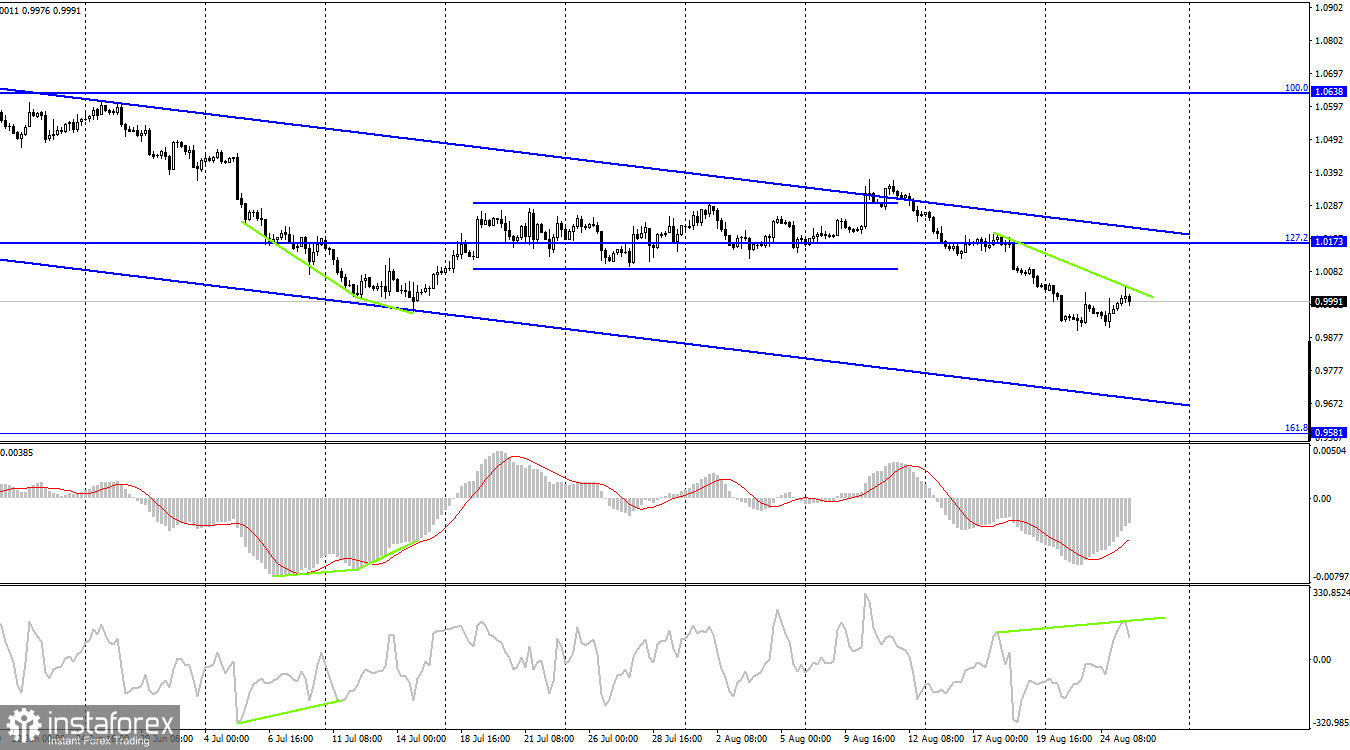

Thus, I think the pair has found its local bottom at this time. It showed a drop for two weeks, and not every day was there an information background that could be attributed to a bad mood among traders. Now it's just time for a little pause. At the same time, the quotes increased today to the upper line of the descending trend corridor, which continues to characterize the mood of traders as "bearish." The rebound from this line allows traders to expect a resumption of the fall in the direction of the 0.9782 level. Fixing it will favor continuing the growth of the European currency. But tomorrow evening, Fed President Jerome Powell will speak in Jackson Hole, and this event can greatly affect the mood of traders. I don't see any point in guessing what exactly Powell will say. However, both the euro and the dollar could grow after his speech.

On the 4-hour chart, the pair reversed in favor of the US currency and anchored under the corrective level of 127.2% (1.0173). The pair failed to consolidate over the descending trend corridor, so it continues to characterize the current mood of traders as "bearish." The process of falling can be continued in the direction of the Fibo level of 161.8% (0.9581). Today, a "bearish" divergence is brewing in the CCI indicator, the formation of which may work in favor of the US currency.

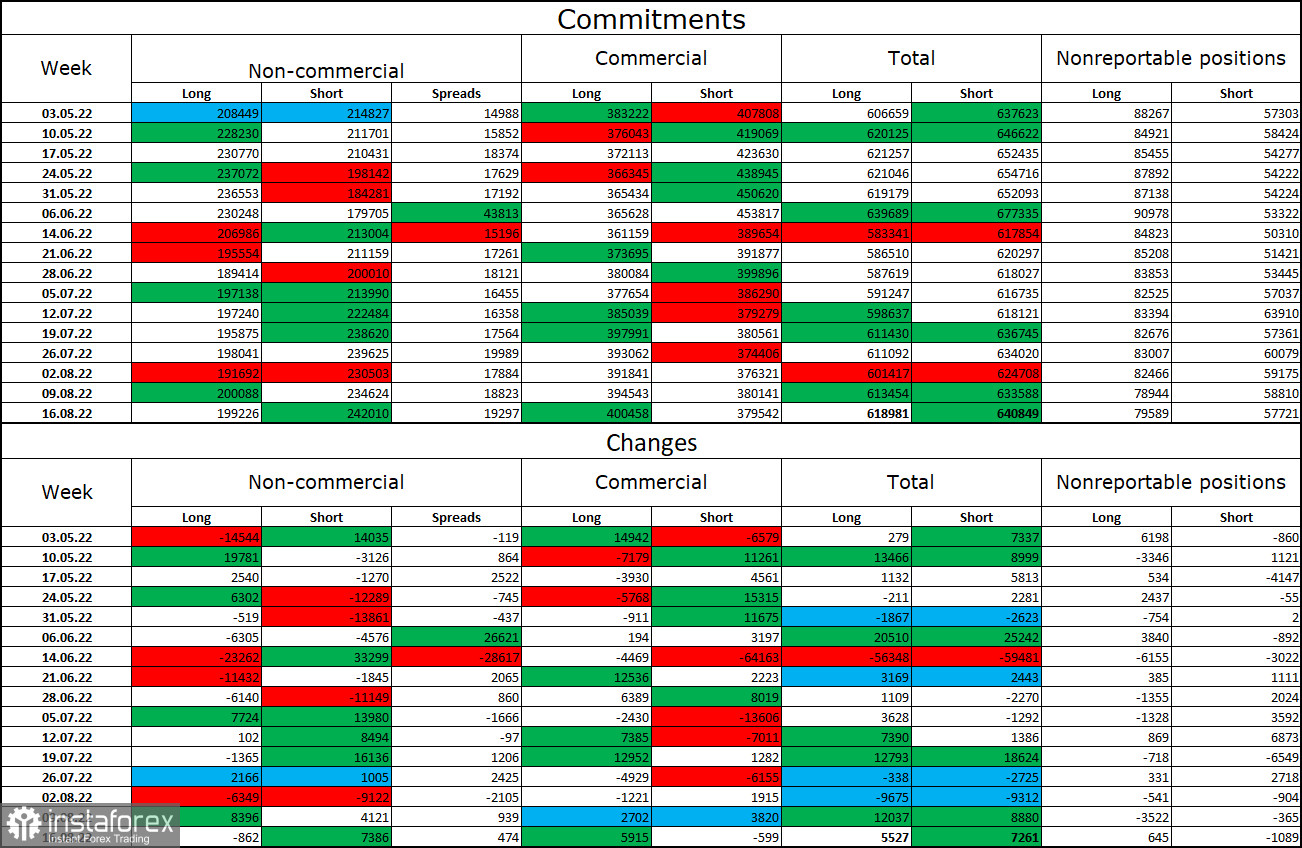

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 862 long contracts and opened 7,386 short contracts. It means that the "bearish" mood of the major players has intensified again. The total number of long contracts concentrated in the hands of speculators is now 199 thousand, and short contracts – 242 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not shown convincing growth in the last five or six weeks. Thus, it is still difficult for me to count on strong growth of the euro currency. So far, I am inclined to continue the fall of the euro/dollar pair.

News calendar for the USA and the European Union:

US - GDP (12:30 UTC).

US - number of initial applications for unemployment benefits (12:30 UTC).

On August 25, the calendar of economic events of the European Union does not contain a single interesting entry, and in the USA, a report on GDP will be released. The influence of the information background on the mood of traders may be average in strength today.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair with a target of 0.9581 when it closed at 0.9963. The goal can be adjusted to 0.9782 and stay in sales. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.