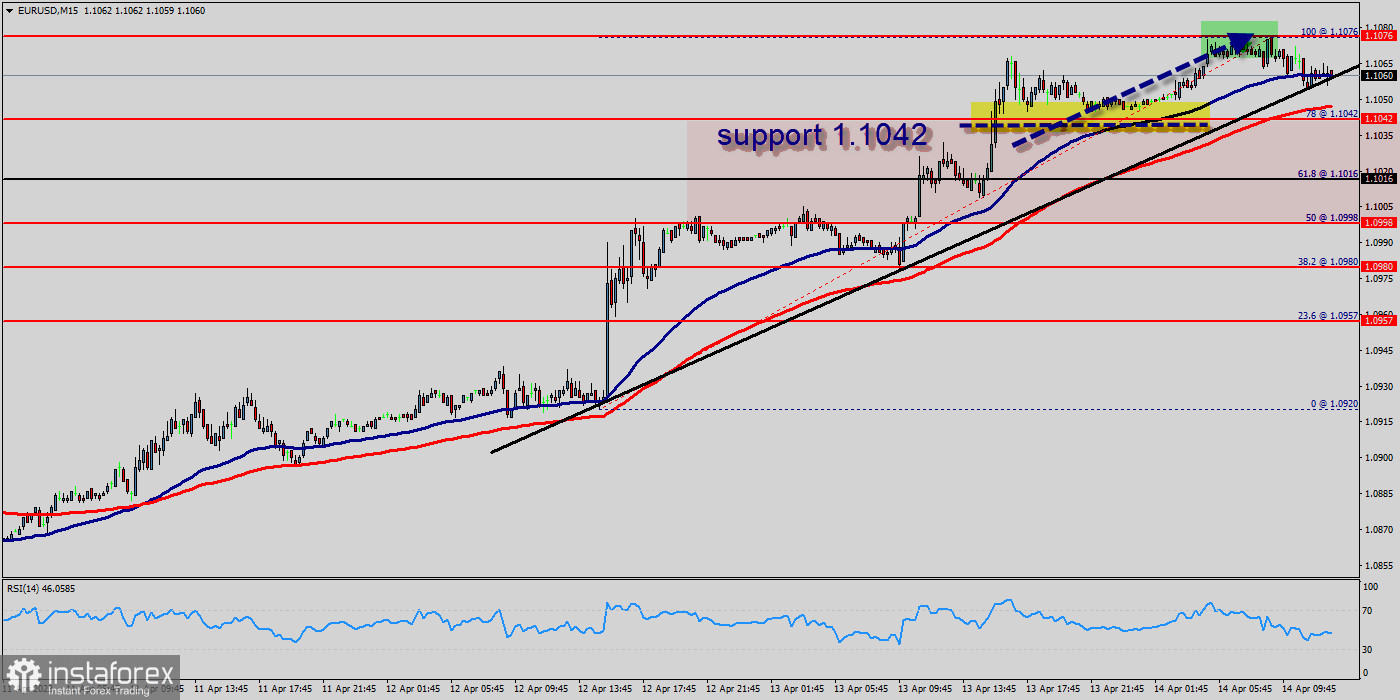

In the short term, the original EUR/USD rate is 1.1060 euro for 1 US dollar right now on the M15 chart. The EUR/USD rate is at its highest in April 2023: it rose to 1.1076 following the eurozone's slowup in economic growth. The highest EUR to USD rate was registered during the economic crisis and Coronavirus (COVID-19) last two years: the pair rose to the level of 1.1076 (last bullish wave at the same time frame).

The EUR/USD pair is the most liquid Forex currency pair. It accounts for over 35% of all trades conducted in the foreign exchange market. Our best time for trading the EUR to USD pair is London and New York's trading hours.

The EUR/USD pair is trying to settle above the 1.1016 level. For that, it moved to new highs as traders reacted to U.S. The nearest support level for U.S. Dollar Index is located at 1.1016. In case U.S. Dollar Index settles above this level, it will move towards the next resistance at 1.1100. A successful test of the 1.1100 level will open the way to the test of the support at 1.1150.

Intraday bias in the EUR/USD pair remains on the upside for the moment. Up trend from 1.1016 is in progress for 1.1076 so as to test the daily top.

Yesterday the EUR/USD tpair raded higher and closed the day in the positive territory near the price of 1.1076. Today it has also slightly increased, having risen to the level of 1.1076.

The EUR/USD pair is still trading above the moving average line MA (100) M15 (1.1016 - probably, the main scenario is the resumption of growth to 1.1016 (session high)). The situation is similar on the one-hour chart. Based on the foregoing, it is probably worth sticking to the north direction in trading, and as long as the EUR/USD pair remains above MA 100 H1, it may be necessary to look for entry points to buy for the formation of a correction.

On the downside, below 1.1016 support will turn intraday bias neutral and bring consolidations first. But near term outlook will stay bullish as long as 1.1016 support holds.