The market is flat ahead of Fed Chairman Jerome Powell's speech today. His statement will be driving the market until the upcoming Governing Council meeting of the European Central Bank. There are two possible outcomes.

In the first-case scenario, the US central bank could slow down the pace of rate hikes due to a drop in the inflation rate and the concerns of a number of Fed officials about an extremely strong dollar. Should Mr. Powell make such an announcement, the greenback will fall steeply, and the pound will recover.

In the second-case scenario, the Federal Reserve could stay aggressive towards interest rates due to the strong-enough jobs market and the White House's intention to expand financial support for various community groups. In fact, it is about hundreds of billions of dollars in financial aid. Such a move could boost inflation, which just started to show some signs of a slowdown. If this is the case, the greenback will keep strengthening despite already being overbought.

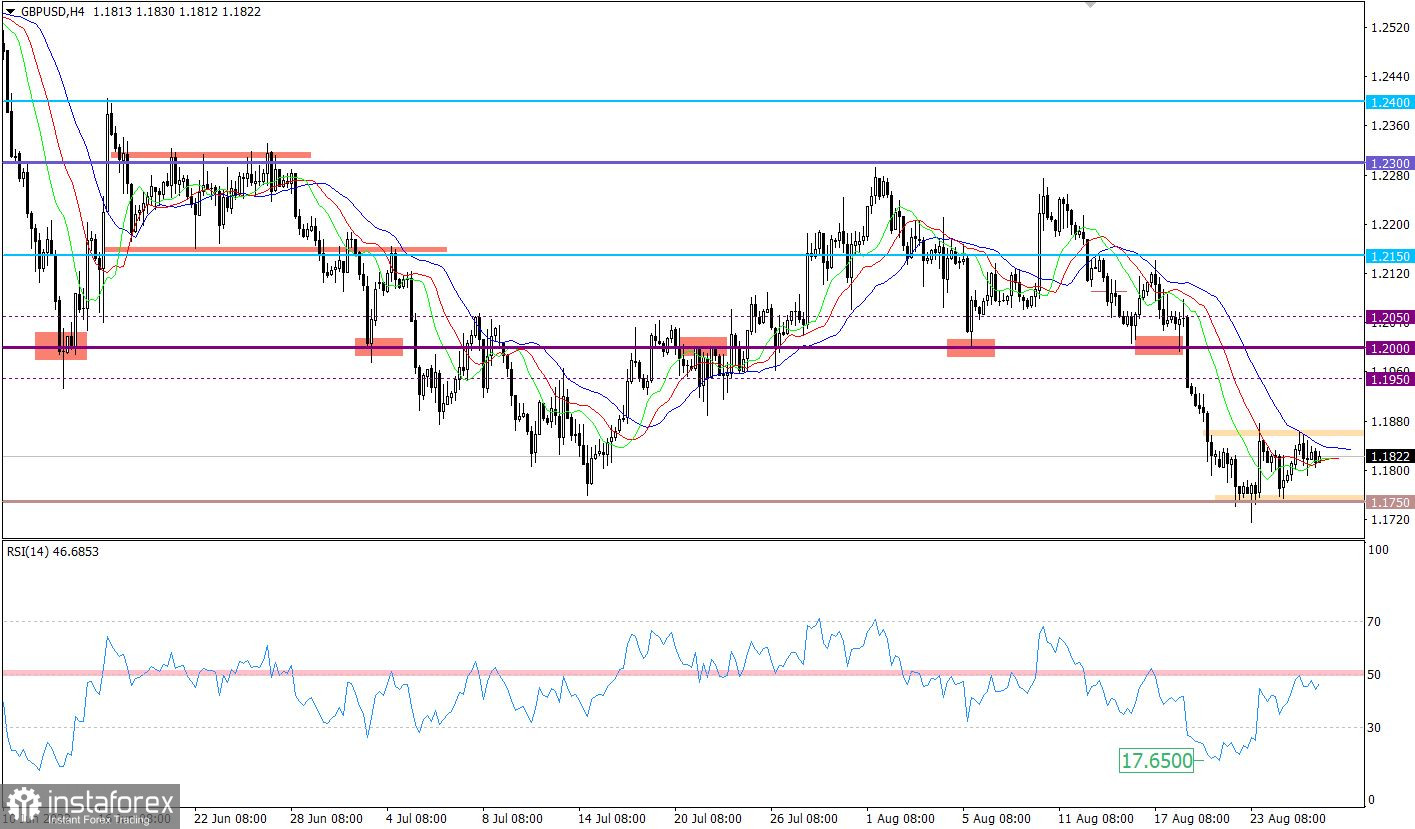

Through positive correlation with EUR/USD, GBP/USD is moving sideways in the range of 100 pips (1.1750/1.1850) due to the current accumulation phase ahead of an important event.

The RSI left the overbought zone and came to a standstill on the 4-hour chart. The indicator is now in the 30/50 range, signaling the continuation of the downtrend. The RSI above line 50 will make a buy signal.

There is a crossover of the Alligator's green and red MAs on the 4-hour chart. This shows a slowdown in the downward cycle, which is confirmed by the sideways movement on the trading chart.

Outlook

In such a case, an impulse in the current range is likely to show the future direction of the price.

Should the price consolidate below 1.1750 on the 4-hour chart, the downtrend may extend. Alternatively, the target is seen at 1.1880 in case of a full-fledged correction in the market.

As for complex indicator analysis, there is a mixed signal for short-term and intraday trading due to the flat market. In the medium term, the price has reached a fresh low, thus making a sell signal.