Bitcoin and ether are under a bit of pressure in morning trading on Friday. And if the ether manages to get out to another weekly maximum, then bitcoin has all the signs that it will make one of the biggest drops in recent times. Everything, of course, will depend on the statements of the chairman of the Federal Reserve System and on which way the technical picture will be played. Its complete fracture, which may occur after Powell's performance, can turn everything upside down. But before we talk about the technical picture, I would like to say a few words about the recent statements of SEC Chairman Gary Gensler. Recently, he does not have a positive attitude towards what is happening in the cryptocurrency markets, especially because the SEC may lose the trial with Ripple.

The chairman of the Securities Commission said there is no need to treat the cryptocurrency market differently than other capital markets. He also noted that the SEC would act as a policeman, calling on cryptocurrency trading and lending platforms to come and talk to the authorities.

"There is no reason to treat the cryptocurrency market differently than the rest of the capital markets just because it uses a different technology. Recent market events show why it is important that cryptocurrency companies comply with securities laws," Gensler explained. "In recent months, some crypto lending platforms have frozen their investors' accounts or gone bankrupt. When it comes to bankruptcy, these investors must go to court asking where the regulatory authorities were."

The head of the SEC also stressed that regardless of what a financial product is, whether it is an application, a credit platform, a crypto exchange, or a decentralized financing platform (DeFi), it is the economic realities of the product that determine whether a particular token or cryptocurrency is security following securities legislation.

Gensler also called on platforms for trading and lending cryptocurrencies to come and conduct a dialogue with the SEC, emphasizing that bringing these platforms into compliance with securities laws will benefit investors and the cryptocurrency market and save company owners from a "headache." The head of the SEC concluded: "The SEC will perform the functions of a policeman. As in the case of seat belts in cars, we need to provide standard protection for investors in the cryptocurrency market."

Let me remind you that recently, Gensler said what to expect from the SEC regarding regulating cryptocurrencies. And although he has repeatedly been sharply criticized for applying an enforcement-oriented approach to the regulation of the crypto market, according to Gensler, most crypto tokens have the attributes of securities, which fall under the control of the SEC.

Returning to the topic of the technical picture, bitcoin buyers again tried unsuccessfully to return to the $21,600 level yesterday but failed to gain a foothold above this range. Most likely, the pressure on the trading instrument will continue to increase as investors abandon the risk. The bulls' focus is now on the nearest support of $20,800, a fall to which for the third time could be fatal for the bulls. In the event of a breakthrough in this area, the $19,966 level will play an equally significant role. Its breakdown will send the trading instrument back to the lows of $19,232 and $18,600. To return the demand for bitcoin, dovish statements by American politicians and consolidation above the $21,650 level are needed. To build an uptrend, you need to break above the resistance levels of $22,180 and $22,670. Fixing this range will make a real prospect of returning to the highs: $23,180 and $23,680.

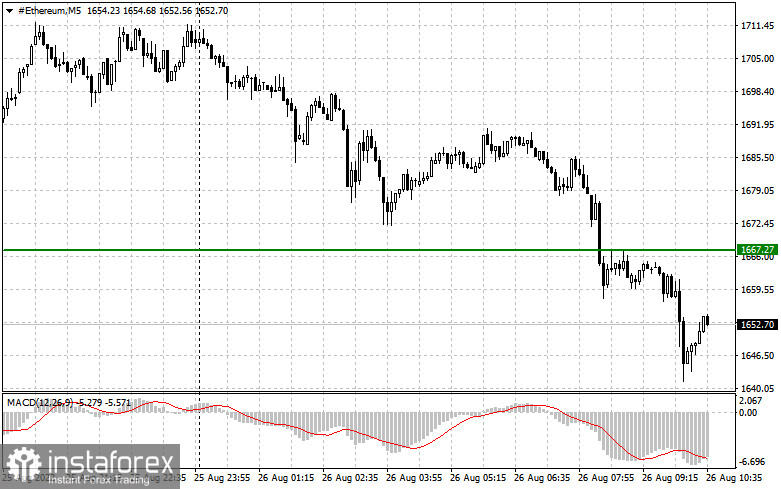

Ether has sunk significantly from yesterday's highs, having already lost about 3.5% since the opening. Technical prerequisites still point to the continuation of the bear market, but Powell's comments could change everything. In the event of a decline in the trading instrument, ether buyers will do their best to protect the nearest support of $ 1,605. Its breakdown will lead to a change in the market direction to a downward one and will open up an opportunity to update the longer-range target of $1,548. While maintaining demand for the trading instrument, buyers need to prove themselves above 1,669 again, as only this will allow them to reach a new maximum of $ 1,743. A breakdown of this level will quickly push ether to $1,819 with the prospect of updating to $1,885.