Ethereum has managed to hold above a key support zone at $1,500. Bulls pushed the price higher and it reached the level of $1,650. However, judging by the green candlesticks that helped the altcoin get above $1,600, the asset's uptrend looks weak. Despite this, Ethereum tried to break through $1,750, where a strong support area once passed. As of August 26, that level became a resistance zone, and the altcoin failed to pierce it. As a result, the ETH/USD pair rolled back to the level of $1,650, where it is trying to consolidate.

The long-awaited Merge update is approaching. ETH's transition to the PoS method will be a key event in the crypto industry in 2022. For the past month and a half, the market has been excitedly awaiting mid-September, when the Merge will take place. The update has been supported by major stablecoin issuers Tether and Circle, as well as cryptocurrency exchange Binance, which has announced that it was preparing a platform for transactions with the new token. Fundamentally, Etherium has gained support, and the marketing campaign has amplified the investment effect. As a result, the altcoin managed to touch $2,000, after which the situation changed dramatically.

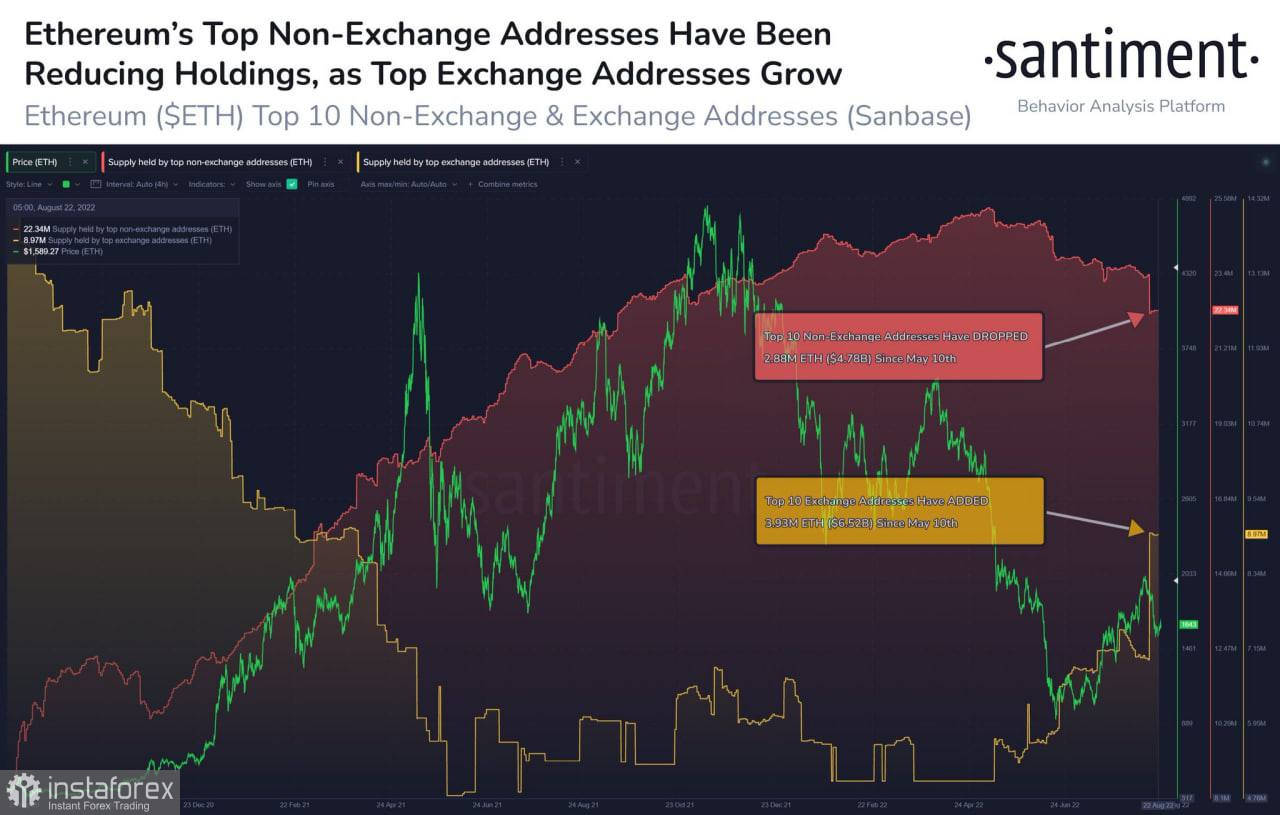

Santiment experts report that ahead of the September Merge update, there is a significant inflow of ETH coins to crypto exchanges. Analysts note that the OTC balances of the top 10 largest ETH addresses have begun to decline. On the contrary, the balances of the largest exchange wallets of Ethereum owners began to grow. This may point to the fact that large investors in ETH are preparing to lock in profits after the altcoin update. It is likely that miners will follow a similar strategy. They increased their holdings to a 3-year high. The actions of large investors may indicate the short-term nature of their plans for ETH/USD, and disbelief in a prolonged rally of the asset.

Technically, Ethereum is approaching the fall in an upbeat mood. Technical indicators on the weekly time frame point to rising buying sentiment. The RSI is making an upward reversal near 40, indicating persistent buying interest. The stochastic oscillator is preparing to form a bullish crossover and the MACD is gradually turning upward. At the same time, on the weekly chart, ETH formed the bearish engulfing pattern, which indicates the probability of a downtrend.

On the daily chart, the situation is not so positive. The major indicators show prevailing bearish sentiment and we should expect a decline and a retest to the area of $1,500-$1,550. The RSI reached the level of 50 and made a sharp reversal on the downside, which tells about the sellers' activity and increasing pressure of the bearish volumes. The stochastic oscillator also formed a bearish crossover and the MACD entered the red zone. All these factors point to a retest of the support in the area of $1,500-$1,550. Notably, the price touched this area three times during the last week, and we can expect the asset to drop in this area.

Despite the dominance of bears, Ethereum may resume its upward movement ahead of the Merge. The Ethereum Foundation's marketing campaign continues to actively promote the update. Among the latest announcements is the introduction of ERC-3475 standards after the Merge update. This will take DeFi to the next level and enable individuals and organizations to issue tokenized bonds and derivatives in secondary markets. Ethereum's update is an event that will fundamentally change the crypto industry. Therefore, it is only a matter of time before ETH resumes its uptrend.