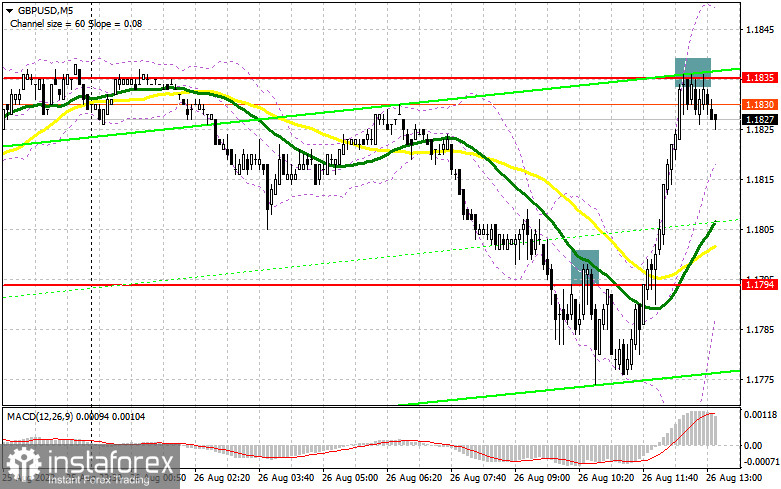

In my morning forecast, I paid attention to the 1.1794 level and recommended making decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. A breakthrough and a reverse test from the bottom up of this range led to an excellent signal to sell the pound, but a major downward movement did not occur. After a decline of 20 points, the pressure on the pair eased before the important speech of Citizen Powell, which led to the closure of short positions and an upward correction of GBP/USD. In the afternoon, the technical picture completely changed.

To open long positions on GBP/USD, you need:

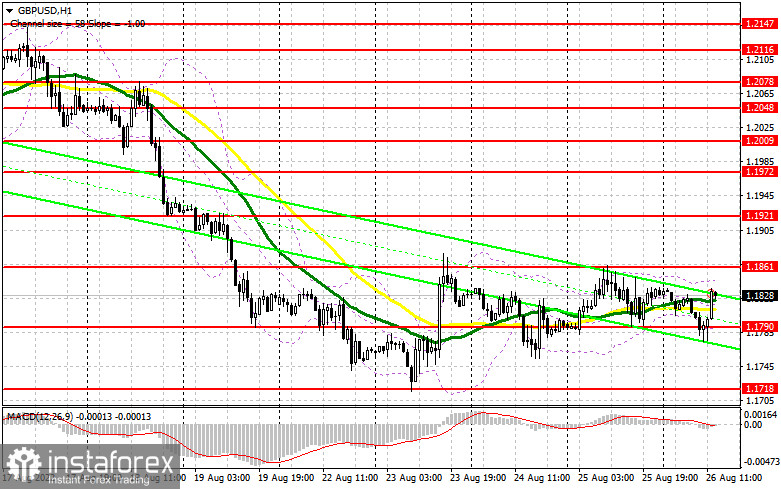

It doesn't matter at all what Powell says. Our task is to have a clear plan and act on it. The guidance is as follows: if the head of the Fed announces further aggressive policy and maintains high rates of interest rate hikes this year, the US dollar will strengthen its position against risky assets, especially against the pound. Then we are looking for short positions to continue the bear market. If the head of the Fed gives at least one hint that the further cycle of rate hikes will be more restrained, demand for risky assets will surely return, and we will see a sharp jump up the pound – we are looking for entry points into long positions. For buyers, an important task is to protect the new support at 1.1790, formed at the end of the first half of the day. If the pair declines after strong US data or Powell's hawkish statements, only the formation of a false breakdown there will form a buy signal to recover to the 1.1861 area. A breakdown and a reverse test from top to bottom of 1.1861 will help strengthen the position of buyers, opening the way to 1.1921. A more distant goal will be a maximum of 1.1972, where I recommend fixing the profits. If the GBP/USD falls and there are no buyers at 1.1790, the bulls may have serious problems. Below this level, only the annual minimum of 1.1718 remains, from which I also recommend opening long positions only when a false breakdown is formed. I advise buying GBP/USD immediately for a rebound from 1.1684 or even lower – around 1.1643 with the aim of a correction of 30–35 points within a day.

To open short positions on GBP/USD, you need:

The bears need to defend weekly highs around 1.1861 today. A breakthrough to this level may occur in the case of weak data on the expenses and incomes of Americans, from which, in conditions of high inflation, nothing good can be expected. A false breakdown at 1.1861 after Powell's speech will provide sellers of the pound with new strength, strengthening the bear market and allowing them to count on a downward movement to the 1.1790 area. A breakout and a reverse test from the bottom up of this range will give an entry point for sale with the prospect of reaching 1.1718, below which the lows open: 1.1684 and 1.1643. The farthest target will be the 1.1573 area, where I recommend fixing the profits. With the option of GBP/USD growth and the absence of bears at 1.1861, bulls will have a real chance to correct and develop a sharper upward price channel. In this case, I advise you not to rush with sales: only a false breakdown in the area of 1.1921 will give an entry point into short positions. It is possible to sell GBP/USD immediately for a rebound from the 1.1972 level, but only to move down by 30-35 points within a day.

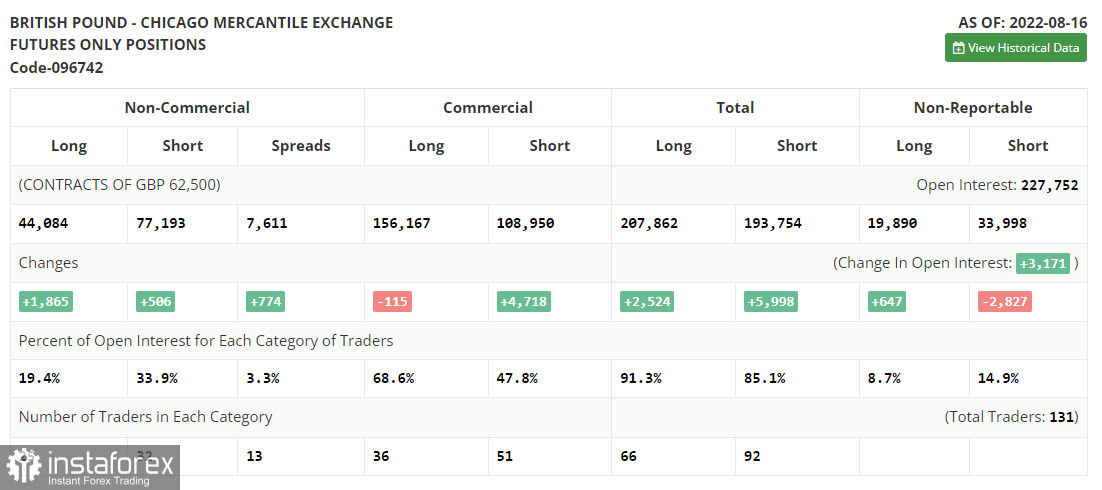

The COT report (Commitment of Traders) for August 16 recorded an increase in both short and long positions, but these changes no longer reflect the real current picture. Serious pressure on the pair, which began in the middle of last week, continues now, and for sure, there will be fewer people willing to buy the pound in the current difficult macroeconomic conditions. We have a meeting of American bankers in Jackson Hole ahead of us, which may lead to an even greater strengthening of the dollar against the pound. This will happen if the Chairman of the Federal Reserve System, Jerome Powell, announces the preservation of the previous position of the committee regarding an active and tough increase in interest rates in the hope of further combating inflation and bringing it back to normal. The latest COT report indicates that long non-commercial positions increased by 1,865 to the level of 44,084. In contrast, short non–commercial positions increased by 506 to the level of 77,193, which led to an even greater reduction in the negative value of the non-commercial net position to the level of - 33,109 versus -34,468. The weekly closing price remained almost unchanged and amounted to 1.2096 against 1.2078.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.