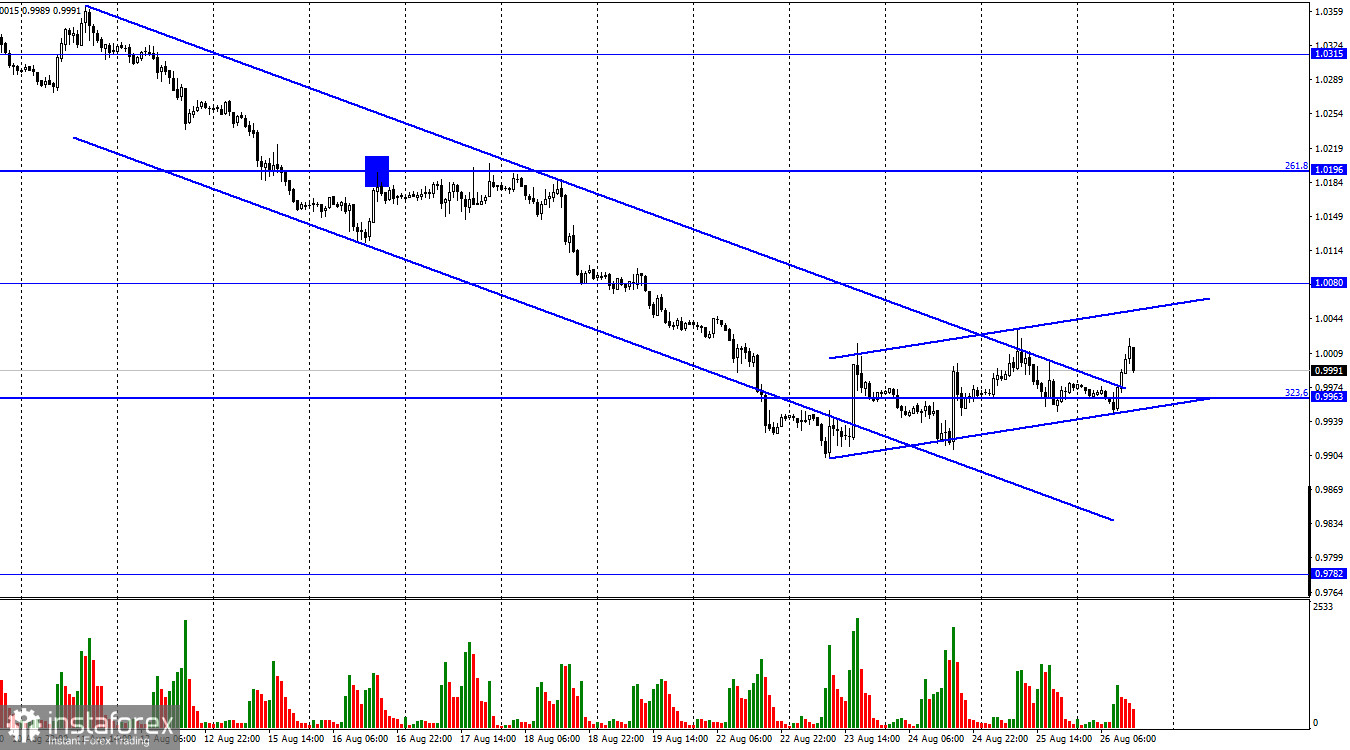

On Friday, the EUR/USD pair again reversed in favor of the European currency and began the growth process, simultaneously consolidating over the downward trend corridor. At the same time, I formed an ascending mini-corridor, which so far characterizes the mood of traders as "bullish." I don't think the pair will spend much time in it, but closing under it will favor resuming the fall of quotes in the direction of the 0.9782 level. The current week has turned out to be quite boring. There was practically no background information. Of all the reports and events that did exist, I can only note the business activity index in the US services sector, which continued its decline and finished the last month at 44. If the pair continued its trend decline on Monday, it would not move from its place in the next four days. This week's most important event tonight is Jerome Powell's performance in Jackson Hole.

Opinions among traders and analysts, as usual, were divided. Some believe that Powell's rhetoric will gradually soften as a series of not-the-best economic reports and a high recession probability will force the Fed to slow down. Some believe that now is not the time to talk about slowing down the pace of interest rate increases since inflation has slowed down only once. I am inclined to believe that Jerome Powell's rhetoric will remain the same, and we should still expect a 0.75% rate hike in September. In addition, I do not expect today that the Fed president will "open his soul" and report something specific. He will most likely limit himself to general phrases like "we will continue to fight inflation in all available ways." However, I must admit that what will matter is not Powell's speech but how traders will understand or want to understand it. If traders see a "hidden meaning" and hint at it, then a strong movement at the very sunset of the trading week is not excluded.

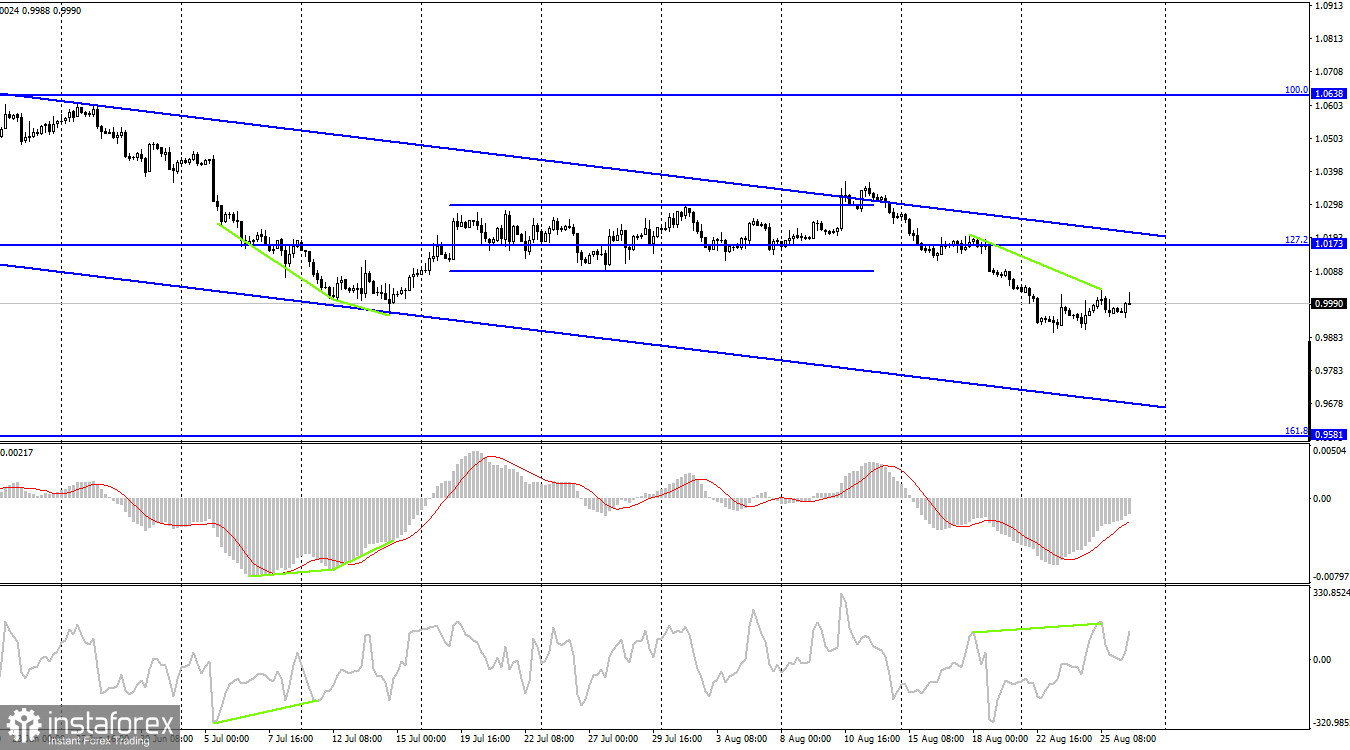

On the 4-hour chart, the pair reversed in favor of the US currency and anchored under the corrective level of 127.2% (1.0173). Thus, the process of falling can be continued in the direction of the Fibo level of 161.8% (0.9581). A "bearish" divergence has formed in the CCI indicator but has not yet led to a resumption of the fall in the direction of 0.9581. A rebound from the level of 127.2% may work in favor of the US currency.

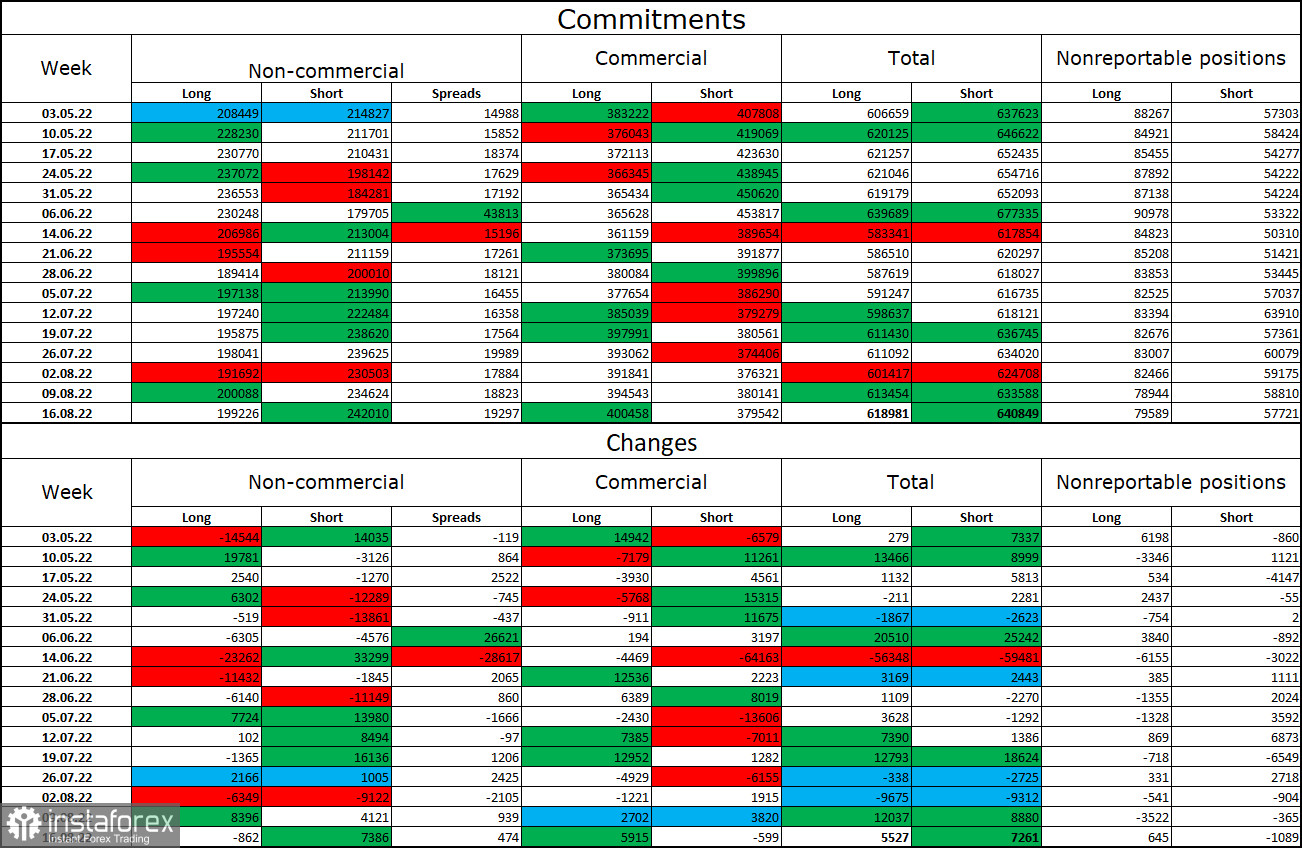

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 862 long contracts and opened 7386 short contracts. This means that the "bearish" mood of the major players has intensified again. The total number of long contracts concentrated in the hands of speculators is now 199 thousand, and short contracts – 242 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually growing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not shown convincing growth in the last five or six weeks. Thus, it is still difficult for me to count on strong growth of the euro currency. So far, I am inclined to continue the fall of the euro/dollar pair.

News calendar for the USA and the European Union:

US - speech by the head of the Fed, Mr. Powell (14:00 UTC).

On August 26, the calendar of economic events of the European Union does not contain a single interesting entry, and Jerome Powell's speech will take place in the USA. The influence of the information background on the mood of traders can be quite strong, but late.

EUR/USD forecast and recommendations to traders:

I recommend new pair sales with a target of 0.9782 when closing under the ascending corridor on the hourly chart. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.