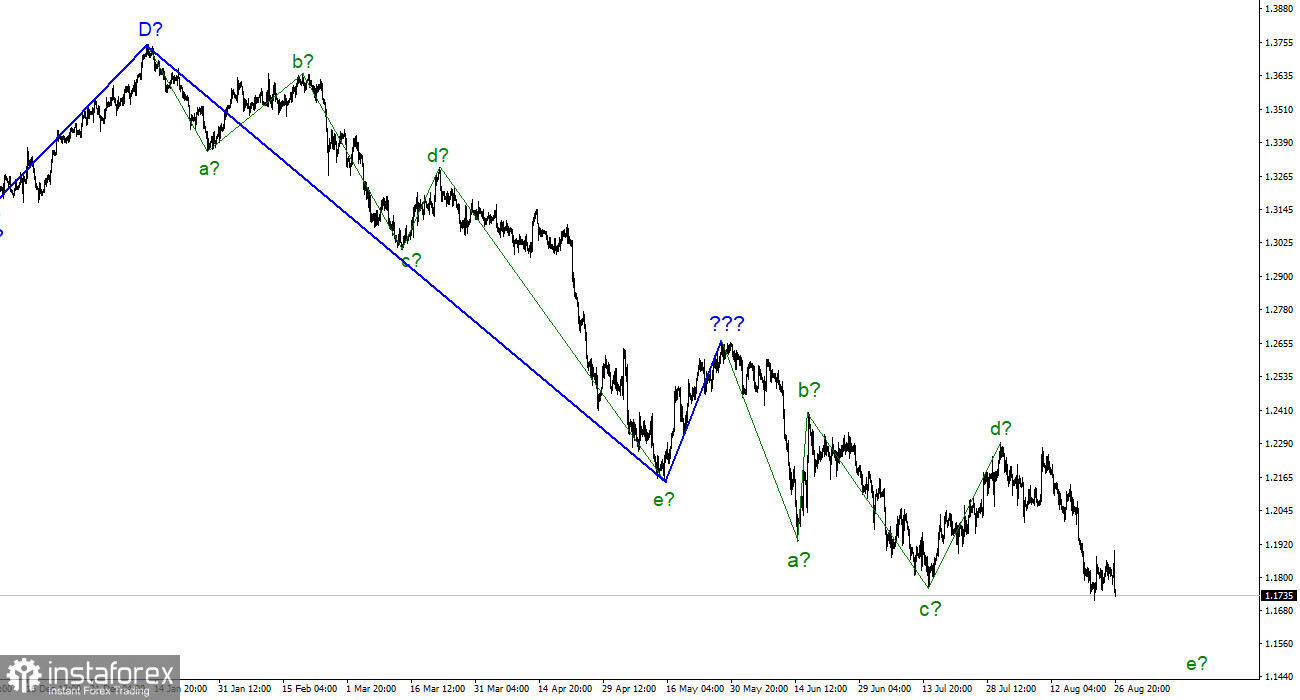

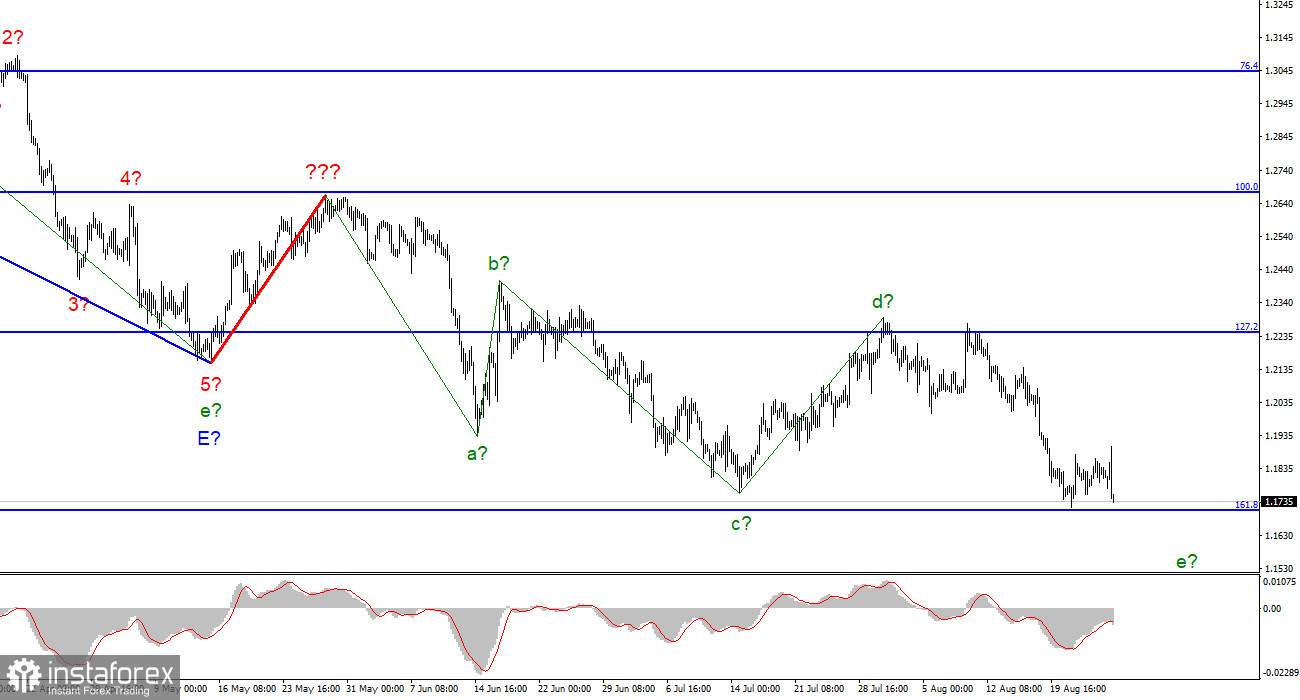

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but it does not require any clarifications yet. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. At this time, we have completed waves a, b, and d, so we can assume that the instrument is continuing to build wave e. If this assumption is correct, then the decline in quotes should continue in the near future. However, I remind you that if impulse structures can become more complicated and lengthened, corrective ones can become even more so. Given the news background and the fact that the Fed will not stop raising interest rates now, the entire downward trend section may take a much longer form. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. Ascending and descending waves alternate almost exactly. However, the corrective status of the trend for the British allows it (theoretically) to complete the wave e near the Fibonacci level of 161.8%.

The threat of a recession in America does not bother the markets

The exchange rate of the pound/dollar instrument on August 26 first increased by 70 basis points and then decreased by 165. The decline began just during the speech of the Fed president, so there is no doubt what it was connected with. Jerome Powell's rhetoric can be called "hawkish," so why the demand for the US currency began to grow on Friday is also understandable. I want to mention one important fact, which makes it even easier to understand why the US currency may continue to grow in the coming months. This year, the probability of a recession in the American economy exceeds 50%. And although the Fed disagrees that two negative quarters of GDP can be considered a recession, citing a strong labor market and low unemployment, for most economists, the recession has already begun. I want to note that there is a high probability of a recession in the European Union and the UK. But in the USA, we already see negative GDP values, and in Britain or the EU, we can only see them in the future. At the same time, the demand for US currency continues to grow.

Based on this, I can conclude that the issue of recession at this time, while the Fed raises the interest rate (causing the recession by its actions), is not of interest to the markets. It turns out that we have two sides of the same coin. On the one hand, the Fed is raising the rate, and on the other hand, the US economy is falling, which is now happening solely because the Fed is raising the rate. Markets cannot react to the same event in two different ways simultaneously. Therefore, I believe that only after the completion of the tightening of the PEPP, the markets will remember both how much the US economy has fallen, and how things are in the UK or the EU.

General conclusions

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equating to 200.0% Fibonacci for each MACD signal "down." But first, you must wait for a successful attempt to break through the 1.1708 mark, indicating that the market is ready for new British sales.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.