Analysts of positions and tips for trading EUR

On Friday, traders were unable to reap profit. There was only one test of the 0.9975 level. It occurred at a time when the MACD indicator went up quite a lot from the zero level, which limited its further upward movement. I decided to wait for the implementation of scenario No. 2 for short positions, which did not take place. There were no other signals.

Germany unveiled weak economic reports last Friday. Yet, they did not affect the euro as traders were waiting for Jerome Powell's speech at the Jackson Hole Symposium. Therefore, they paid zero attention to the reports on the euro area money supply M3 and the private sector loans. The US dollar surged following Powell's speech, which led to a sharp drop in the euro. The bears took the upper hand because the Fed could stick to monetary tightening in 2023. It means that the next year the Fed is unlikely to cut key rates. It may adversely affect the economy, which is gradually sliding into a recession. Investors are revising their portfolios in favor of safe-haven assets, getting rid of risk assets. This is a bullish factor for the US dollar. Today, Philip R. Lane, a Member of the Executive Board of the ECB, will deliver a speech. He is likely to talk about the need for a tougher stance to curb soaring inflation in the eurozone, blaming high gas prices for a downturn. There will be no crucial economic reports in the afternoon. The speech of Fed policymaker Lael Brainard, who backs further aggressive tightening, will surely lead to a new wave of sell-off of the EUR/USD pair.

Buy signal

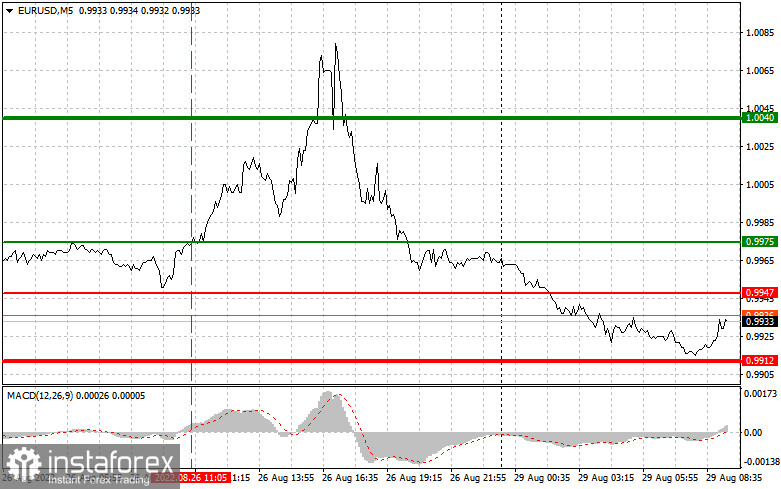

Scenario No.1: today, it is recommended to buy the euro if the price reaches 0.9953 (the green line on the chart) with the potential of a rise to 1.0014. At 1.0014, it is better to close long positions and open short ones, keeping in mind a 30-35 pip correction from the given level. The pair is unlikely to climb significantly today, especially after Powell's speech last Friday. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to rise from it.

Scenario No.2: it is also possible to buy the euro today if the price approaches 0.9917. At this moment, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It could also trigger an upward reversal of the market. The pair is expected to grow to the opposite levels of 0.9953 and 1.0014.

Sell signal

Scenario No.1: it is recommended to open short positions on the euro if the price hits 0.9917 (the red line on the chart). The target will be the 0.9867 level. It is better to close short positions and open long ones at this level, keeping in mind a 20-25 pip correction from the given level. Demand for the euro will hardly revive in the near future. This is why a further decline looks likely. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price slides down to 0.9953. At this moment the MACD indicator should be in the overbought area, which could limit the upward potential of the pair. It may also lead to a downward reversal. The pair is projected to dip to the opposite levels of 0.9917 and 0.9867.

What's on the chart:

The thin green line is the entry point where you can buy the trading instrument;

The thick green line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to rise above this level;

The thin green line is the entry point where you can sell the trading instrument;

The thick red line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to decline below this level;

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders should make very careful decisions when entering the market. Before the release of important fundamental reports, it is better to stay out of the market. It helps you avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place Stop Loss orders to minimize losses. Without placing Stop Loss orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that it is necessary to have a clear trading plan for successful trading, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.