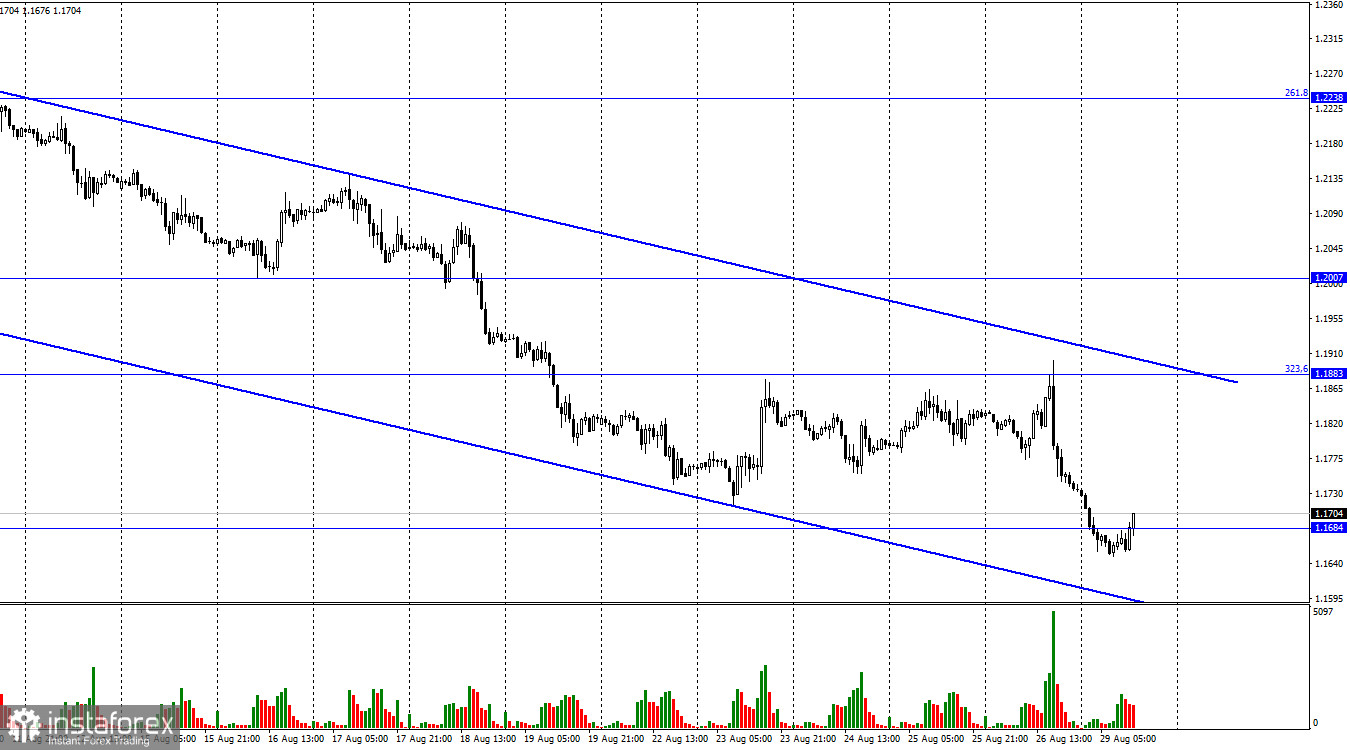

According to the hourly chart, the GBP/USD pair on Friday increased to the corrective level of 323.6% (1.1883), a rebound from it and a reversal in favor of the US dollar. After that, a strong fall began, at the end of which the pound found itself at 1.1684. Only this morning, it attempted to close above this level, but if the euro showed growth today, the pound did not. Thus, the process of falling quotes can be continued in the direction of the next corrective level of 423.6% (1.1306), and the downward trend corridor does not even allow the thought that the British can show strong growth in the near future. On Friday, the entire information background was reduced to a speech by Jerome Powell, about whom I already wrote in an article on the euro/dollar. In addition to the speech of the Fed president, reports on personal income and expenses of Americans for July were also released. I can't say they were a failure, but they were still below traders' expectations. They led only to a slight drop in the US currency, after which the US dollar quickly caught up.

I am inclined to count on the fact that the British may move up a little earlier this week, after which it will resume its fall. The next meetings of the Bank of England and the Fed are still far away, so traders can focus on other things. Now the markets are in full swing discussing the recessions in the American and British economies, trying to guess where it will be stronger. So far, forecasts and calculations suggest that the recession will be stronger in the United States. The British economy may lose only about 1%. But with inflation, everything is much more complicated since figures of about 18% have already begun to appear as the maximum inflation in 2022-2023. In the US, let me remind you, the consumer price index has already begun to slow down, and taking into account the rate hike, which the Fed will not abandon, it will only decrease over time. As you can see, the dollar is growing against this background, so I assume that traders pay more attention to rates, not the recession.

On the 4-hour chart, the pair dropped to the corrective level of 161.8% (1.1709) and anchored below it. Thus, the process of falling can be continued in the direction of the level of 1.1496. A "bullish" divergence was formed at the MACD indicator, but it is better now to "mature" it. If it does not form, nothing will interfere with the fall of the pound. Consolidation above the level of 1.1709 will work in favor of the pound and some growth, which is unlikely to be strong.

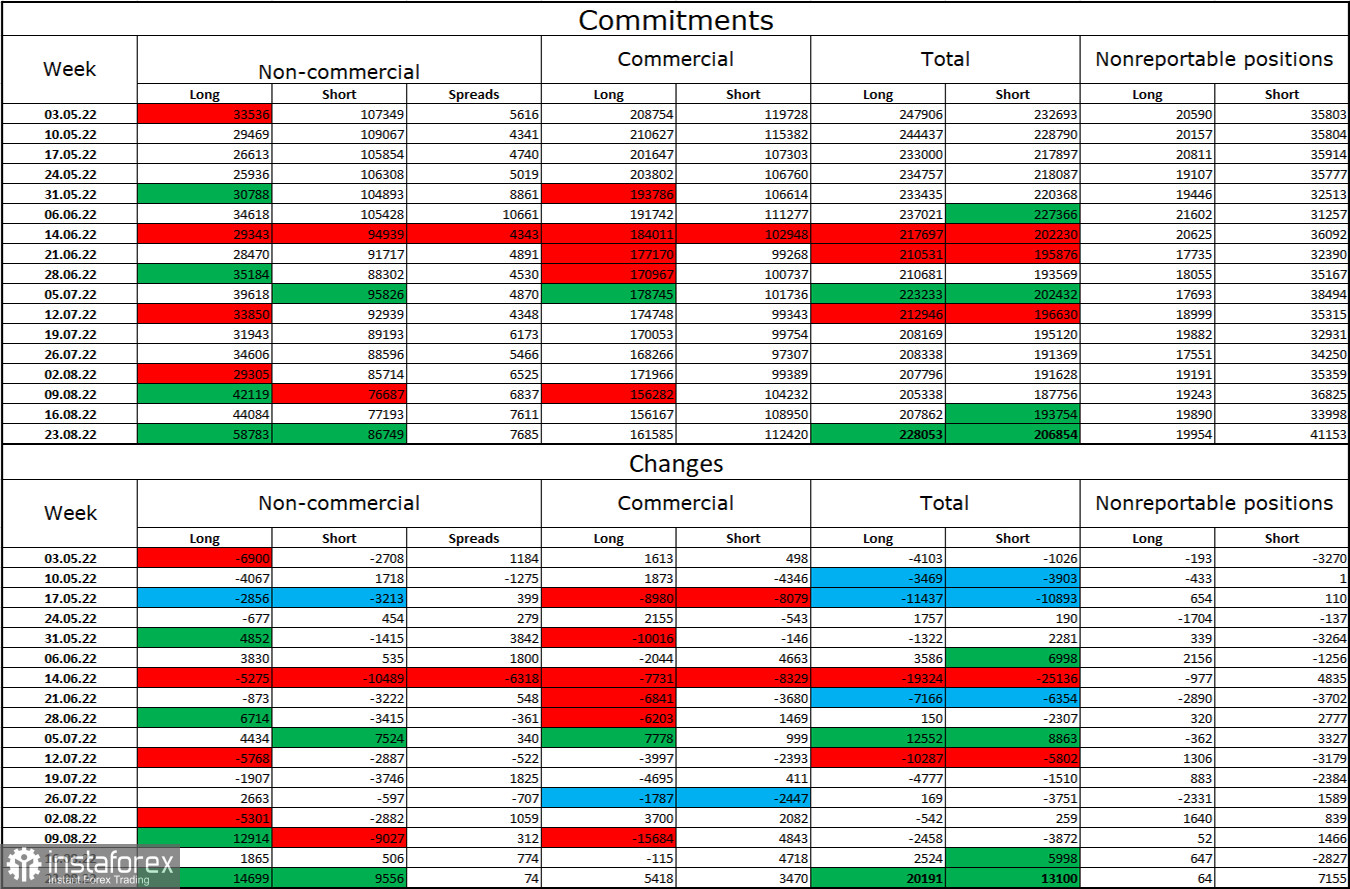

Commitments of Traders (COT) Report:

Over the past week, the mood of the "Non-commercial" category of traders has become slightly less "bearish" than a week earlier. The number of long contracts in the hands of speculators increased by 14,699 units, and the number of short – by 9556. Thus, the general mood of the major players remains the same – "bearish," and the number of short contracts still exceeds the number of long contracts, but much less than before. The big players stay in the pound sales for the most part, and their mood is gradually changing towards "bullish," but this process is still very far from completion. The pound has shown weak growth in recent weeks but has already resumed falling, and COT reports so far make it clear that the pound is more likely to continue its decline than to start a long upward trend now.

News calendar for the USA and the UK:

On Monday in the UK and the US, the calendars of economic events do not contain a single interesting entry. Thus, the influence of the information background in the rest of the day may be absent, as in its first half.

GBP/USD forecast and recommendations to traders:

I recommended selling the British when rebounding from the level of 1.1883 on the hourly chart with a target of 1.1709. This goal and the level of 1.1684 have been achieved. Sales can be kept open now until closing above 1,1709. I recommend buying the British when fixing the pair's rate above the downward trend corridor on the hourly chart with a target of 1.2007.