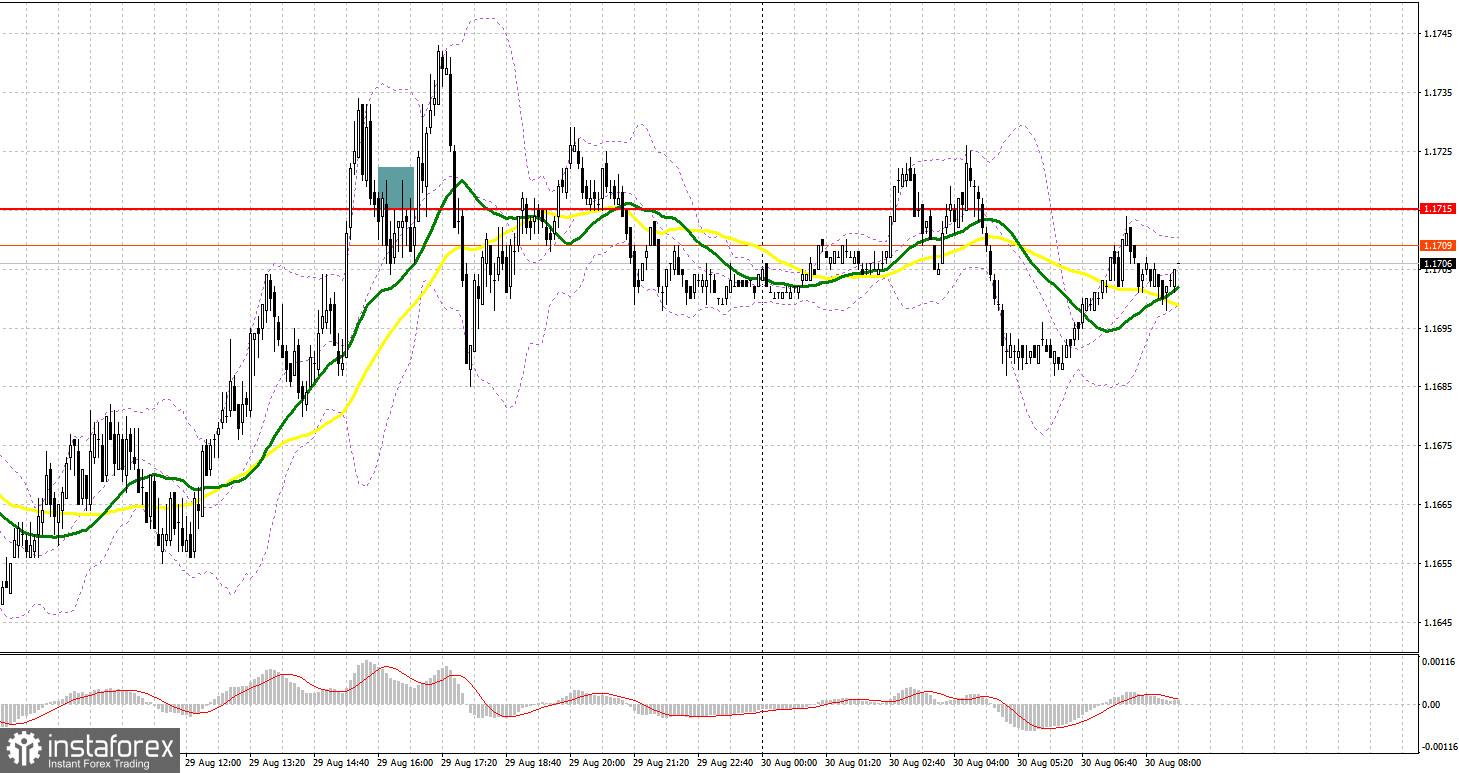

Yesterday was not the best day for trading the British pound. Let's take a look at the 5-minute chart and see what happened. In my morning forecast, I paid attention to the level of 1.1684, but just a couple of points were missing before a false breakout formed there. For this reason, I did not see a signal to enter the market. The technical picture was slightly revised in the afternoon. As a result of a sharp rise in the pound, and then the pair returning to the area under the level of 1.1715, it was possible to get a good signal to sell in continuation of the bear market observed since the end of last week. But, to my regret, I did not see any downward movement. Another wave of growth led to consolidating losses.

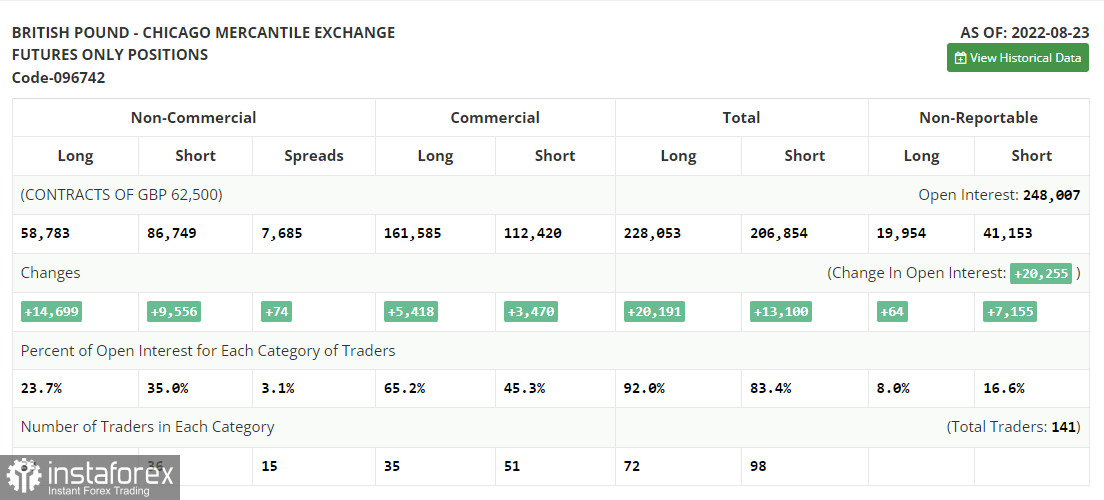

COT report:

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. The Commitment of Traders (COT) report for August 23 logged an increase in both short positions and long positions. And although the latter turned out to be a bit more, these changes did not affect the real current picture. Serious pressure on the pair remains, and recent statements by Federal Reserve Chairman Jerome Powell that the committee will continue to aggressively raise interest rates further have only increased pressure on the British pound, which has been experiencing quite a lot of problems lately. Expected high inflation and a looming cost-of-living crisis in the UK does not give traders room to take long positions, as a fairly large range of weak fundamentals is expected ahead, likely to push the pound even further below the levels at which it is currently trading. This week, it is important to pay attention to data on the US labor market, which, among other things, determine the Fed's decision on monetary policy. Continued resilience with low unemployment will lead to higher inflationary pressures going forward, forcing the Fed to further raise interest rates, putting pressure on risky assets, including the British pound. The latest COT report indicated that long non-commercial positions rose 14,699 to 58,783, while short non-commercial positions rose 9,556 to 86,749, leading to a slight rise in the negative non-commercial net position to -27,966 against - 33,109. The weekly closing price fell off from 1.1822 against 1.2096.

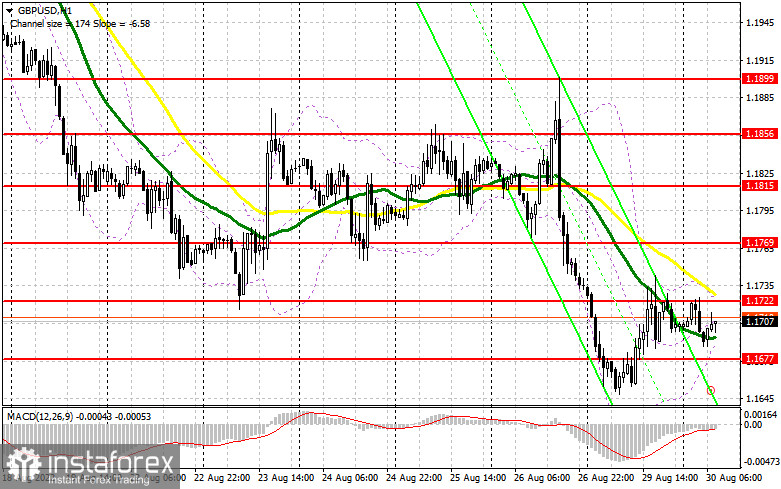

When to go long on GBP/USD:

Today we expect a fairly large number of fundamental statistics, which are not of great interest, since the data will relate to lending. Considering that there has been no data for the UK for quite some time, even these figures may attract interest. The change in the M4 money supply, the number of approved mortgage applications and the volume of net loans to individuals in the UK - all of these reports could show a slowdown as the economy slides into recession and inflation is at a record level. In case GBP/USD falls further in the first half of the day, which is more likely, the best scenario for buying will be a false breakout in the area of the nearest support at 1.1677, formed on the basis of yesterday. This will lead to an upward bounce and push the pair to the 1.1722 area, where the average moving averages play on the bears' side. After getting above 1.1722 we can talk about the prerequisites for building an upward correction for the pair. A breakdown of 1.1722, as well as a reverse downward test opens the way to 1.1769. A more distant target will be the area of 1.1815, where I recommend taking profits.

If the GBP/USD falls and there are no bulls at 1.1677, the pressure on the pound will increase again, which will force the bulls to leave the market again, as the risk of further development of the bearish trend will become more real. If this happens, I recommend postponing long positions to 1.1634 - the annual low, below which there is nothing. I advise you to buy there only on a false breakout. You can open longs on GBP/USD immediately for a rebound from 1.1573, or even lower - around 1.1499, counting correcting 30-35 points within the day.

When to go short on GBP/USD:

Protecting the nearest resistance at 1.1722, where the moving averages, playing on the bears' side, is the most important task for today. Strong fundamental reports will help. In case the pair rises, forming a false breakout at 1.1722 will return pressure on the pound and create a sell signal in order to develop a further bearish trend and decline to the nearest support at 1.1677. A breakthrough and reverse test from the bottom to the top of this range will provide an entry point for short positions with a fall to the year's low at 1.1634. A more distant target will be the area of 1.1573, where I recommend taking profits.

In case GBP/USD grows and there are no bears at 1.1722, bulls will have an excellent chance of returning to 1.1769, which will make life difficult for pound bears. Only a false breakout around 1.1769 can create an entry point into shorts, counting on a new downward movement of the pair. If traders are not active there, there may be a surge up to a high of 1.1815. There, I advise you to sell GBP/USD immediately for a rebound, based on a rebound of the pair downwards by 30-35 points within the day.

Indicator signals:

Moving averages

Trading is conducted below 30 and 50 moving averages, which leaves a chance for bears to pull down the pair further.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.1680 will increase pressure on the pair. If the pair grows, the upper border of the indicator around 1.1725 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.