Both stock and forex markets bounced back after Fed Chairman Jerome Powell's speech at the Jackson Home symposium. This created opportunities for medium-term traders to enter positions.

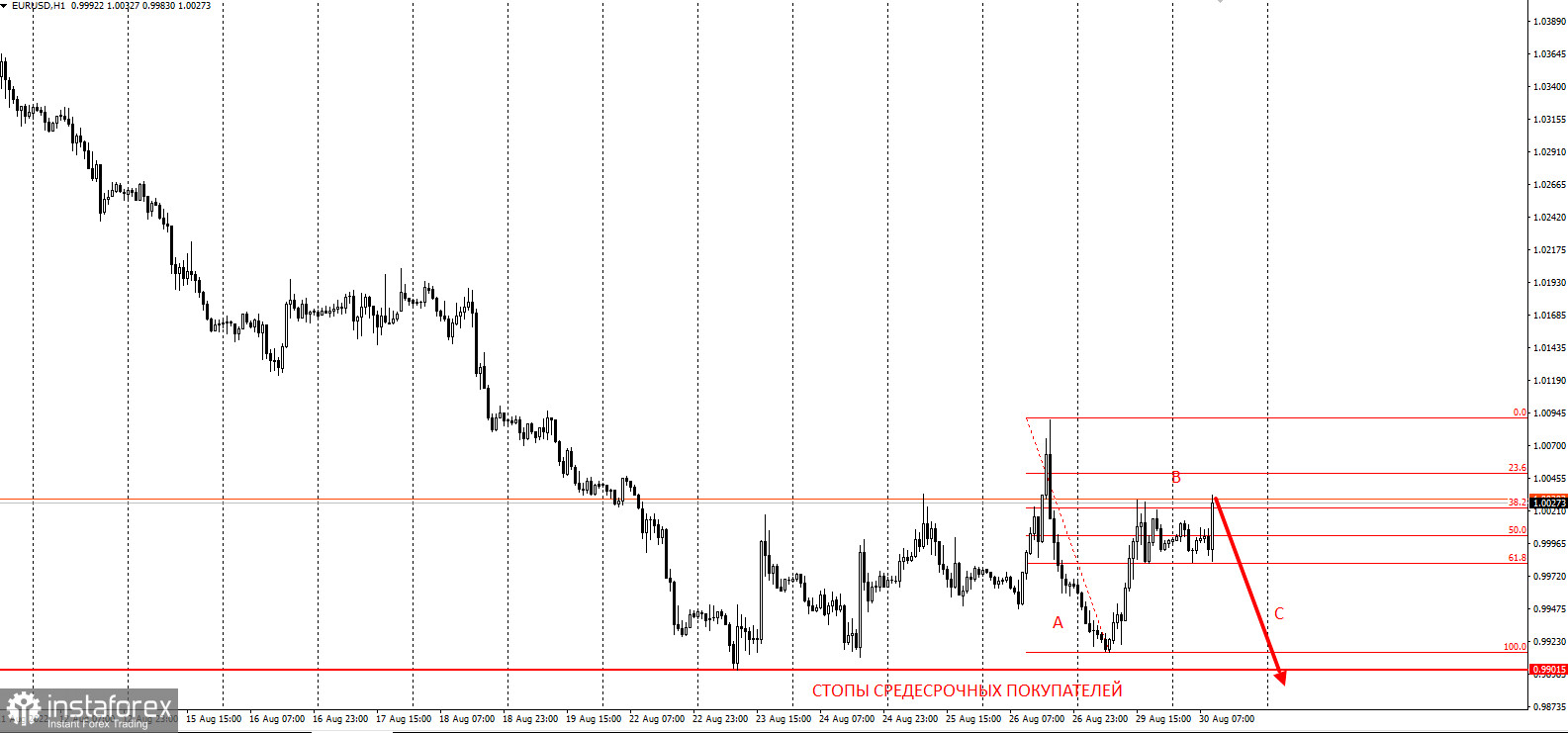

EUR/USD was not an exception as it has rolled back to the 38.2% retracement level. Its movement also continued the three-wave (ABC) pattern.

In lower time frames, trading is conducted around buyers' stops at 0.99800.

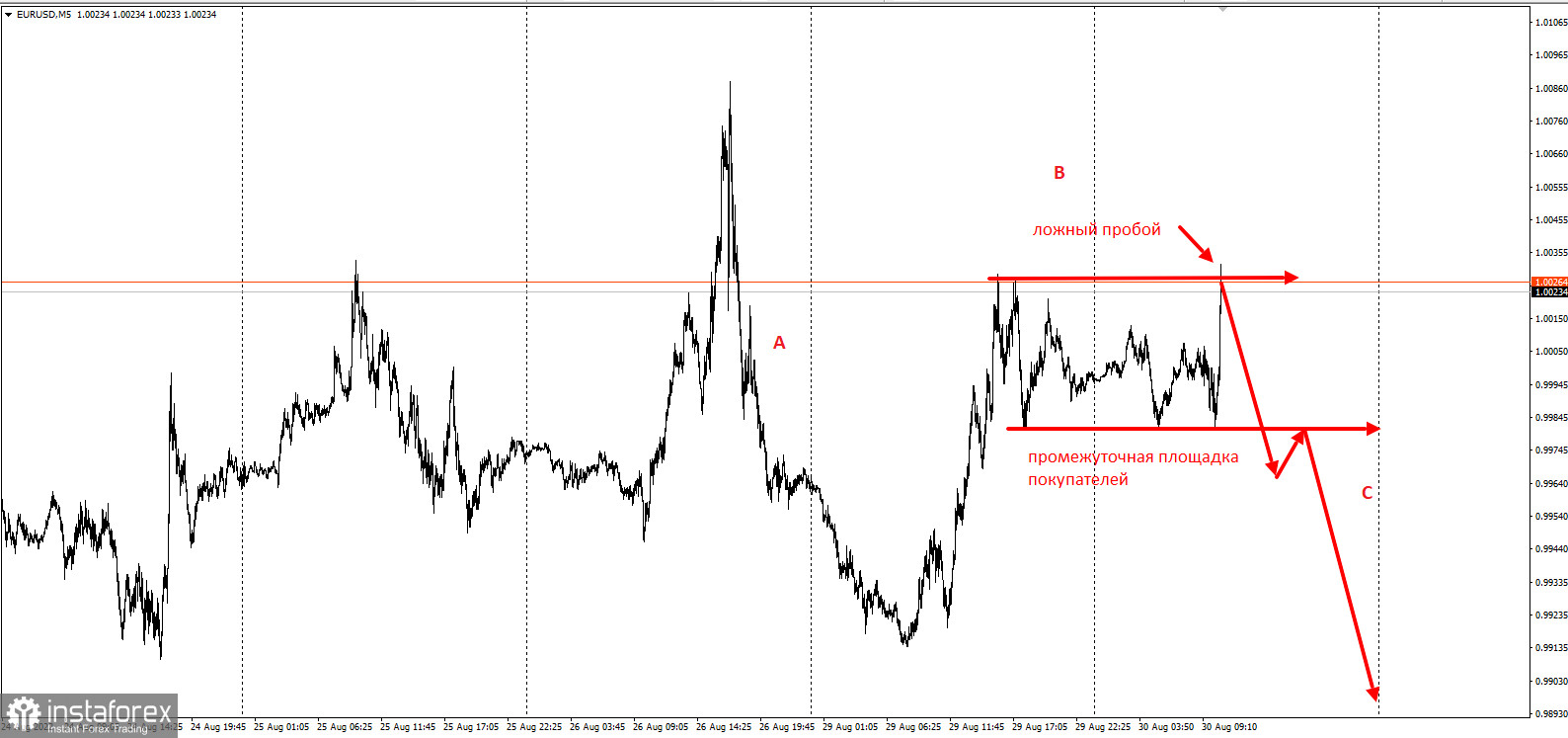

Most likely, if the pair does not consolidate above 1.00300, a false breakdown will occur according to this scenario:

Since recent movements form a three-wave (ABC) pattern, where wave A represents the selling pressure last Friday, traders can enter the market by selling according to the scenario above. Stop loss could be placed after the false breakdown of 1.00300 or 1.00800. Exit the market on the breakdown of 0.99.

This trading idea is based on the "Price Action" and "Stop Hunting" methods.

Good luck and have a nice day! Don't forget to control the risks!