When it comes to your own safety, there is no time for jokes. Saudi Arabia's claims that the paper oil market has broken away from its fundamentals, and if this continues, OPEC+ will be forced to cut production, can be viewed in two ways. On the one hand, Riyadh's dissatisfaction with falling prices. On the other hand, as a message from the United States. If the nuclear deal with Iran is resumed, the Saudis will have no choice but to reduce production. And it's not only about the balance of the market but also about their own security.

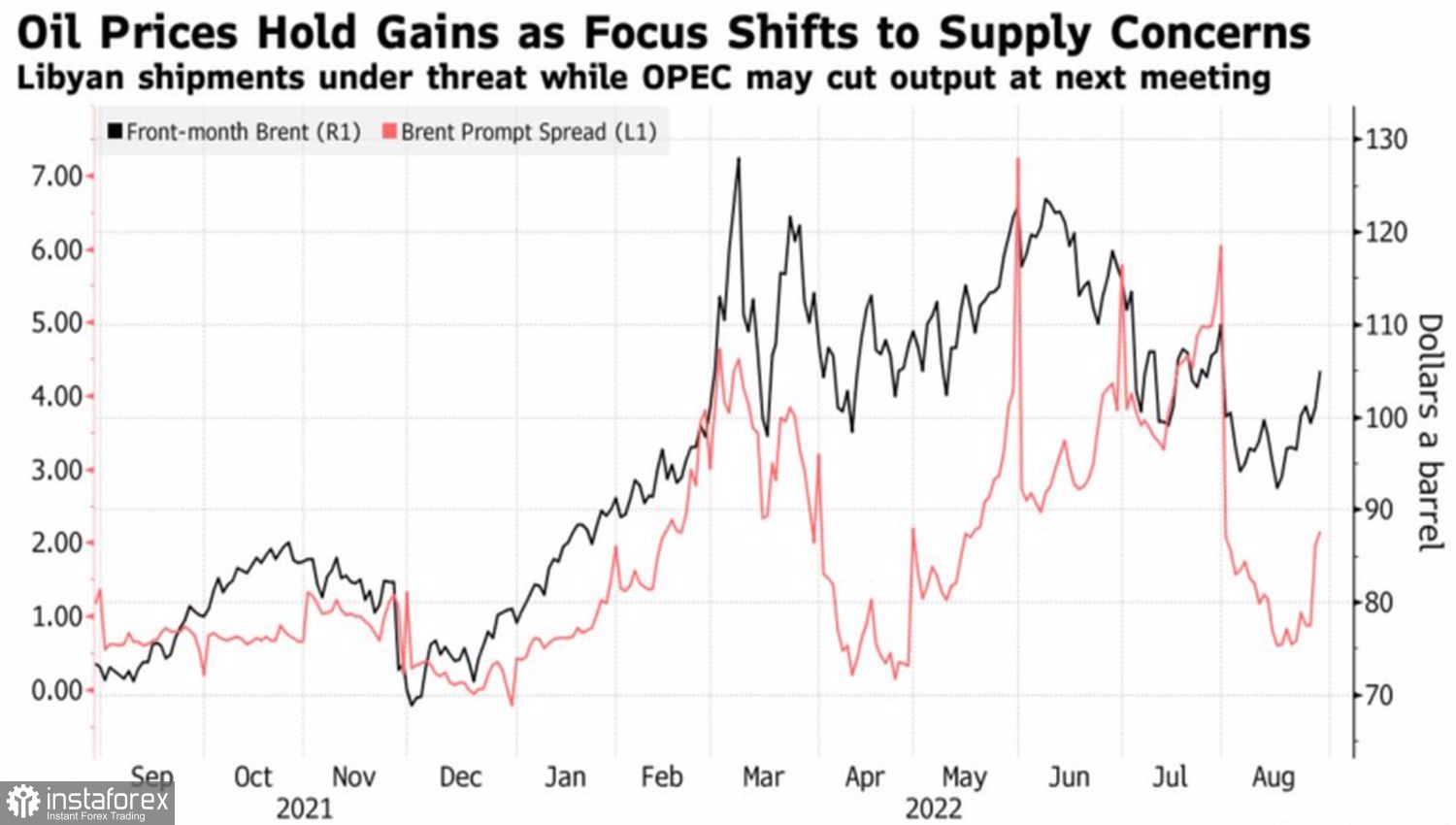

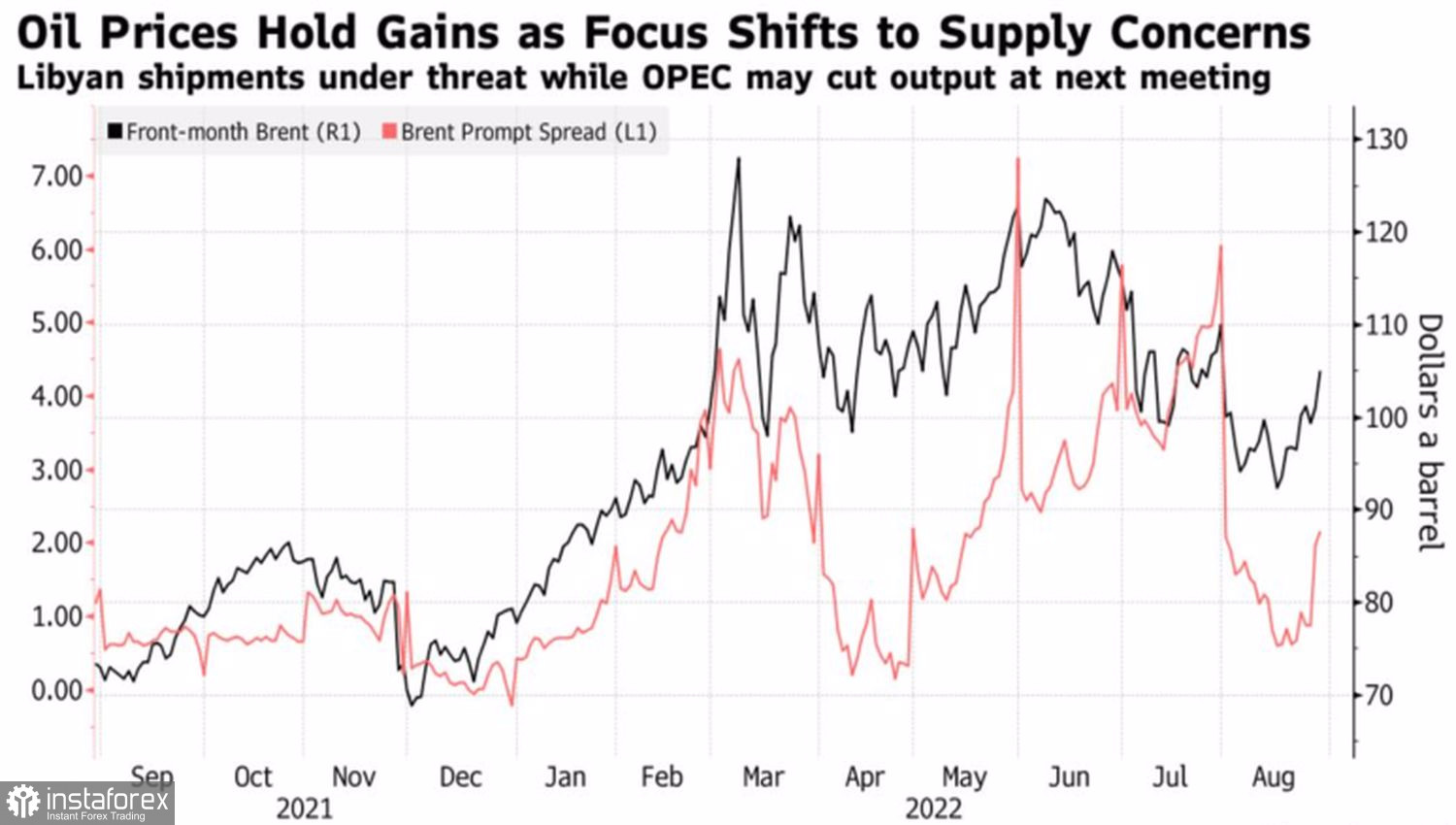

It is difficult to admit that we live in a very turbulent world. The armed conflict in Ukraine and the associated energy crisis are pushing the European and global economies into recession. Bloody clashes in Libya and Iran cannot but affect the oil market. Concerns about a reduction in supply and the expectation that the OPEC+ summit on September 5 will decide to reduce production returned Brent above the psychologically important mark of $100 per barrel. The spread between nearby contracts for the North Sea variety has grown from $0.6 to $1.9 and still indicates a "bullish" conjuncture.

Dynamics of Brent and spread on futures contracts

Information from Tehran also fueled the best daily oil rally in more than a month. Iran believes that the deal with the West will be concluded a little later than expected. Not before September. Despite the fact that everyone is well aware that the country needs time to return to production of 1.3 million bpd, the reserves of oil ready for sale are huge. Kpler estimates that 93 million barrels of Iranian oil are stored on ships in the Persian Gulf. Vortexa estimates its volume near Singapore and China at 60–70 million barrels.

How can Saudi Arabia respond? In fact, it does not have many opportunities. According to a Reuters insider, OPEC+ produced 2.89 million barrels per day of oil less than planned in July. Only information about a significant reduction in production can stir up the market. In all other cases, selling on facts will follow after buying on rumors. They can be fast enough, given that central banks from North America and Europe are pushing these regions into recession by raising rates. The reduction in global demand is a "bearish" factor for Brent.

On the other hand, as December 5 approaches, when the European embargo on Russian oil comes into effect, fears of supply cuts could be the catalyst for a new rally. Moreover, the fall in gas prices and the growth of its exports from China to Europe reduce the risks of a recession in the EU, which is beneficial for the North Sea variety.

Technically, on the daily chart, Brent is working out the Wolfe Wave pattern. Long entry from $99 per barrel turned out to be successful. At the same time, the rally potential may be limited to $109.4, so for now, we use pullbacks to build up positions, and as prices rise, we take profits.