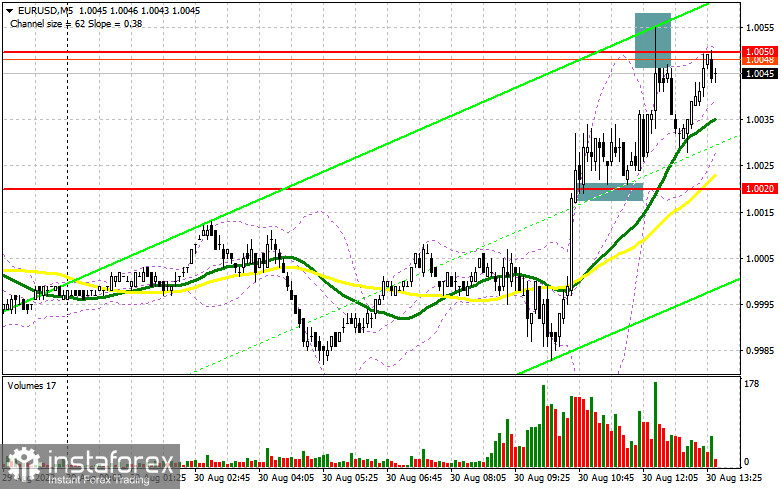

In the morning article, I highlighted the level of 1.0020 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and try to figure out what actually happened. The euro has maintained its upward correction today. A breakout and a downward test of 1.0020 gave an excellent buy signal. The euro/dollar pair climbed by more than 35 pips. However, it was unable to break through the resistance level of 1.0050. The bears immediately asserted strength. The price dropped by 20 pips. In the afternoon, the technical outlook changed slightly.

What is needed to open long positions on EUR/USD

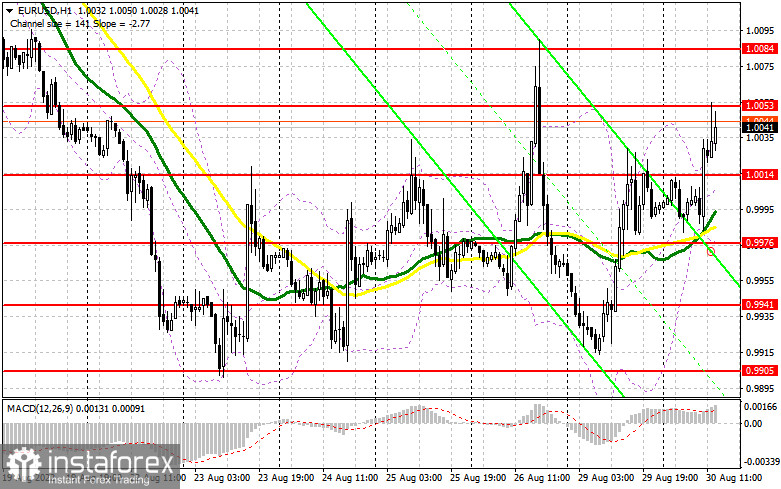

The consumer confidence indicator in the euro area turned out to be better than expected, pushing the euro slightly higher. Those sellers who were betting on a further decline of the euro after Friday's decrease had to leave the market. In the afternoon, traders are anticipating Germany's inflation data. However, they will mainly focus on the US Consumer Confidence Index and speeches of Fed policymakers - Thomas Barkin and John Williams. If one of them suddenly speaks in favor of less aggressive tightening, it will facilitate further growth of the euro. The most optimal scenario for opening long positions will be a false breakout of 1.0014. It will provide an excellent buy signal in the continuation of the upward correction. If so, the euro could recoup all its Friday losses. The nearest target will be the 1.0053 level, formed in the morning. A breakout and a downward test of this level will force the bears to close their Stop Loss orders. Traders will be more willing to buy the pair above the parity level. It will open the way for a correction to 1.0084. A more distant target will be the resistance level of 1.0127 where I recommend locking in profits. If EUR/USD declines and the bulls show no activity at 1.0014 in the afternoon, the pressure on the pair will escalate. In this case, it is better to open long positions after a false breakout of a low located at 0.9976. At this level, the moving averages are passing in negative territory. You can buy EUR/USD immediately at a bounce from 0.9941 or near the parity level of 0.9905, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open short positions on EUR/USD

The bears show up each time when the euro climbs higher. They are not in a hurry to defend the levels that have already been tested. If they continue to act like this, they could completely lose all the advantage they gained last Friday. The optimal scenario for opening short positions today will be a false breakout of a new resistance level of 1.0053. It could give a sell signal. The price is likely to decline to 1.0014. The bears need to regain control over this level. Otherwise, a downtrend is likely to end, especially when the price has been approaching intraday highs for the second day in a row. A sell signal may appear after a breakout below 1.0014 amid the strong US economic reports as well as an upward test of this level. If so, the price could drop to 0.9976 where I recommend locking in profits. A more distant target will be the 0.9941 level. If EUR/USD rises in the afternoon and the bears show no energy at 1.0053, the bulls are sure to take the upper hand. In this case, it is better to postpone short positions to 1.0084 but only if a false breakout occurs. You can sell EUR/USD immediately at a bounce from a high of 1.0127 or 1.0155, keeping in mind a downward intraday correction of 30-35 pips.

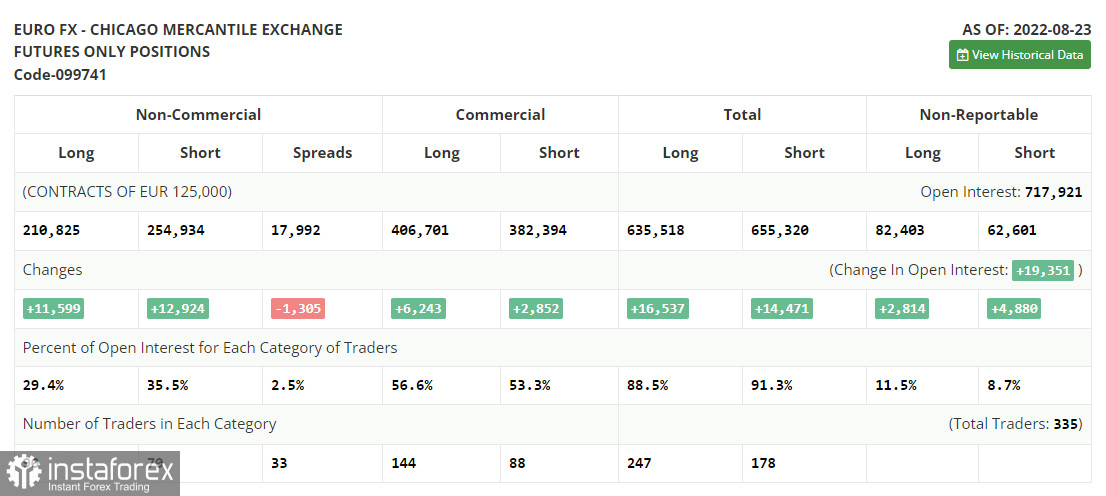

COT report

The COT report (Commitment of Traders) for August 23 logged a sharp increase in both short and long positions. It indicates a high risk appetite among traders, especially after the price approached the parity level. Jerome Powell's speech at the Jackson Hole Symposium led to a surge in volatility and facilitated a short-term rally of the US dollar. However, large retail traders try to prevent the pair from decreasing below the parity level. They begin to enter the market each time the pair start declining. Jerome Powell said that the Fed's main priority is to curb inflation. He also hinted at another sharp rate hike at the September meeting. Investors have priced it in already. So, it did not lead to a drastic drop in the euro versus the US dollar. This week, the Nonfarm Payrolls report is due. The Fed is sure to take notice of this report as it may impact the regulator's monetary policy decision. A strong labor market will keep boosting inflation, which may force the watchdog to raise interest rates further. The COT report revealed that the number of long non-commercial positions increased by 11,599 to 210,825, while the number of short non-commercial positions jumped by 12,924 to 254,934. At the end of the week, the total non-commercial net position remained negative and decreased to -44,109 against -42,784, signaling pressure on the euro and a further fall in the trading instrument. The weekly closing price declined to 0.9978 against 1.0191.

Signals of technical indicators

Moving averages

EUR/USD is trading above 30- and 50-period moving averages, signaling a further rise in the pair.

Remark. The author is analyzing the period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

If EUR/USD goes down, the indicator's lower border at 0.9976 will serve as support. Otherwise, if the currency pair grows, the upper border at 1.0031 will act as resistance.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.