Jerome Powell's remarks at the symposium in Jackson Hole continue to influence market players. The US dollar remains in an advantageous position against other currencies. At this moment, few things could slow down the US dollar's advance. Even the upcoming consumer confidence data by the Conference Board, which is expected to decline, could possibly fail to affect the ongoing sentiment in the market.

Economists at ING note that while CB confidence data could likely bounce amid falling gasoline prices, the US dollar would ignore the data release if it fails to meet expectations. ING expects the US dollar index to attract demand under 108.50.

"Our point here is that the Fed policy is designed to slow demand and that (orderly) weakness in equity markets and some softer consumer data (confidence and spending) are not enough to blow the Fed off its tightening course," ING's economists noted. "This environment should keep the dollar bid."

In his speech, Jerome Powell underscore the importance of incoming data for the Federal Reserve. Therefore, traders will pay close attention to macroeconomic statistics. This week's key data release is the US employment data, which will be published on Friday. Economists expect the US economy to add 285,000 jobs. An outlook by Wells Fargo sees employment increase by 325,000 in August.

However, such an increase would pale compared to July's report, when the number of jobs rose by 528,000, greatly above the projected rise by 250,000.

"The report likely still caused some indigestion for members of the FOMC. Wage growth came in stronger than expected, and the labor force participation rate fell by a tenth of a percentage point, putting it three-tenths of a percentage point below its March 2022 level," Wells Fargo economists said in a report.

"Job growth of more than half a million new jobs per month is consistent with an economy that is experiencing robust economic growth. Yet, other indicators suggest the economy is slowing down, and monetary policymakers are charting a course that brings labor supply and demand more into balance. As a result, we would be surprised by job growth continuing anywhere near the July pace in the months ahead," they added.

It is currently unclear how the actual data would match estimates. The US dollar is yet to price in the non-farm payrolls. Already, traders are somewhat uncertain ahead of the NFP release. However, the US dollar should still attract demand near 108.50.

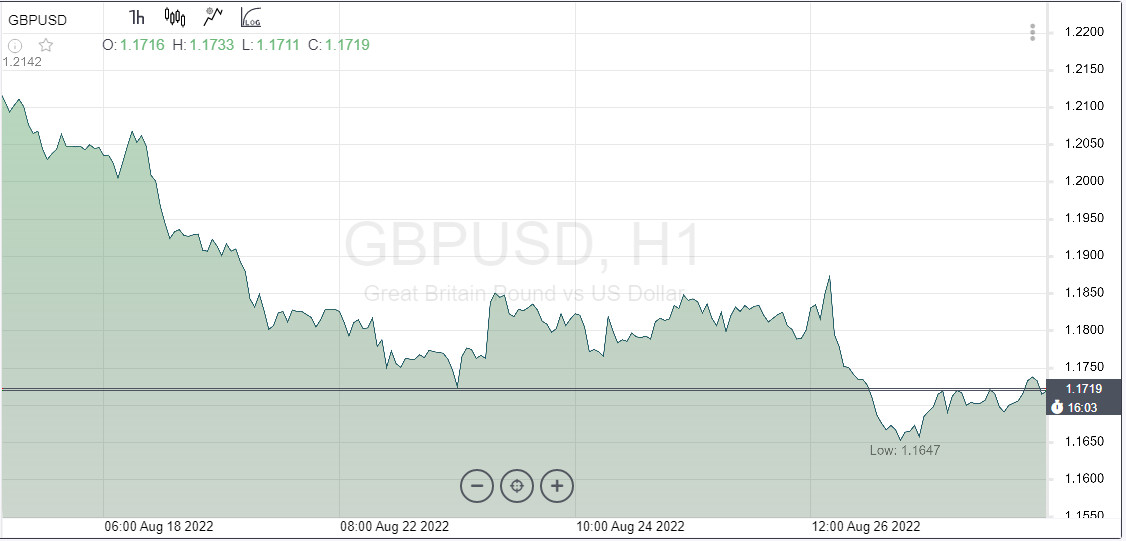

The pound sterling has been particularly vulnerable to the volatility in the market. GBP, which is sensitive to movements in the global stock market, would only halt its decline if the global market stabilizes. The pound sterling has suffered significant losses against both the US dollar and the euro.

At the symposium in Jackson Hole, Jerome Powell clearly tried to hold back the recent rally of US equities, which was fuelled by expectations of monetary policy easing. Powell's comments successfully sent the stock market downwards. GBP, which is highly sensitive to mood swings of investors in the equity markets, was particularly vulnerable to the impact of Powell's remarks.

"A tough environment for equities is therefore a real headwind to any sterling recovery," analysts at ING noted.

The pound sterling fell by 0.70% against the euro and slid down by 0.60% on Monday. Against USD, GBP decreased by 0.80% on Friday and by 0.30% on Monday. On Tuesday, GBP/USD is trying to consolidate near 1.1750.

"We think the path of least resistance for GBP/USD is down in the near term. GBP/USD has downside support at 1.1412, the low reached in early 2020 when the Covid pandemic first came in to play," Kristina Clifton, FX strategist and economist at CBA said.

Market activity is steadily increasing following yesterday's bank holiday in the UK. Month-end position adjustments could occur in the FX market today.

Meanwhile, EUR/USD remains near parity. GBP and EUR trader will possibly await more important data releases and events later this week before taking more directional positions. The pair will likely undergo some corrections as the US dollar index retreats from the highs near 110.00.

The euro has found support in hawkish comments by ECB policymakers this weekend, as well as falling natural gas prices.

Ursula von der Leyen, the president of the European Commission, stated on Monday that the EC plans a significant reform of the European energy market.

"We, the Commission, are now working on an emergency intervention and a structural reform of the electricity market. We need a new market model for electricity that really functions and brings us back into balance," the EC president said.

If investors sense the worst of Europe's energy crisis is near, they could once again begin to dump the euro aggressively.

The permabear thesis on the pound sterling remains, which leaves it at risk of further decline against other major currencies. GBP/USD is still expected to fall to 1.1500.