Currently, most investors are confident that the USD index rally will continue, and the trend in US stock indices will remain bearish. They also ignore the increase in the likelihood of a 75 bps increase in the ECB deposit rate in September to over 50%, and the reluctance of the VIX fear index to climb well above 25, signaling no panic in the stock market. Going against the crowd is always dangerous, there is a risk of being burned at the stake, but trends break at the very moment when the majority is sure that they are right.

After Jerome Powell's speech at Jackson Hole, the Fed's position became more than transparent. Regardless of the further dynamics of inflation, the Central Bank intends to raise rates, as a pause in this process can turn into sad consequences. Entrenched high prices and a deep recession. The Fed is ready to sacrifice the labor market, so I would venture to assume that the August employment statistics are unlikely to dot the I. Everything will depend on inflation data on September 13. That's when it will become clear whether the rate will increase by 50 or 75 bps at the next FOMC meeting.

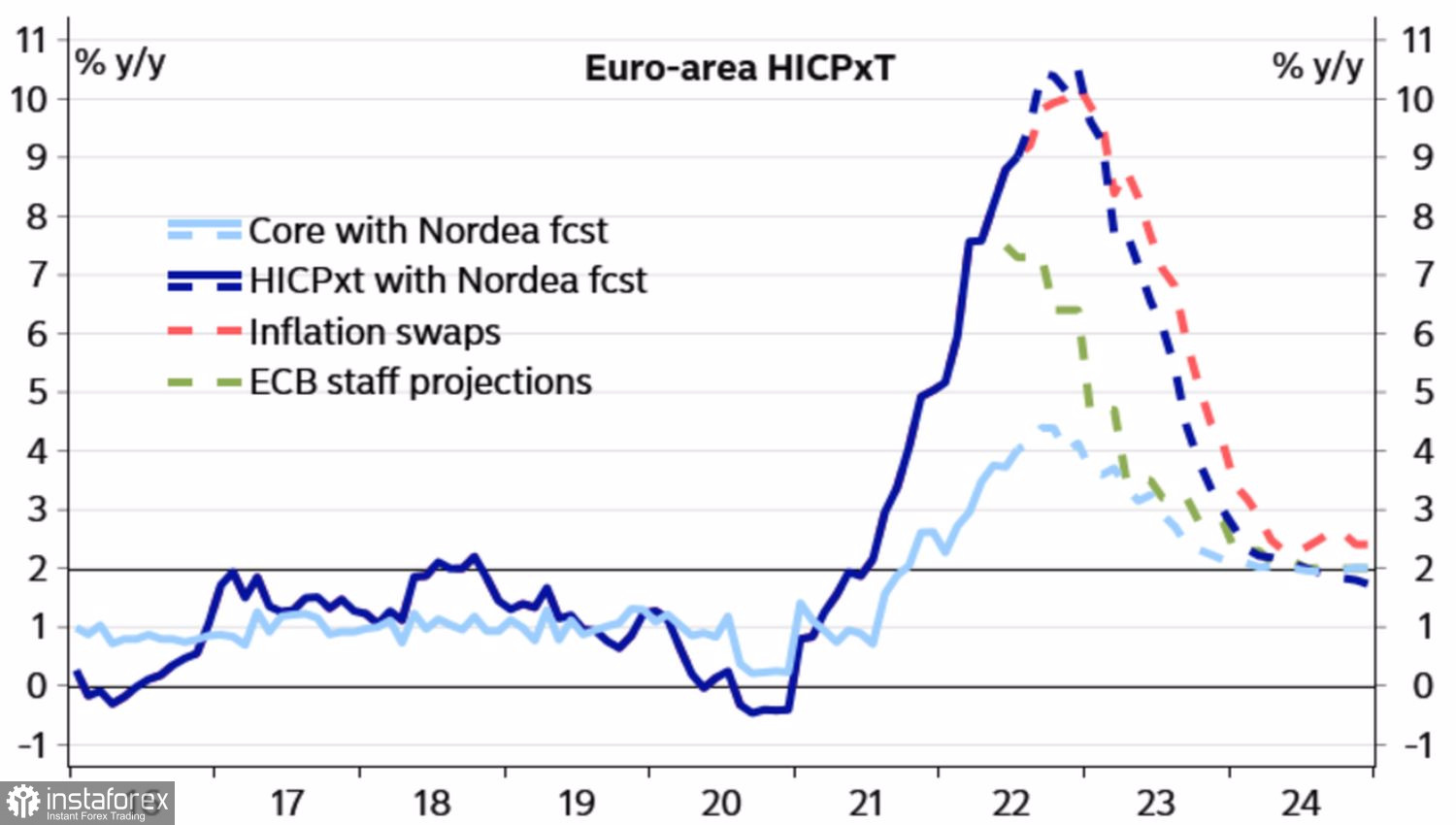

This circumstance, in my opinion, transfers the initiative from the Fed to the ECB. Indeed, European inflation data is released earlier, and the Governing Council meeting is approaching. They are clearly worried about the fall in EURUSD, which accelerates energy prices, raises inflation expectations and pushes the eurozone into recession. Christine Lagarde and her colleagues must do something. And the best option seems to be a 75 bps increase in the deposit rate on September 8.

Dynamics of European inflation expectations

It is about such a step that the heads of the central banks of Austria and the Netherlands, Robert Holzmann and Klaas Knot, are talking about. Nevertheless, investors are used to seeing them as the main hawks of the Governing Council, and the statement by ECB chief economist Philip Lane that monetary policy should be tightened gradually to look at the reaction of the economy, brought down the EURUSD bulls' momentum. In fact, it was Lane who put forward the proposal to raise the deposit rate by 50 bps in July, although before that, he also talked a lot about gradualism.

In my opinion, a further decline in gas prices against the backdrop of growing occupancy of European storage facilities and an increase in LNG imports from China, coupled with the acceleration of European inflation and the "hawkish" rhetoric of ECB officials, will create the foundation for EURUSD correction. The dollar in the current situation will be able to draw strength only in the fall of the S&P 500. However, the stock index is able to jump up in response to weak employment statistics in the US.

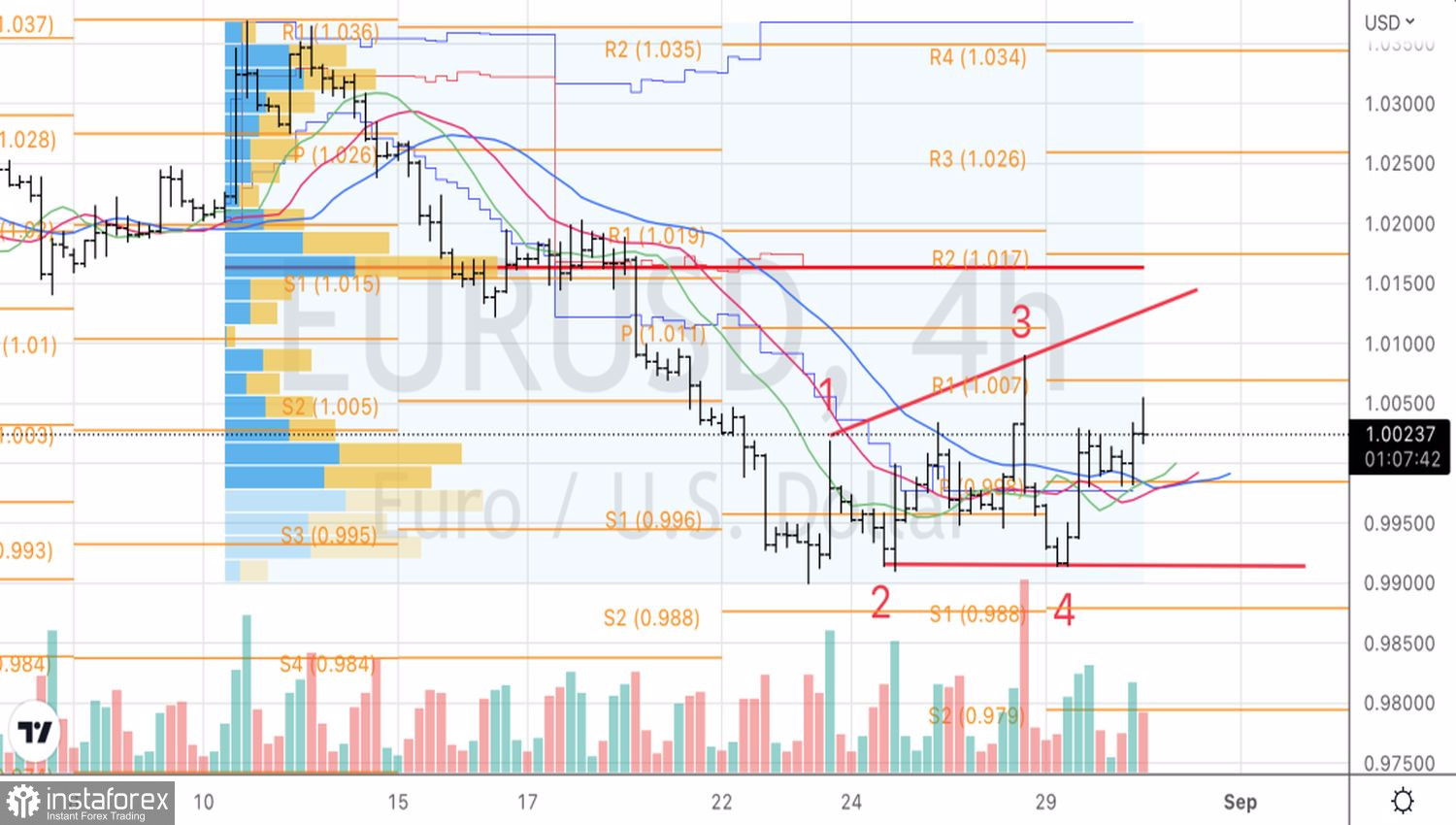

Technically, on the 4-hour chart, the consolidation of EURUSD above the pivot point at 0.999 and moving averages indicates the seriousness of the intentions of the bulls. The longs formed on the break of resistance at 0.9985–0.9999 are kept and increased in case of updating the local high at 1.0055 or on a rebound from parity.