US stock index futures recovered slightly from a record sell-off seen late last week, and investor sentiment stabilized after turmoil triggered by the Fed's signal of an extended period of monetary policy tightening to curb inflation. Treasury yields also declined slightly, as did the US dollar against a number of risky assets. Thus, the Dow Jones Industrial Average rose by 0.2%, while the S&P 500 and the tech-heavy NASDAQ added about 0.3%.

The current upward pullback does not mean that a decline in the stock market that began last Friday is over. Fed Chairman Jerome Powell has made it clear that the regulator is ready to let the economy suffer in order to ease inflationary pressures. Against this background, long-term growth in risky assets, including shares, is unlikely.

The leaders in the European market are the banking sector and retailers, while energy stocks have fallen amid rising prices. Data showed that euro-area economic confidence dropped to its lowest level in a year and a half, although Spanish inflation eased for the first time in four months. As for macroeconomic reports to be released soon, markets will receive data on Germany's consumer prices, which are expected to decrease. The United States is set to report statistics on consumer confidence.

Meanwhile, following the Jackson Hole symposium, analysts at Credit Suisse Group AG recommended that their investors reduce equity holdings in their portfolios. According to strategists at JPMorgan Chase & Co, a reading on the US labor market that spells bad news for the economy is actually a bullish signal for stocks. Most likely, this is due to the fact that in the event of major negative changes in the labor market, Powell's opposition to investors' hopes for a sharp decrease in interest rates next year may weaken a little.

This week, the Fed is set to start shrinking its nearly $9 trillion balance sheet. This could slightly destabilize the market as investors fear that the Fed will continue to focus on a harder economic landing than previously expected. The prospect of Fed's higher interest rates cools a stock bounce from the June low.

Minneapolis Fed President Neel Kashkari said yesterday that he sees a sell-off in the stock market as evidence that investors are taking the US central bank's inflation fight seriously. "People now understand the seriousness of our commitment to getting inflation back down to 2%," he said.

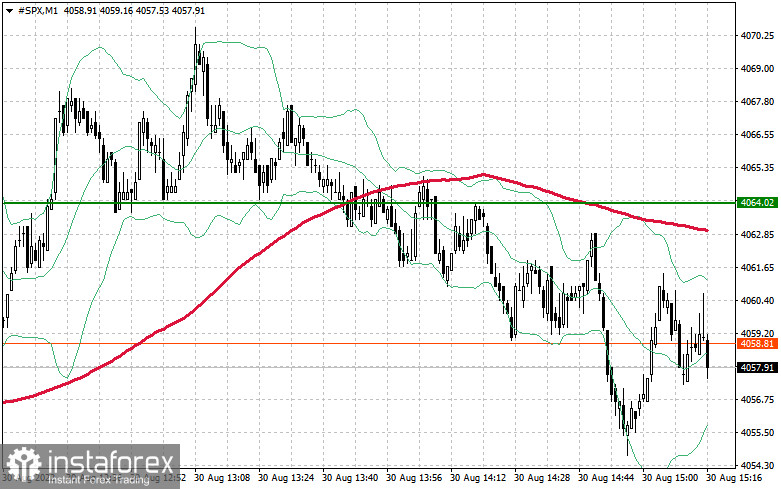

From a technical point of view, the S&P 500 has a slight chance for an upward correction, but it needs to first overcome the level of $4,064. In case of upbeat statistics from the US, I recommend you pay attention to this level. If the index is able to break through it, an uptrend will continue. Otherwise, the index will return to weekly lows. In case of a further downward movement following Fed members' statements and downbeat statistics, a breakout of $4,038 will return the trading instrument to $4,003. This in turn will open the way to the levels of $3,968 and $3,940, where the pressure on the index may slightly ease. If bulls regain control of the resistance level of $4,064, the index will most likely advance and head towards $4,091. In this case, the price may rise to the area of $4,116, which will prompt major sellers to return to the market. At least, there will be those who want to lock in profits on long positions. The level of $4,150 can be seen as a more distant target.