The euro-dollar pair continues to circle around the parity level, which until recently acted as a powerful price barrier. As of today, EUR/USD bears easily overcome the 1.0000 mark, but at the same time they cannot go below 0.9950, while in order to develop the downward trend, they need to solve a more difficult task - to gain a foothold in the area of the 98th figure. Amid hawkish sentiment, voiced by the head of the Federal Reserve at a symposium in Jackson Hole, the greenback strengthened its position across the market. The US dollar index updated a 20-year high on Monday, reflecting increased demand for the US currency. But even on the wave of the dollar rally, EUR/USD bears failed to enter the area of the 98th figure. Bulls entered the game when the level of 0.9901 was reached, extinguishing the downward momentum. In turn, the bulls are struggling to hold their positions above the parity level.

In other words, traders currently cannot decide on the EUR/USD movement vector: despite the impulsiveness, the pair, by and large, is marking time, in the notorious sideways trend. Take a look at the daily chart - any of the bulls' advance attracts the pair's bears. And vice versa - any more or less impressive price decline is used by traders as an excuse to open long positions. Both warring parties are sensitive to the current news flow, but at the same time they are waiting for a more powerful informational driver that would pull the pair out of the 100-point price range, in the center of which is the 1.0000 mark.

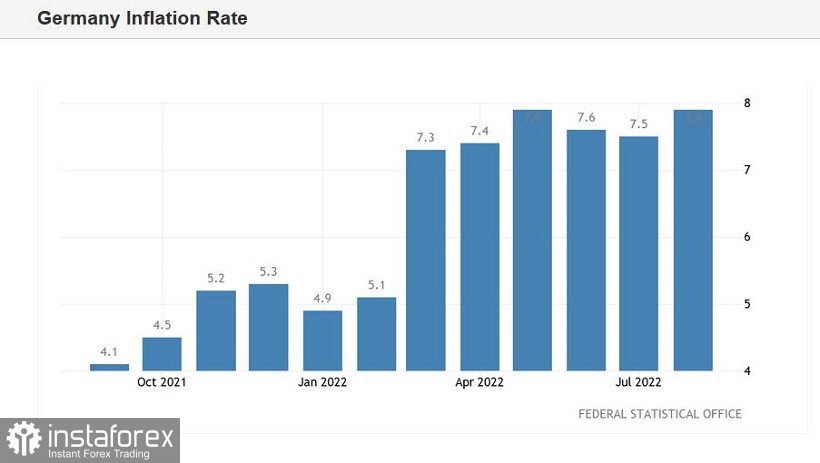

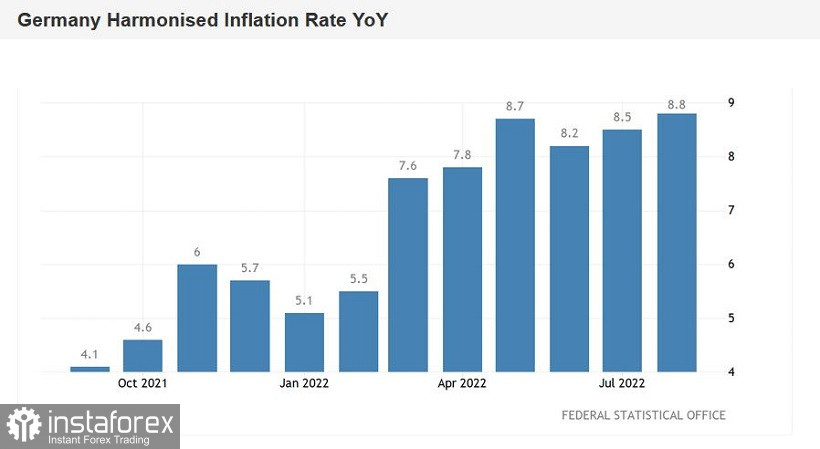

For example, this afternoon EUR/USD traders reacted positively to the release of German inflation data.

The general consumer price index in Germany in annual terms came out at around 7.9%, while in the previous month it was at the level of 7.5%. The harmonized CPI showed similar dynamics. It jumped to 8.8% in August. This is the highest increase since 1973. All published components of the release came out in the green zone - experts expected to see a more modest increase in indicators. But the fact remains that German inflation is not slowing down, as if confirming the fears of the European Central Bank hawks. The structure of the report suggests that energy prices in Germany jumped 35% year-on-year in August (up 35.7% last month). Food prices also went up significantly (by 16.6%).

In general, the German release is a kind of "petrel", a warning signal for EUR/USD bulls, as data on the growth of European inflation will be published on Wednesday. According to preliminary forecasts, the CPI in the euro area will also show further growth. The headline consumer price index should reach 9%, while core inflation could pick up to 4.1%.

ECB representative Klaas Knot also supported the single currency on Tuesday, saying that he is likely to support a 75 basis point rate hike at the September meeting. This statement was made amid a recently published inside information agency Reuters. According to journalists, "many ECB politicians" plan to discuss the issue of raising the rate by 75 basis points in September "due to the worsening inflation outlook." Notably, interviewed (but unnamed) representatives of the ECB emphasized that the looming recession in the eurozone "will not slow down or stop the ECB's policy normalization process."

Knot's comments confirmed that ECB officials are determined to discuss a more aggressive pace of rate hikes.

Against this background, EUR/USD bulls exceeded 1.0000 again. Just for a few hours. The dollar once again declared itself after the index of consumer confidence in the US came out in the green zone. It showed a downward trend for three months, but it reached 103 points in August, contrary to the pessimistic forecasts of most experts.

Reacting to this release, the EUR/USD pair reversed 180 degrees and plunged below the parity level again. An additional factor of pressure on the pair was the news that Gazprom confirmed the shutdown of the Nord Stream 1 gas pipeline from 4:00 on August 31 to 4:00 on September 3.

As you can see, any growth of the pair is unsteady. Despite rising German inflation, despite forecasts of further growth in European inflation, and despite the increased hawkish mood of the ECB, the single currency remains too vulnerable. Literally one US macroeconomic report extinguished the upward momentum.

This suggests that the actual "trampling around" within the 100-points range (0.9950 - 1.0050) should be used only in the context of opening short positions on the upward pullbacks. Long positions are still too risky, despite the ability of EUR/USD bulls to organize counterattacks. Downward targets are still limited by 1.0000 (with the price rising to 1.0050) and 0.9950. The main target in the medium term is 0.9910 (bottom line of the Bollinger Bands on the four-hour chart).