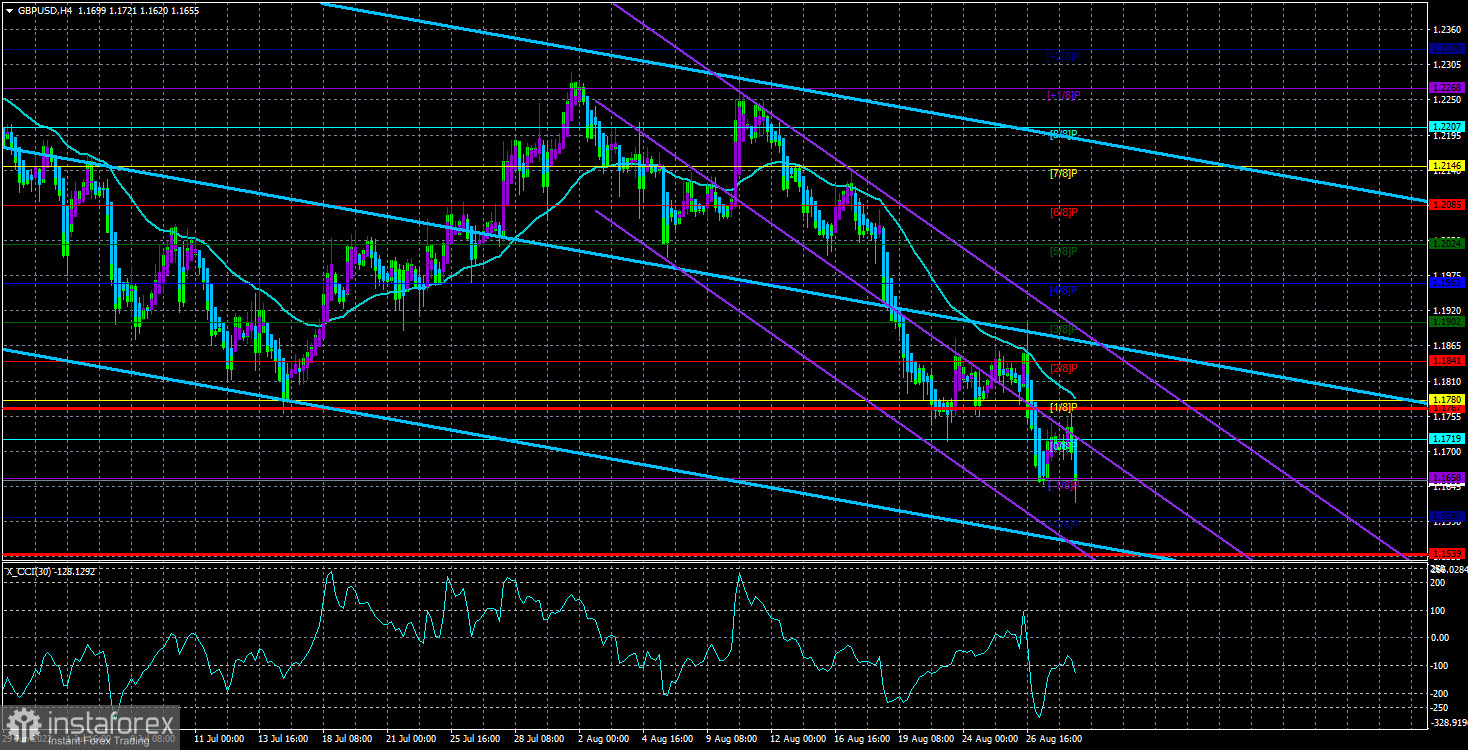

The GBP/USD currency pair continued a weak correction on Tuesday after updating its 2-year lows. Recall that the pair has already fallen to the Murray level of "-1/8" - 1.1658, from which only 250 points remain at 35-year lows. So far, the pound does not give the impression of a currency preparing for powerful and protracted growth. If the euro moves up at least a little bit, then the pound continues to be very low and cannot adjust normally. Thus, neither the rate hike by the Bank of England six times in a row, the expectation of the seventh, nor the promises of Liz Truss can help the pound "rise from the dead."

We have repeatedly said that the key factors of the fall are geopolitics and the foundation. At the same time, the foundation is not so bad for the pound now as for the euro currency. This explained the higher resistance of the pound against the US dollar. The British currency became cheaper less readily and grew more strongly. However, now it seems that the situation is changing. Traders are not eager to buy the pound, and it isn't easy to understand why they continue to sell it. Recession in the British economy? It will only start in the fourth quarter, and it has already begun in the US. Energy crisis and the rising cost of living? Inflation is high in the States too, and hydrocarbons are growing in value, not only in the UK. Geopolitics? Yes, it remains difficult for the European continent, but the pound may fall to zero at this rate. Thus, we believe that the market will maintain a "bearish" mood in the next few months. Based on all possible factors at once. Then everything will depend on the geopolitical situation (Sweden and Finland may join NATO in the fall, and a new conflict is possible) and on the Fed's plans for the final level of the key rate.

Liz Truss makes very populist statements.

Meanwhile, Foreign Minister Liz Truss is racing at full speed to her victory in the election of Prime Minister. Just in the last couple of weeks, she has made several resonant statements that seem to appeal to the British. And although the British people will not participate in the elections, their support is very important since parliamentary elections will follow the election of the prime minister, and the Conservatives need a victory. Thus, the future Prime Minister should be popular and enjoy their support. First, Truss declared her readiness to use nuclear weapons to protect the UK. This point of view is scary, but at the same time, any citizen wants his country to be able to fight back against external enemies. Then Truss announced that she would reduce VAT by 5%, as electricity prices in Britain were growing and will continue to grow. Therefore, taxes will be reduced to alleviate the fate of households who will have to pay 2-3 times more for electricity and other utilities in the coming years. The UK budget, of course, will not reach several billion pounds. Still, for now, it is necessary to solve the political problem, the problem of power, and economic problems – there is already a huge pile of them.

Yesterday, Truss said that if she were elected Prime Minister, she could issue about 130 new licenses for developing oil fields in the North Sea. London planned a transition to "green energy," and an unspoken veto was imposed on new oil fields. But now, due to sanctions against the Russian Federation and the voluntary refusal of its hydrocarbons, there is a shortage of them worldwide, and prices are rising by leaps and bounds. Many countries have decided either to increase purchases. At the same time, energy resources are still available for purchase or to start developing new deposits in their territories. For example, Germany is pumping gas into its storage facilities with might and main, preparing for a difficult winter. Naturally, the energy independence of the UK is what the British want to see, and with the transition to "green energy," you can wait a couple of years. We would say that Truss is doing everything right so far, and she will most likely become the new head of state.

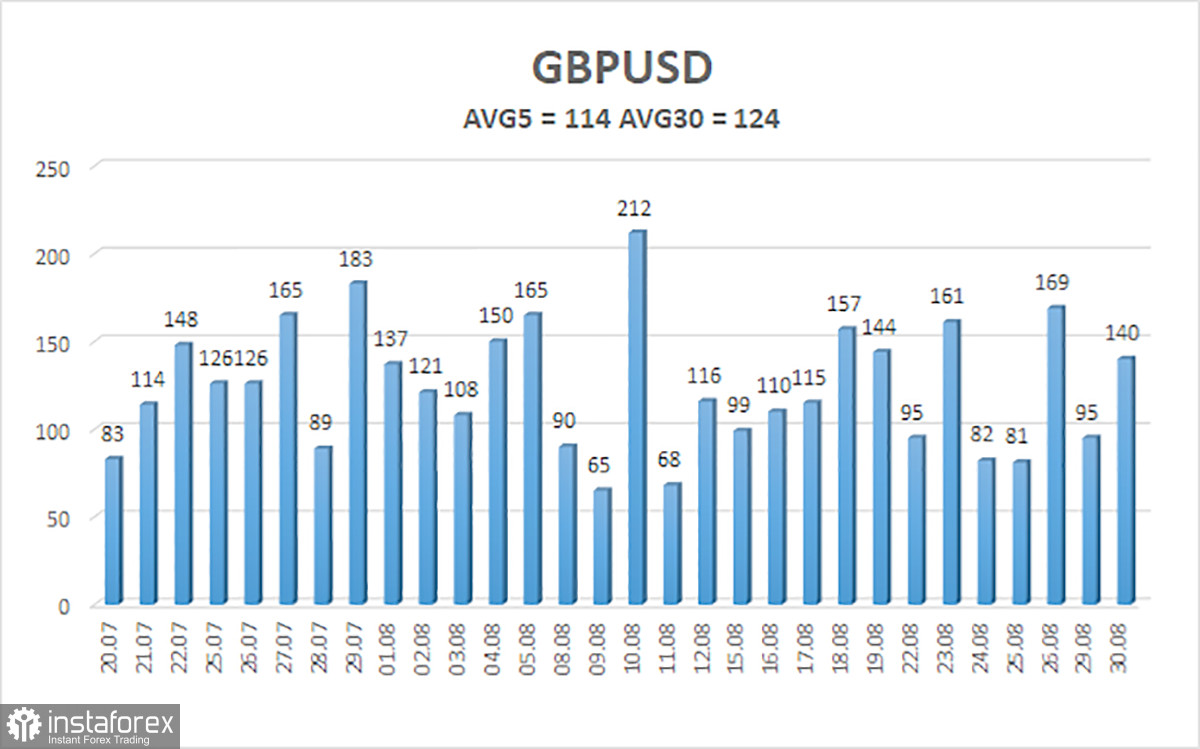

The average volatility of the GBP/USD pair over the last five trading days is 114 points. For the pound/dollar pair, this value is "high." On Wednesday, August 31, thus, we expect movement inside the channel, limited by the levels of 1.1539 and 1.1767. A reversal of the Heiken Ashi indicator upwards will signal a new round of correction.

Nearest support levels:

S1 – 1.1658

S2 – 1.1597

Nearest resistance levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading recommendations:

The GBP/USD pair resumed its downward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1.1597 and 1.1539 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixing above the moving average line with targets of 1.1841 and 1.1902.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.