On Tuesday, EUR/USD movements were very slow. I have slightly adjusted the previous channel so that it has become wider but fully horizontal at the same time. Based on this channel, we can conclude that the pair is trading sideways. Neither bulls nor bears have taken control over the market. The euro/dollar pair is til holding near its 20-year lows. So, I suggest we should wait for the pair to leave the given range. The fundamental background was quite weak yesterday. Only the inflation report in Germany was worth paying attention to. Since Germany is the leading economy of the EU, the inflation rate here is a bit lower than in other European countries. The CPI for August rose to 7.9% which met traders' expectations but didn't cause any reaction from them. It was reported on Wednesday morning that Germany's unemployment rate increased to 5.5%. Later in the day, the EU inflation data will be released.

In the meantime, analysts at Danske Bank predict the ECB to raise interest rates by 75 basis points next month. It is high time the EU regulator took serious measures to fight inflation. Apart from a rate increase in September, analysts expect the ECB to introduce more rate hikes of 0.50% and 0.25% in October and December respectively. This is actually something that can change the situation for the better. Recently, the euro has been rapidly declining due to the fact that the Fed was more hawkish compared to the ECB. If the latter changes its policy, the euro will get significant support from this. At the moment, bull traders do not seem encouraged by the news as if they doubt that the ECB may take aggressive steps. According to Danske Bank, even if the European economy faces a recession, the regulator will continue to raise the rate to its maximum level of 1.5%. This is lower than the current Fed's rate and is much lower than its future rate. Therefore, the US dollar may keep strengthening in the coming months.

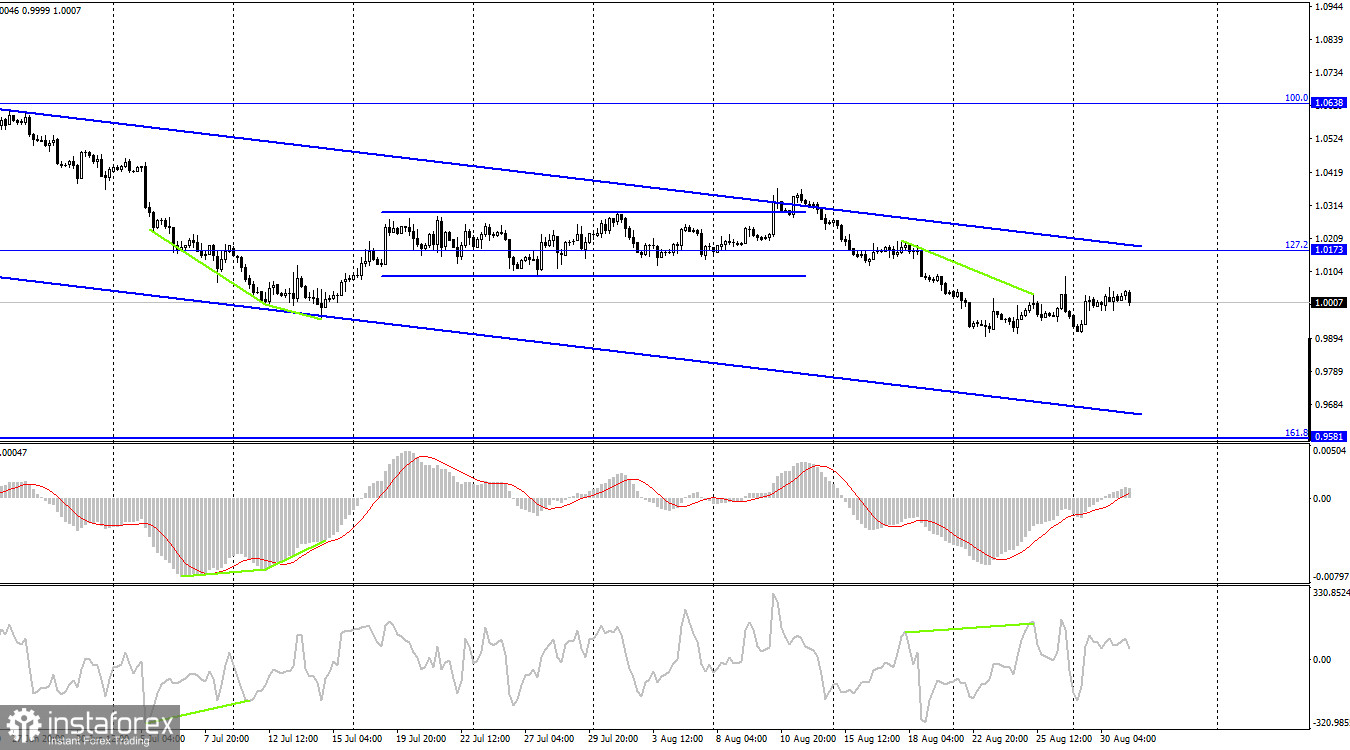

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the retracement level of 127.2% at 1.0173. Therefore, the pair may continue to fall towards the fibo level of 161.8% located at 0.9581. The CCI has formed a bearish divergence so that it declined to the level of 0.9581. The ongoing upside pullback may be short-lived. The downward channel confirms the bearish sentiment of the market.

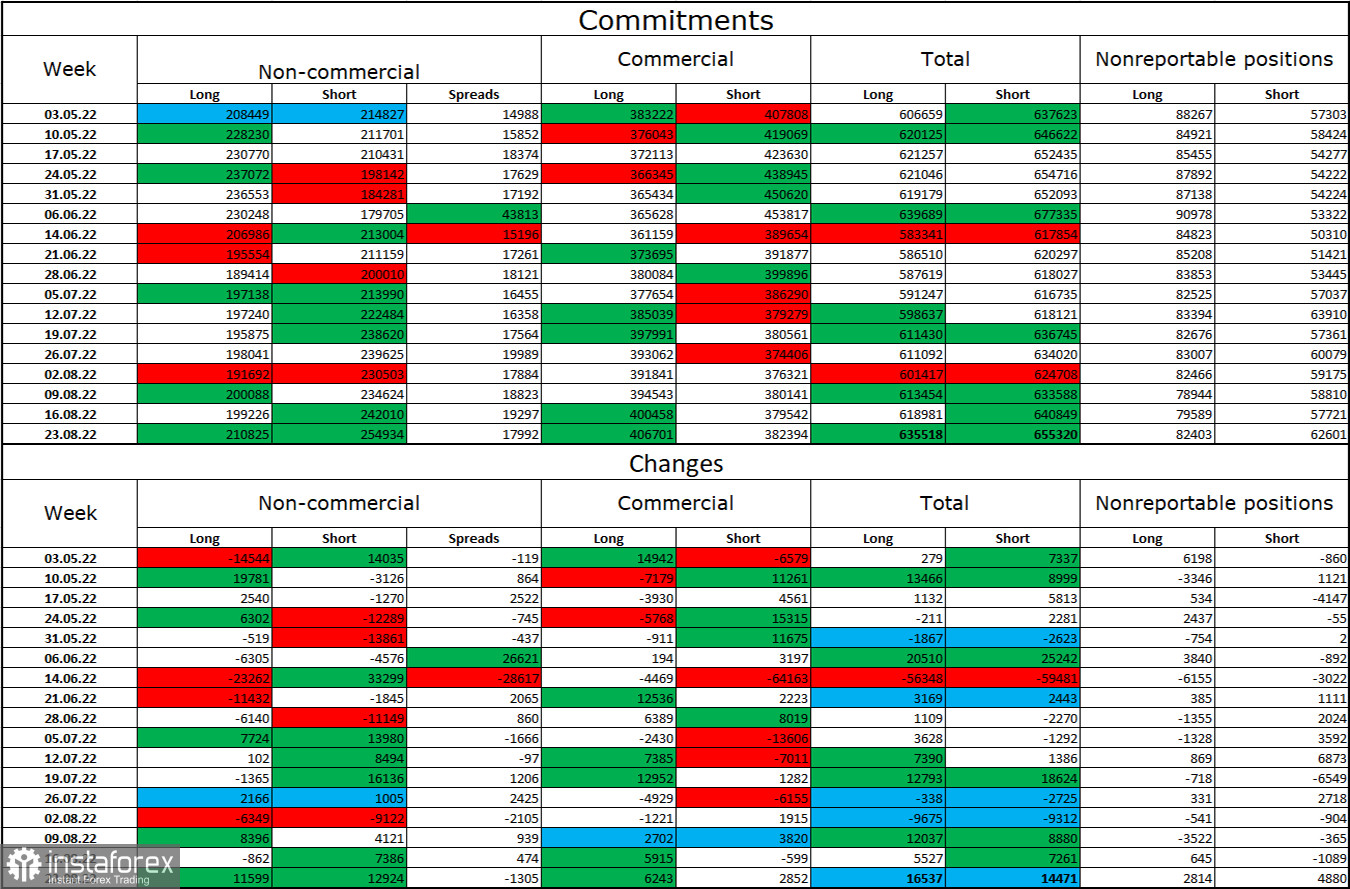

Commitments of Traders (COT) report

:

Last week, traders opened 11,599 long contracts and 12,924 short contracts. This signals that large market players became more bearish on the pair. The total number of opened long contracts is 211,000 and the number of short contracts is 255,000. The difference is not big but euro bears are still prevailing. In the last few weeks, the likelihood of an uptrend in the euro was getting higher. Yet, recent COT reports showed that bulls failed to gain a strong foothold in the market. The euro failed to develop a proper upside movement in the past 5-6 weeks. Therefore, I can hardly see any chances for strong growth. Given the COT data, I think EUR/USD will continue to depreciate.

Economic calendar for US and EU:

EU - Consumer Price Index (CPI) (09-00 UTC).US - ADP Nonfarm Employment Change (12-15 UTC).

On August 31, the economic calendars for the US and EU have one important entry each. The inflation report in the EU will be of great importance to the market. Therefore, the impact of the fundamental background on the market sentiment will be average today.

EUR/USD forecast and trading tips:

It is possible to go long on the pair when the price closes below the sideways channel on H1 with the target at 0.9782. I recommend selling the pair when the quote settles firmly above the descending channel on H4 with the target at 1.0638.