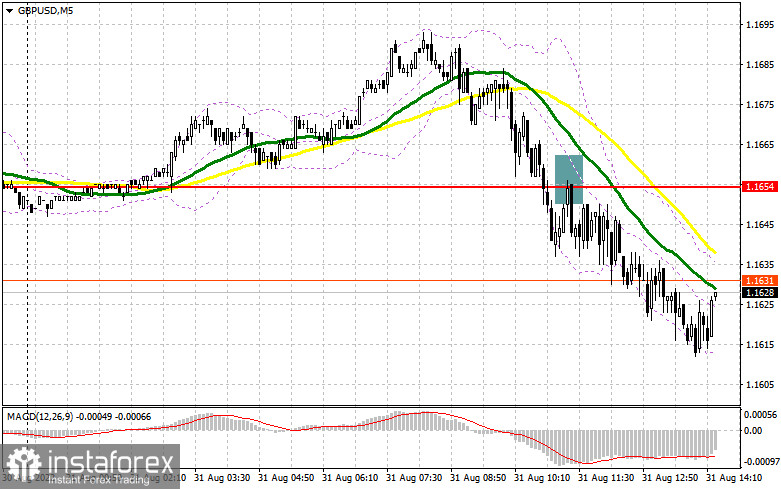

In my morning article, I focused on the level of 1.1654 and recommended making decisions to enter the market, taking it into account. A breakout and a reversed down-top test of this range gave a sell signal, which eventually resulted in the sharp downward movement by more than 30 pips. By the time of writing, the GBP/USD pair did not reach the nearest support. The technical picture was not revised in the afternoon. However, the trading strategy changed.

To open long positions on GBP/USD, you need:

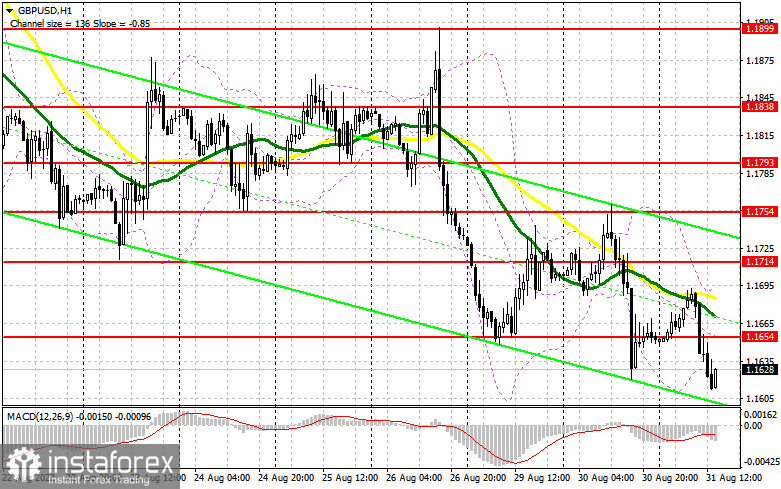

A lot of significant fundamental data will be released during the American session. It is advisable to focus on the ADP non-farm payrolls as this reading influences the Fed's view of the labor market. Chicago PMI and its growth will be a good catalyst for opening short positions as well as FOMC member Loretta Mester's hawkish statements. Therefore, it is better not to buy the pound immediately. In case the GBP/USD pair continues declining in the afternoon, the defense of the support at 1.1591 will be a key target for buyers. The pair headed for this support during the European session. However, it failed to reach it. Only the formation of a false break there will give a buy signal to return to 1.1654. This area acted as the support in the morning. There are moving averages above this resistance favoring sellers. This aspect will limit the uptrend. A breakout and a reversed top-down test of this range will strengthen buyers' stance giving a chance to reach 1.1714. A more distant target is 1.1754 where I recommend locking in profits. Today, bulls are unlikely to be more active. In case the GBP/USD pair declines and there are no buyers at 1.1591, the problems of pound buyers will only increase. There is a low at 1.1532 below this level. It is also advisable to open long positions considering it only in case of a false break. I recommend buying the GBP/USD pair immediately on a rebound from 1.1484, with the target of 30-35 pips intraday correction.

To open short positions on GBP/USD, you need:

It is significant for bears to defend the resistance at 1.1654 amid weak US fundamental data. A false break there will be the starting point to open new short positions. Moreover, sellers will plan to break through the nearest support at 1.1591. A breakout and a reversed down-top test of 1.1654 will give a sell entry point with the prospect of a decline to 1.1532, where I recommend locking in profits. A more distant target will be 1.1484. If the GBP/USD pair rises and there are no bears at 1.1654, bulls can expect correction and development of an uptrend at the end of the month. In this case, I recommend not to sell. Only a false break around 1.1714 will form a sell signal. It is possible to sell the GBP/USD pair immediately on a rebound from the level 1.1754 or even higher, counting on the pair's downward intraday movement of 30-35 pips.

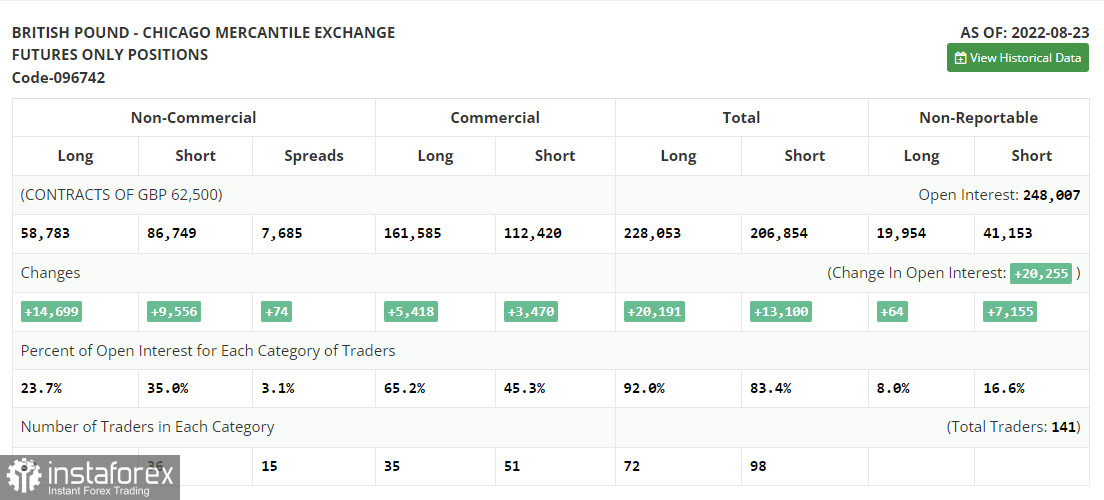

The COT report of August 23 recorded an increase of both short and long positions. Although long positions were more numerous, these changes did not affect the current situation. The pair remained under significant pressure. Moreover, Federal Reserve Chairman Jerome Powell's recent statements that the FOMC committee will continue to aggressively raise interest rates only increased pressure on the British pound, which has been experiencing a lot of problems lately. High inflation and the coming UK cost of living crisis are the reasons why traders have no chance to hold long positions. Besides, a lot of weak fundamental data will be released, pushing the pound even lower from the levels at which it is currently traded. This week, it is significant to focus on the US labor market data which will also determine the Federal Reserve's monetary policy decisions. Continued resilience with minimal unemployment will cause higher inflationary pressures in future. Therefore, the Fed will have to raise interest rates further, putting pressure on risky assets, including the British pound. The latest COT report indicated that long non-commercial positions rose by 14,699 to 58,783, while short non-commercial positions rose by 9,556 to 86,749. This resulted in a slight rise in the negative non-commercial net position to -27,966 versus -33,109. The weekly closing price fell to 1.1822 versus 1.2096.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating further pound's decline.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

In the case of growth, the upper boundary of the indicator around 1.1690 will act as resistance. In the case of decline, the low boundary of the indicator around will act as support 1.1620.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.