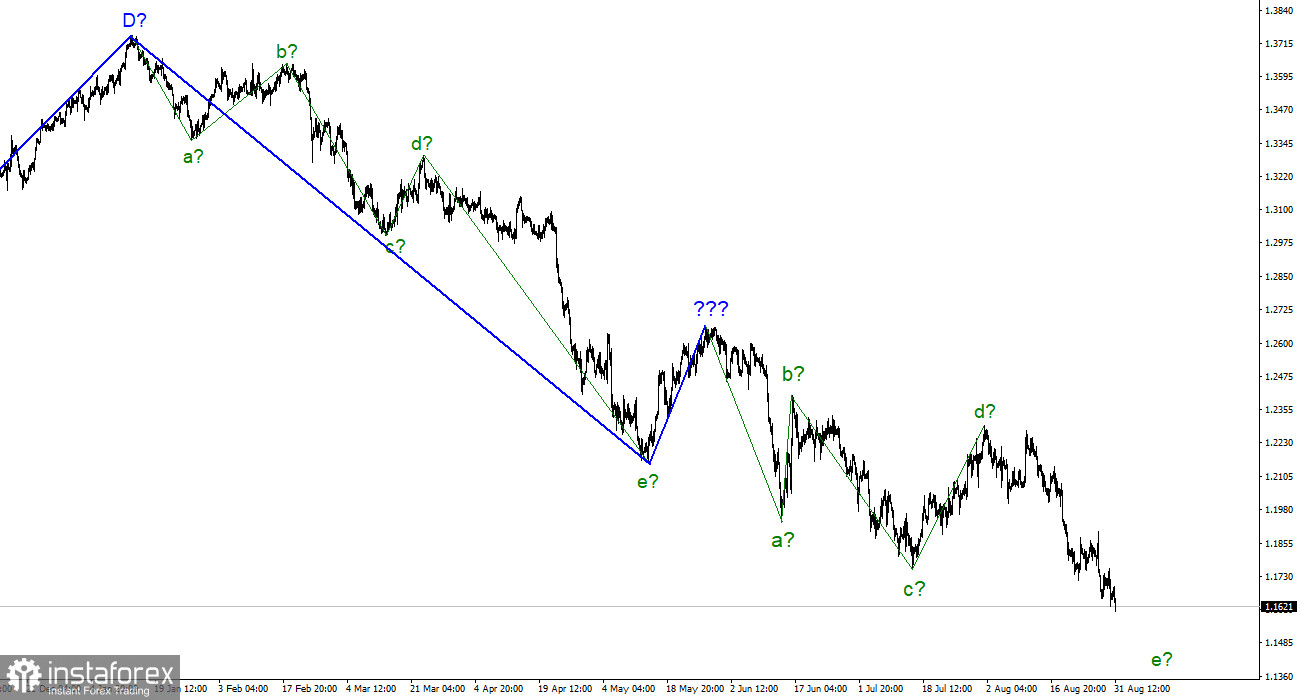

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but it does not require any clarifications yet. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. We have completed waves a, b, c, and d, so we can assume that the instrument continues to build wave e. If this assumption is correct, then the decline in quotes should continue in the near future. However, I remind you that if impulse structures can become more complicated and lengthened, corrective ones can become even more so. Given the news background and the fact that the Fed will not stop raising interest rates now, the entire downward trend section may take a much longer form. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. Ascending and descending waves alternate almost exactly.

The market does not need rest

The exchange rate of the pound/dollar instrument decreased by 50 basis points on August 30 and today – by another 40. The decline in the British dollar cannot be called strong, but it is stable daily. Thus, the construction of the proposed wave e continues with targets located around the 11th figure. I am not sure that the pound will reach this mark, but it is quite capable of going some distance down. The most important thing for us now is that the wave marking does not become even more complex and extended. It's always nice to work with wave markup when you clearly understand when and how this structure will end. And the current downward wave structure may end now since the low of wave e is below the low of wave C. However, the news background (practically absent now) may continue to cause a decline in demand for the pound.

Almost the first interesting report of this week was released today. In America, the ADP report was published, which shows the change in the number of workers in the non-agricultural sector. And this report showed an increase of only 132 thousand. For comparison: a month earlier, the increase was 270 thousand, a month earlier – 380 thousand. The correlation between nonfarm payrolls and ADP reports has always been weak, but a strong ADP slowdown raises some concerns. I expect that the payroll report will disappoint the markets on Friday, which may cause a decrease in demand for the US currency. And this moment could be the beginning of a new trend. So far, it sounds too optimistic for a Briton who has been falling for a long time and cannot find a straw to cling to. But sooner or later, the trend will end. Why not this Friday? Market expectations for payrolls are +300 thousand. It seems to me that the actual value will be lower. However, a month ago, the market also did not expect a high value, so the forecast was exceeded twice.

General conclusions

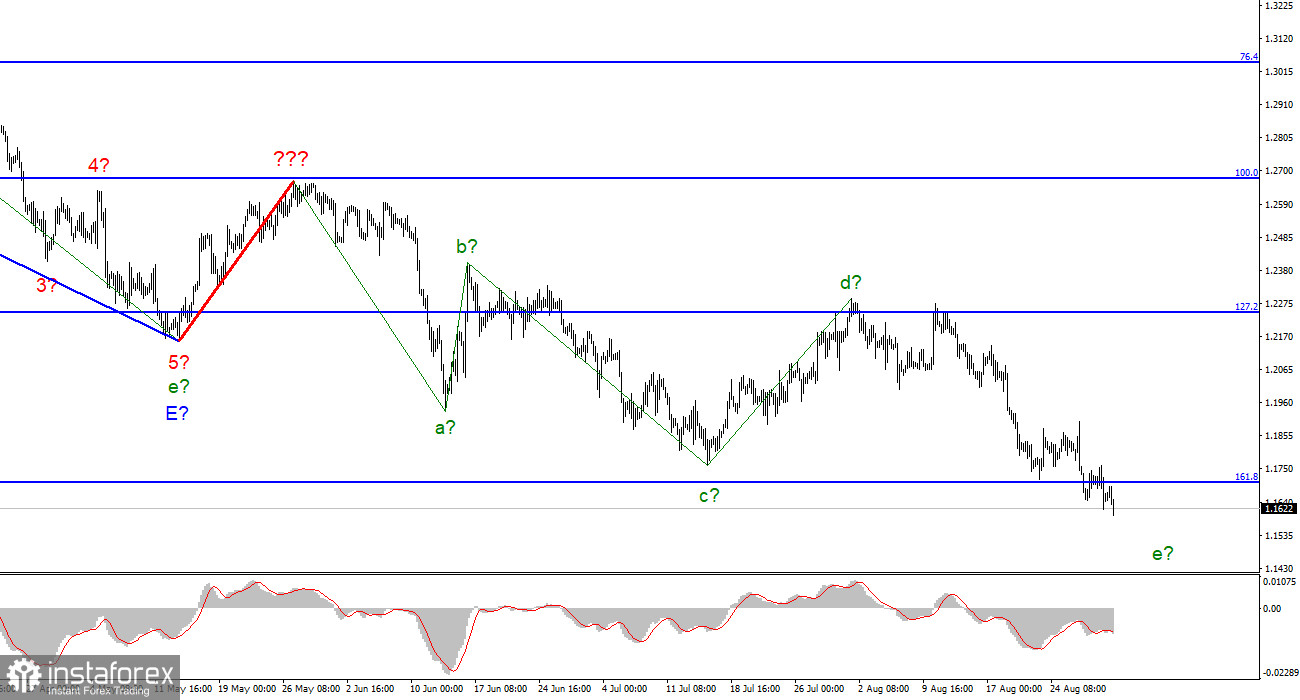

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, equivalent to 200.0% Fibonacci, for each MACD signal "down."

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.