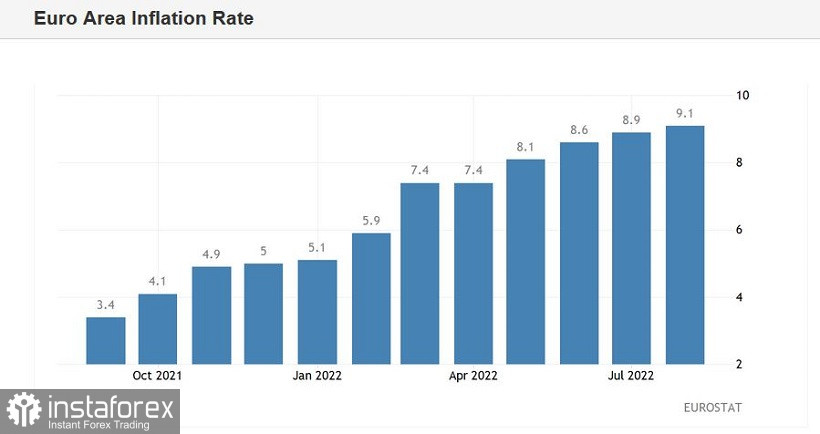

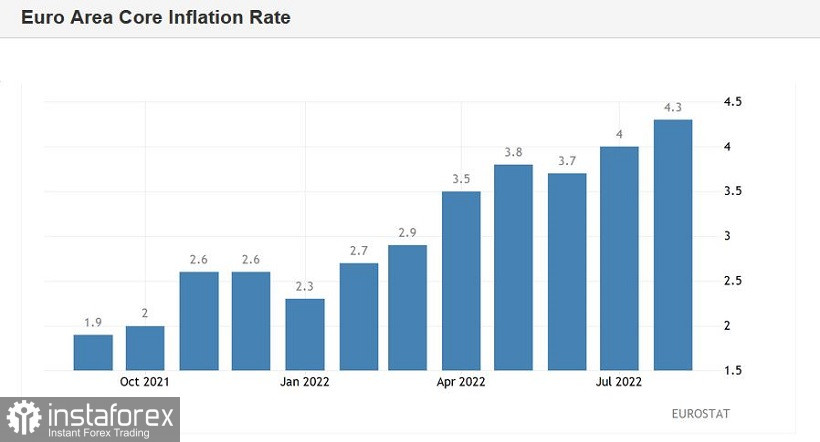

So, the next report on the growth of inflation in the euro area again surprised with its "green color". All components of the latest release exceeded the predicted estimates of experts. For example, the general consumer price index overcame the 9% mark and reached the target of 9.1% in August (against the forecast of growth to 9.0%). The core inflation index, excluding volatile energy and food prices, rose to 4.3%, while experts expected to see this indicator at around 4.1%. In general, this is a record increase in inflation in the eurozone in the history of observations.

Reacting to the published figures, EUR/USD bulls are again trying to settle above the parity level. Let me remind you that traders are circling around the 1.0000 mark for the second week since last Tuesday. Bears are unable to push through the intermediate support level of 0.9950, while the EUR/USD bulls are resting on the price ceiling in the 1.0050-1.0070 area.

Today, traders again made a lap of honor.

Take note that a strong rise in European inflation was predictable, especially after the release of inflation data from Germany. A report published the day before showed that the general consumer price index in annual terms came out at around 7.9%, and the harmonized CPI jumped to 8.8% (the highest increase since 1973). All components of the German release published the day before also came out in the green zone.

It is obvious that the aggravated energy crisis continues to unwind inflationary processes in the eurozone. The structure of the report suggests that the rise in energy prices has become the main driver of the acceleration of European inflation. According to the latest data, electricity prices in France and Germany rose to new records. In particular, the French contract for 2023 increased by 13%, to 1,022 euros per MWh. With these trends in mind, it's no surprise that the CPI in the euro area is moving steadily towards double digits.

In other words, the latest release did not become a sensation. But in doing so, it significantly reinforced the hawkish rumors that have been hovering around the European Central Bank since last Friday. Let me remind you that the Reuters news agency published insider information that many members of the ECB are ready to support a 75-point rate hike at the September meeting. Later, this insider was indirectly confirmed by the head of the Central Bank of the Netherlands, Klaas Knot, who said that he was inclined to raise the rate by 75 basis points next month. A very unambiguous statement was made today by the head of the Bundesbank, Joachim Nagel. According to him, the central bank will need to resort to "a strong rate hike in September."

Reacting to such clear hawkish signals, EUR/USD bulls tried to build a corrective upside by testing the upper end of the range (1.0050). But in order to strengthen the upward correction, the bulls need not only to test this target, but also to gain a foothold above it.

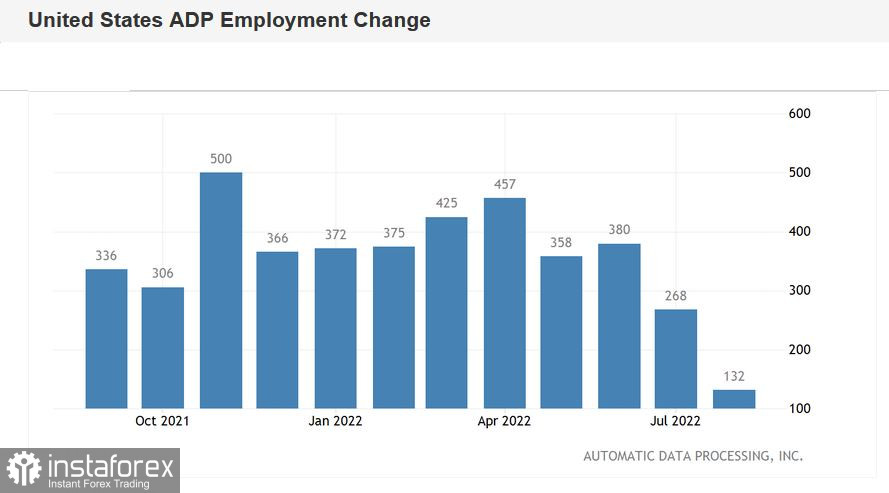

The dollar, in turn, came under pressure from a disappointing report from the ADP agency. According to them, the number of people employed in the US non-farm sector increased by only 132,000 in August. While the forecast was at the level of 300,000.

In other words, today sounded a very alarming signal for the dollar bulls, as the report from the ADP agency is a kind of petrel ahead of the August Nonfarms. If the official numbers on Friday repeat the trajectory of this release, the dollar will again come under significant pressure. To date, the consensus forecast for official data suggests that the US labor market will show positive dynamics. According to experts, 325,000 non-farm payrolls were created in the United States in August (in July, this figure came in at 528,000, exceeding forecast estimates). In the private sector of the economy, the increase should be 310,000. But the unemployment rate should fall to 3.4%.

However, taking into account the latest release, a certain intrigue regarding Friday's data has increased significantly. In my opinion, dollar bulls can now at least not count on exceeding the predicted values. If the official figures do not reach the forecast levels at all, then EUR/USD bulls will have a reason for another upward rush to the resistance level of 1.0140 – at this price point, the average line of the Bollinger Bands indicator on the daily chart coincides with the Kijun-sen line.

In today's price turbulence, it is risky to open short or long positions on the pair. On the one hand, the euro received support this week due to the hawkish comments of the ECB representatives, the hawkish Reuters insider and record inflation growth in Germany and the eurozone. On the other hand, the dollar is also able to hold its own, having Federal Reserve Chairman Jerome Powell as an ally, who last Friday confirmed the US central bank's aggressive pace of monetary tightening.

Therefore, at the moment it is more expedient to be out of the market. Short positions can be considered as a riskier alternative - but only if the pair does not go above 1.0070. The first (and so far the main) downward target in this case will be the parity level. The support level is the lower limit of the 0.9950-1.0050 (70) price range, within which the pair has been trading since August 23.